As the Bitcoin market approaches 2025, investors are attentively examining seasonal patterns and historical statistics to foresee what February may bring. Given Bitcoin’s cyclical characteristics often linked to its halving events, historical data offers a valuable guide for anticipating future performance. By analyzing historical figures—including Bitcoin’s average monthly returns and its February outcomes following halving events—we strive to provide a comprehensive overview of what February 2025 could resemble.

Comprehending Bitcoin’s Seasonality

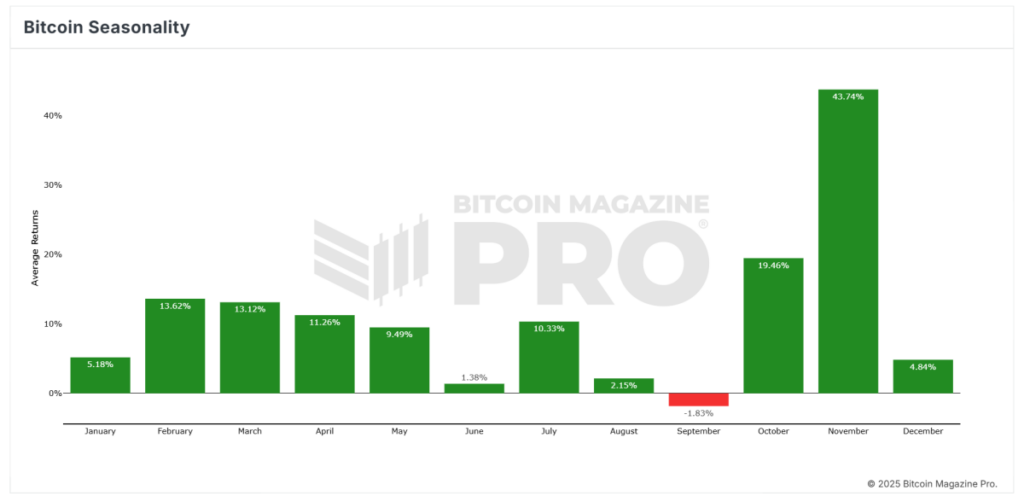

The initial chart, “Bitcoin Seasonality,” showcases average monthly returns from 2010 to the latest monthly closing data. The figures emphasize Bitcoin’s most fruitful months and its cyclical behaviors. February has historically demonstrated an average return of 13.62%, positioning it as one of the more robust months for Bitcoin performance.

Notably, November emerges as the month with the highest average return at 43.74%, followed by October at 19.46%. In contrast, September has statistically been the weakest month, showing an average return of -1.83%. February’s commendable average ranks it among the superior months for Bitcoin’s seasonality, providing investors with optimism for favorable returns in early 2025.

February’s Historical Performance in Years Following a Halving

A more profound examination of Bitcoin’s historical February returns unveils intriguing observations for the years succeeding a halving event. Bitcoin’s halving process—which happens approximately every four years—halves block rewards, generating a supply shock that has consistently propelled price increases. February’s results in these post-halving years have habitually been positive:

