Introduction

Academics debate whether it was Mahatma Gandhi who originally stated, “First they disregard you, then they mock you, then they confront you, then you prevail.” What cannot be contested is that proponents of bitcoin have embraced the saying as their own.

Bitcoin enthusiasts frequently predict that, at some stage, bitcoin will supplant the US dollar as the globe’s primary store of value.[1] Less often examined is the fundamental question of precisely how such a shift could occur and what dangers may present themselves along the journey, particularly if fiat currency issuers decide to resist challenges to their monetary dominance.

Will the US government and other Western administrations readily adjust to an emerging bitcoin standard, or will they implement restrictive policies to hinder the substitution of fiat currencies? If bitcoin indeed surpasses the dollar as the planet’s most commonly used medium of exchange, will the transition from the dollar to bitcoin be placid and positive, akin to the transformation from Blockbuster Video to Netflix? Or might it be tumultuous and harmful, reminiscent of Weimar Germany and the Great Depression? Or will it fall somewhere in the middle?

These inquiries are not merely of academic interest. If bitcoin is to emerge from potentially tumultuous times ahead, the bitcoin community must consider how to ensure it remains robust against these future scenarios and how to facilitate the most tranquil and least disruptive transition back toward an economy grounded in sound currency.

Particularly, we must recognize the weaknesses of individuals whose income and wealth fall below the average of wealthy nations—those who, at today’s and future bitcoin valuations, might struggle to save sufficiently to shield themselves from forthcoming economic adversities. “Enjoy staying poor,” some Bitcoiners respond to their doubters on social platforms. However, in a genuine economic crisis, the impoverished will not be enjoying themselves. The breakdown of fiat-centric fiscal policy will cause the greatest damage to those who rely most heavily on government spending for their economic stability. In democracies, populists across the political spectrum will have significant motivations to exploit the grievances of the non-bitcoin-owning majority against the bitcoin-holding elite.

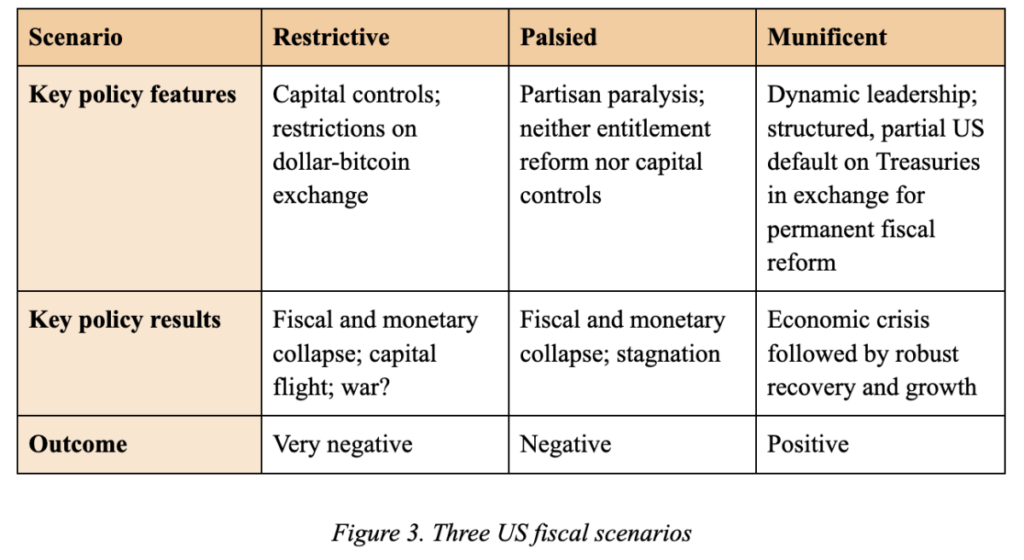

It is, of course, challenging to foresee precisely how the US government will react to a hypothetical fiscal and monetary collapse decades in the future. However, it is feasible to generally categorize the potential scenarios as relatively adverse, neutral, or favorable for society as a whole. In this article, I outline three such scenarios: A restrictive scenario, wherein the US endeavors to vigorously limit economic freedoms to stifle competition between the dollar and bitcoin; a palsied scenario, in which partisan, ideological, and special-interest disputes paralyze the government, restricting its capability to enhance America’s fiscal condition or curtail bitcoin’s ascent; and a munificent scenario, where the US integrates bitcoin into its monetary framework and reverts to prudent fiscal policy. I derive these scenarios from the highly likely emergence of a fiscal and monetary crisis in the United States by 2044.

While these scenarios could also transpire in other Western countries, I concentrate on the US here as the US dollar currently stands as the world’s reserve currency, making the US government’s reaction to bitcoin particularly significant.

