Statistics indicate that the metrics concerning the Bitcoin derivatives market have recently intensified, which might result in increased volatility in BTC’s value.

Bitcoin Open Interest & Leverage Ratio Have Increased Significantly

As noted by CryptoQuant community analyst Maartunn in a recent update on X, the Bitcoin Open Interest has seen a marked rise coinciding with the asset’s rebound above the $100,000 threshold. The term “Open Interest” here denotes a measure that accounts for the total volume of derivatives contracts related to BTC that are presently open on all centralized exchanges.

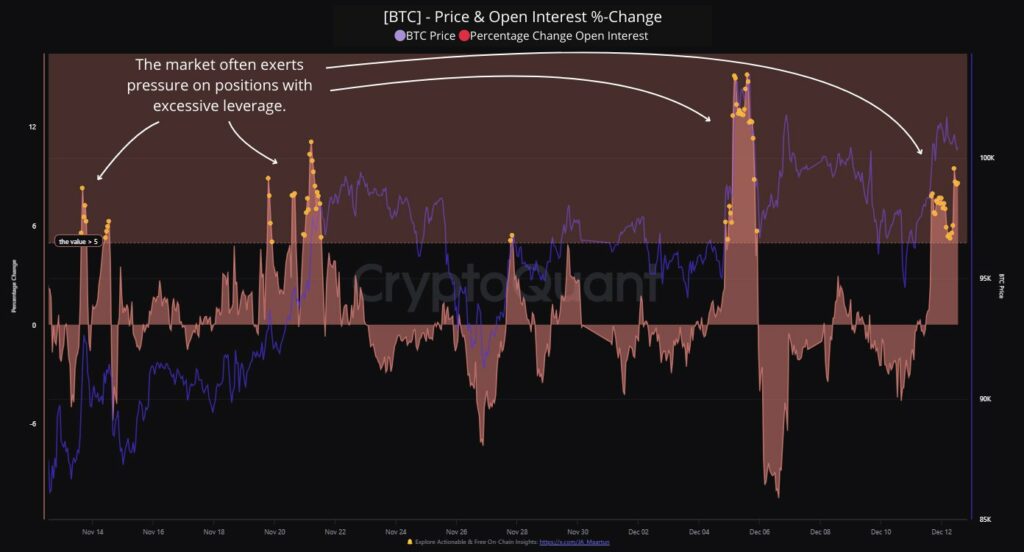

Below is the chart provided by the analyst, illustrating the trend in the percentage variation of the Bitcoin Open Interest over the preceding month:

The chart exhibits a notable positive shift in the Bitcoin Open Interest recently, suggesting a considerable number of positions have emerged in the market. In the graph, Maartunn has emphasized previous occasions where the metric noted a substantial percentage rise. It appears that typically, when this pattern was apparent in the past month, the price experienced a downturn.

Regarding the underlying cause of this trend, additional positions generally indicate an increased degree of leverage in the market. A tumultuous occurrence known as a squeeze may become more probable under these conditions.

During a squeeze, numerous positions are liquidated simultaneously and contribute to the price movement that triggered them. This extended price movement can then result in a chain reaction of further liquidations.

A squeeze is more likely to impact the side of the market with more leveraged positions. The prior increases in Open Interest were associated with upward trends, implying that the new positions were likely long trades. This might explain why the market experienced a long squeeze aimed at eliminating these surplus positions.

It’s feasible that the recent surge in Open Interest could similarly influence Bitcoin, since these new positions have arisen in conjunction with a rally. Ultimately, the outcome hinges on whether these positions are overleveraged or not.

Regrettably for the cryptocurrency sector, this condition appears to be met, as data regarding the Estimated Leverage Ratio shared by CryptoQuant author IT Tech in an X update suggests.

The Estimated Leverage Ratio reflects, as its title implies, the average level of leverage that users in the derivatives market are utilizing. Given that this metric has also surged alongside the increase in Open Interest, the newly formed positions could be carrying considerable leverage.

It remains to be seen how Bitcoin will progress in the upcoming days, considering the potentially overheated circumstances that have surfaced in these derivatives metrics.

BTC Price

At this moment, Bitcoin is hovering around $100,400, up over 2% in the last week.