In the realm of Bitcoin investment, grasping market cycles is crucial for recognizing purchasing prospects and detecting possible price zeniths. An indicator that has proven reliable over time in this context is the Puell Multiple. Initially developed by David Puell, this metric evaluates Bitcoin’s valuation through miner revenue, providing insights into whether Bitcoin could be undervalued or overvalued relative to its historical averages.

This article aims to elucidate what the Puell Multiple entails, how to interpret it, and what the present chart reading indicates for investors. For a real-time overview of this tool, visit the Puell Multiple chart on Bitcoin Magazine Pro.

What is the Puell Multiple?

The Puell Multiple is an indicator that contrasts Bitcoin miners’ daily income with its long-term mean. Miners, representing the “supply side” of Bitcoin’s economy, must sell portions of their BTC rewards to manage operating expenses such as energy and hardware. Therefore, miner revenue plays a pivotal role in shaping Bitcoin’s price behavior.

How is the Puell Multiple Calculated?

The calculation is straightforward:

Puell Multiple = Daily Issuance Value of BTC (in USD) ÷ 365-Day Moving Average of Daily Issuance Value

By contrasting current miner revenues with their annual average, the Puell Multiple highlights times when miner earnings are notably high or low, indicating possible market peaks or troughs.

How to Read the Puell Multiple Chart

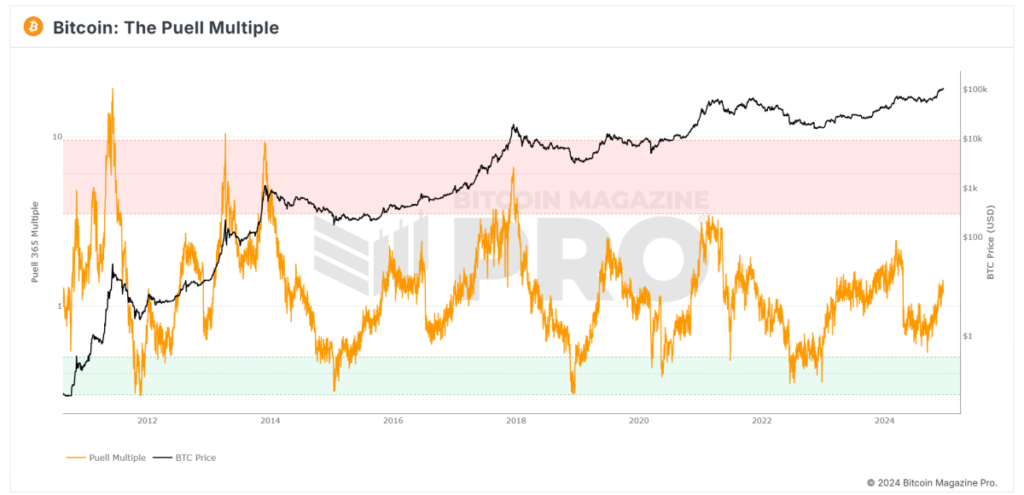

The Puell Multiple chart employs color zones to facilitate interpretation:

- Red Zone (Overvaluation)

- When the Puell Multiple enters the red zone (above 3.4), it indicates that miner revenues are considerably higher than typical.

- Historically, this has coincided with Bitcoin price peaks, suggesting potential overvaluation.

- Green Zone (Undervaluation)

- When the Puell Multiple falls into the green zone (below 0.5), it indicates that miner revenues are irregularly low.

- These phases have typically coincided with Bitcoin market bottoms, presenting excellent purchasing opportunities.

- Neutral Zone

- When the Puell Multiple remains between these thresholds, Bitcoin’s price is generally stable relative to historical norms.

Current Insights: What is the Puell Multiple Indicating?

- The Puell Multiple (orange line) is showing an upward trend yet remains significantly below the red overvaluation territory.

- This implies that Bitcoin is not currently in an overheated phase, where prices often peak historically.

- Simultaneously, the metric is considerably above the green undervaluation area, indicating we are past a market bottom stage.

What Does This Imply for Investors?

- Bullish Momentum: With the metric progressively increasing, the market seems to be transitioning into a bullish phase, although it is still far from becoming “overheated.”

- No Immediate Peak: The absence of a red zone reading indicates there is likely additional room for growth before a major correction occurs.

Investors should keep a vigilant eye on this chart in the upcoming months, especially as Bitcoin approaches its next halving event in 2028, which could further affect miner revenues.

Why the Puell Multiple is Important for Bitcoin Investors

The Puell Multiple provides a distinctive viewpoint on Bitcoin’s market cycles by highlighting the supply side (miner revenue) instead of focusing solely on demand. For long-term investors, this instrument can be advantageous for:

- Identifying Buying Opportunities: The green zone marks times of undervaluation.

- Spotting Market Peaks: The red zone has historically been in alignment with significant price tops.

- Navigating Market Cycles: Merging the Puell Multiple with other indicators can assist investors in timing their entries and exits more effectively.

Stay Ahead of the Market with Bitcoin Magazine Pro

For professional investors and Bitcoin aficionados aiming to enhance their analysis, resources like the Puell Multiple chart on Bitcoin Magazine Pro offer crucial insights into Bitcoin’s valuation trends.

By comprehending the Puell Multiple and its historical context, you can make well-informed decisions and navigate Bitcoin’s distinctive market cycles more adeptly.

Disclaimer: This article is for informational objectives only and does not represent financial guidance. Always conduct your own investigation before making investment choices.