The Impending Fiscal and Monetary Crisis

We possess sufficient information regarding the fiscal path of the United States to deduce that a significant crisis is not just possible but likely by 2044 if the federal government fails to alter its course. In 2024, for the first time in contemporary history, interest on federal debt surpassed spending on national defense. The Congressional Budget Office (CBO)—the official, nonpartisan fiscal evaluator of the national legislature—forecasts that by 2044, federal debt held by the public will reach approximately $84 trillion, or 139 percent of gross domestic product. This represents an increase from $28 trillion, or 99 percent of GDP, in 2024.[2]

The CBO projection is based on several optimistic assumptions regarding the country’s fiscal condition in 2044. In its most recent forecasts, at the time of this publication, the CBO assumes that the US economy will expand at a vigorous 3.6 percent per year indefinitely, that the US government will still secure borrowing at a favorable 3.6 percent in 2044, and that Congress will refrain from passing any legislation that could worsen the fiscal outlook (similar to events during the COVID-19 pandemic, for instance).[3]

The CBO acknowledges that its forecasts are ambitious. In May 2024, it released an analysis of how various alternative economic scenarios could influence the debt-to-GDP ratio. In one case, where interest rates increase each year by 5 basis points (0.05 percent) more than the CBO’s baseline, 2044 debt would amount to $93 trillion, or 156 percent of GDP. In another scenario, where federal tax revenue and expenditure levels as a share of GDP remain at historical averages (due to the persistence of supposedly temporary tax incentives and spending initiatives), the 2044 debt would rise to $118 trillion, or 203 percent of GDP.[4]

However, combining several factors demonstrates just how grave the future has become. If we take the CBO’s higher interest rate scenario, with annual interest rate growth of 5 basis points, and then layer onto that a gradual decrease in the GDP growth rate, such that nominal GDP growth in 2044 is only 2.8 percent instead of 3.6 percent, the 2044 debt reaches $156 trillion, or 288 percent of GDP. By 2054, the debt would expand to $441 trillion, or 635 percent of GDP (see figure 1).

View the original article to see embedded media.

Figure 1. US debt-to-GDP ratio: Alternative scenarios

Credit: Avik Roy, https://public.flourish.studio/visualisation/18398503/.

In this scenario characterized by heightened interest payments and diminished economic growth, by 2044 the US government would spend $6.9 trillion on interest payments, comprising nearly half of all federal tax revenue. However, just as we cannot presume that economic growth will remain high over the next twenty years, we cannot take for granted that the appetite for US government debt will remain consistent. At some moment, the US will exhaust other people’s resources. Credit Suisse estimates that in 2022 there was $454 trillion in global household wealth, defined as the total value of financial and real estate assets, minus debts.[5] Not all this wealth is available to be lent to the United States. Indeed, the proportion of US Treasury securities owned by foreign and international investors has consistently diminished since the 2008 financial crisis.[6] Simultaneously, while demand for Treasuries is declining, the supply of Treasuries is steadily rising (see figure 2).[7]

View the original article to see embedded media.

Figure 2. Ownership of US Treasuries

Credit: Avik Roy, https://public.flourish.studio/visualisation/7641395/.

In an unregulated bond market, this drop in demand coupled with an increase in supply should lead to lower bond prices, indicating higher interest rates. However, the Federal Reserve has intervened in the Treasury market to ensure that interest rates remain lower than they otherwise would be. The Fed achieves this by generating new US dollars out of nothing and utilizing them to purchase the Treasury bonds that the broader market undervalues.

to acquire.[8] Essentially, the Fed has opted that monetary expansion (that is, swiftly augmenting the volume of US dollars in circulation) is a more preferable scenario than permitting interest rates to escalate as the nation’s credit status diminishes.

This scenario is not tenable. Economist Paul Winfree, utilizing a methodology conceived by scholars at the International Monetary Fund,[9] predicts that “the federal government will start depleting its fiscal capacity, or its ability to assume more debt to address unfavorable events, within the next 15 years”—that is, by 2039. He further points out that “interest rates and potential [GDP] growth are the most crucial factors” that would influence his estimates.[10]

For the sake of our analysis, let us assume that the US will undergo a fiscal and monetary collapse by 2044—that is, a significant economic upheaval characterized by a mix of rising interest rates (triggered by the lack of market interest in purchasing Treasuries) and elevated consumer price inflation (resulting from swift monetary inflation). Over this two-decade span, let us also envision that bitcoin gradually appreciates in value, such that the liquidity of bitcoin, gauged by its overall market capitalization, becomes competitive with that of US Treasuries. Competitive liquidity is essential because it implies that large entities, such as governments and multinational financial institutions, can acquire bitcoin at a large scale without significantly destabilizing its price. Based on the behavior of traditional financial markets, I estimate that bitcoin will attain a level of competitive liquidity with Treasuries when its market valuation approaches approximately one-fifth of the federal debt held by the public. Given my $156 trillion estimate of federal debt in 2044, this translates to about $31 trillion of bitcoin market capitalization, representing a price of $1.5 million per bitcoin—about twenty times the peak price of bitcoin reached in the first half of 2024.

