The Bitcoin price trajectory in 2024 is remarkable, as the leading cryptocurrency surpassed the $100,000 threshold for the first time in history. Nevertheless, achieving this landmark has sparked a new discussion — when will the market peak?

Consequently, numerous forecasts regarding the Bitcoin price peak have surfaced within the crypto community over recent weeks. Recent on-chain analyses indicate that the market might not yet have reached its zenith or may not be nearing a peak.

Realized Profit Ratio Relatively Minimal Compared To Previous Cycles

In a recent Quicktake article on the CryptoQuant platform, an analyst identified as CryptoOnChain discussed how the actions and movements of whales could assist in determining the peak for the Bitcoin market. The critical metric in question is the realized profit ratio, which evaluates the percentage of an investor group exiting the market.

The “realized profit ratio” metric calculates the fraction of coins sold at a profit relative to the complete volume of transactions. A high reading for this metric indicates that the market is approaching its peak, as participants start to unload their assets for profit.

Conversely, a low realized profit ratio suggests that fewer market participants are liquidating their holdings for profit. This often indicates ongoing investor trust and optimism about the further price appreciation of a cryptocurrency.

According to CryptoOnChain, the realized profit ratio for various groups of Bitcoin whales (holding between 10 to 100, 100 to 1,000, and 1,000 to 10,000 BTC) is significantly lower than in previous cycles. As illustrated in the chart below, it appears that the whales have yet to initiate any profit-taking.

Source: CryptoQuant

This indicates that Bitcoin whales, who are pivotal market players, are convinced that the leading cryptocurrency has not yet attained its peak in this cycle. At this moment, the Bitcoin price lies slightly below $102,000, showing no considerable change over the last 24 hours.

40,000 BTC Transferred From Centralized Exchanges: CryptoQuant

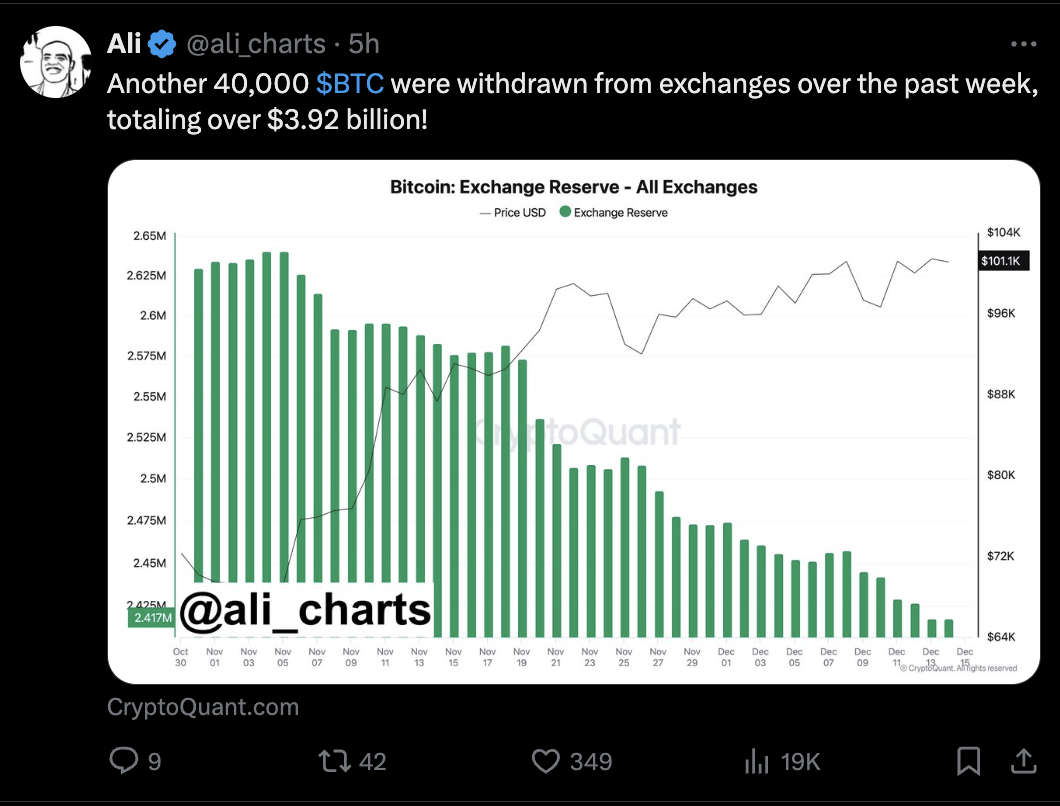

Another data point appears to bolster the idea that market participants are presently holding out for greater returns. Prominent crypto analyst Ali Martinez took to the X platform to inform that substantial amounts of Bitcoin have exited centralized exchanges in recent days.

Source: Ali_charts/X

More than 40,000 BTC (valued at approximately $3.92 billion) were sent from exchanges in the past week. This transfer of assets to non-custodial wallets reflects increasing confidence among investors, prioritizing long-term potential over immediate short-term profits.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from Unsplash, chart from TradingView