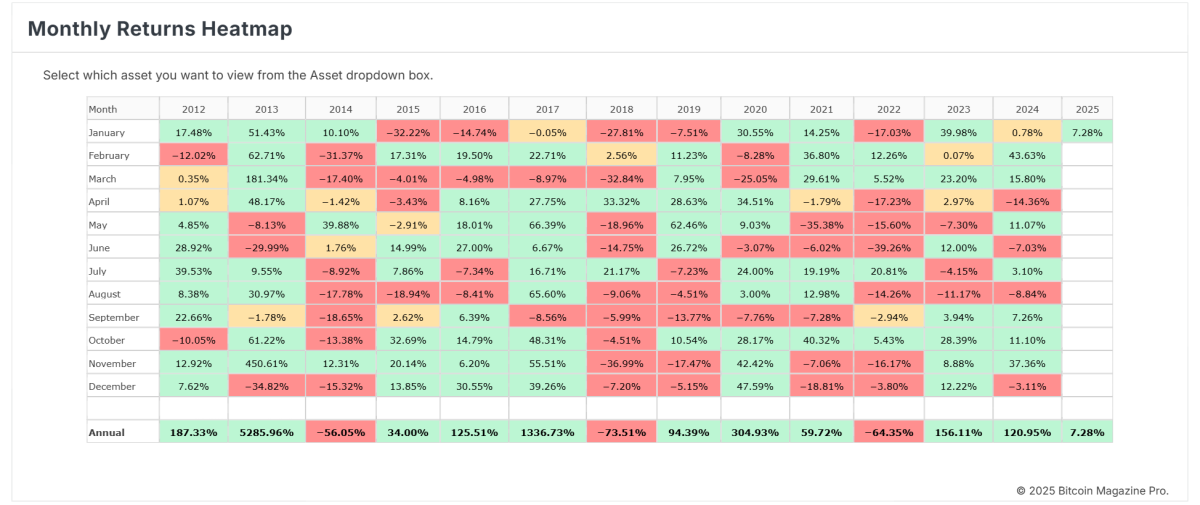

- 2013 (After 2012 Halving): 62.71%

- 2017 (After 2016 Halving): 22.71%

- 2021 (After 2020 Halving): 36.80%

The average return across these three years stands at an impressive 40.74%. Each of these Februarys reflects the bullish momentum that typically ensues from halving events, driven by reduced Bitcoin supply issuance alongside heightened market demand.

Related: We’re Repeating The 2017 Bitcoin Bull Cycle

January 2025’s Results Set the Tone

Although February 2025 is yet to transpire, the year commenced with a modest 7.28% return so far in January, as illustrated in the “Monthly Returns Heatmap.” January’s positive performance suggests a continuation of bullish sentiment during the initial months of 2025, consistent with historical post-halving trends. Should February 2025 mirror the path of prior post-halving years, it could experience returns ranging from 22% to 63%, with an average expectation around 40%.

Factors Behind February’s Robust Post-Halving Performance

Several elements contribute to February’s historical strength in post-halving years:

- Supply Shock: The halving trims new Bitcoin supply entering the market, enhancing scarcity and fostering price appreciation.

- Market Momentum: Investors often react to the halving occurrence with heightened enthusiasm, propelling prices upward in the months that follow.

- Institutional Interest: In recent cycles, institutional adoption has escalated post-halving, injecting substantial capital inflows into the market.

Key Insights for February 2025

Investors ought to approach February 2025 with measured optimism. Historical and seasonal data imply the month has significant potential for positive returns, especially regarding Bitcoin’s post-halving cycles. With an average return of 40.74% in previous post-halving Februarys, investors might anticipate similar performance this year unless significant macroeconomic or regulatory challenges arise.

Conclusion

Bitcoin’s past offers a valuable perspective from which to assess its forthcoming performance. February 2025 appears poised to be another favorable month, propelled by the same post-halving dynamics that have historically driven remarkable gains. Merging historical performance data with a positive regulatory climate, the forthcoming pro-Bitcoin administration, and the recent guideline issued by The Financial Accounting Standards Board (FASB) (ASU 2023-08) that fundamentally alters how Bitcoin is accounted for (Why Hundreds of Companies Will Buy Bitcoin in 2025), 2025 is about to be a transformative year for Bitcoin. As ever, investors should pair these insights with an overarching market analysis and remain vigilant for Bitcoin’s inherent fluctuations.

Related: Why Hundreds of Companies Will Buy Bitcoin in 2025

By applying the lessons drawn from history and the patterns of seasonality, Bitcoin investors can make enlightened decisions as the market navigates this crucial year.

To access live data and stay updated on the latest analyses, visit bitcoinmagazinepro.com.

Disclaimer: This article is intended for informational purposes only and should not be construed as financial advice. Always conduct your own research prior to making any investment decisions.