This is far from an implausible outcome. Bitcoin surged by a comparable multiple from August 2017 to April 2021, a period of under four years.[11] Bitcoin has increased by similar multiples on numerous occasions in the past.[12] And if anything, my forecasts regarding the growth of US federal debt are conservative. Let us, then, further envision that by 2044, bitcoin is a well-recognized, mainstream asset. A young individual who turned eighteen in 2008 will mark his fifty-fourth birthday in 2044. By 2044, over half of the US population will have coexisted with bitcoin throughout their adult lives. A strong ecosystem of financial products, including lending and borrowing, will likely have been firmly established atop the bitcoin base layer. Finally, let us speculate that under these circumstances, inflation has surged to 50 percent annually. (This sits between the over-100 percent inflation rates of Argentina and Turkey in 2023 and the nearly 15 percent inflation faced by the US in 1980.)

In 2044, under these conditions, the US government will encounter a crisis. The swift decline in the dollar’s value will have resulted in a sudden fall in demand for Treasury bonds, leaving no clear path forward. If Congress implements severe fiscal austerity—such as cutting expenditures on welfare and entitlement programs—its members will likely face removal from office. If the Federal Reserve elevates interest rates sufficiently to retain investor audience—let’s say, above 30 percent—financial markets will crash, along with the credit-driven economy, resembling the events of 1929. But if the Fed permits inflation to climb even higher, it will only hasten the exodus from Treasuries and the US dollar.

Under such conditions, how might the US government react? And how would it approach bitcoin? In what follows, I evaluate three scenarios. First, I contemplate a restrictive scenario, in which the US seeks to employ coercive measures to hinder the use of bitcoin as a rival to the dollar. Second, I discuss a paralyzed scenario, in which political divisions and economic frailty render the US government unable to take significant actions for or against bitcoin. Lastly, I assess a generous scenario, in which the US ultimately links the value of the dollar to bitcoin, rejuvenating the nation’s fiscal and monetary well-being. (See figure 3.)

Figure 3. Three US fiscal scenarios

1. The Restrictive Scenario

Historically, the most frequent government response to a declining currency has been to compel its citizens to utilize and retain that currency instead of more stable alternatives, a phenomenon referred to as financial repression. Governments also often employ other economic constraints, such as price controls, capital restrictions, and confiscatory taxation to sustain unsound fiscal and monetary practices.[13] It is conceivable—even likely—that the United States will react similarly to the impending crisis.

Price Controls

In AD 301, the Roman Emperor Diocletian issued his Edictum de Pretiis Rerum Venalium—the Edict Concerning the Sale Price of Goods—which aimed to address inflation stemming from the prolonged debasement of the Roman currency, the denarius, over a period of five centuries. Diocletian’s edict imposed price limits on over 1,200 goods and services.[14] These included wages, food, clothing, and shipping costs. Diocletian attributed rising prices not to the Roman Empire’s excessive spending but rather to “unprincipled and reckless individuals [who] believe greed carries a sort of obligation . . . in ruining the fortunes of all.”[15]

Actions of this nature resonate throughout history right into the present day. In 1971, US President Richard Nixon reacted to the looming collapse of US gold reserves by unilaterally severing the dollar’s peg to one-thirty-fifth of an ounce of gold and by instituting a ninety-day freeze on “all prices and wages across the United States.”[16] Nixon, akin to Diocletian and a multitude of other rulers in between, did not attribute his government’s fiscal or monetary issues to his country’s choices but rather the “international monetary speculators” who “have been conducting a full-scale war on the American dollar.”[17]

Even mainstream economists have convincingly demonstrated that price controls on goods and services are ineffective.[18] This is due to the fact that producers cease to produce if required to sell their goods and services at a deficit, resulting in shortages. Nevertheless, price controls persist as a constant lure for politicians since many consumers believe that price controls will shield them from inflation (at least in the short term). Since 2008, the Federal Reserve has implemented an increasingly assertive array of controls on what economic historian James Grant terms “the most important price in capital markets”—that is, the price of money as reflected by interest rates.[19] As outlined previously, the Federal Reserve can proficiently control interest rates on Treasury securities by acting as the primary buyer and seller of those securities in the open market. (When bond prices increase due to more buying than selling, the interest rates implied by their prices decrease, and vice versa.) The interest rates utilized by financial institutions and consumers, in turn, are profoundly influenced by the interest rates on Treasury bonds, bills, and notes. Prior to the 2008 financial crisis, the Fed employed this authority narrowly, focusing on a subset of short-term Treasury securities. However, afterward, under Chairman Ben Bernanke, the Fed became far more aggressive in using its power to regulate interest rates throughout the economy.[20]

Capital Controls

Price controls are merely one mechanism utilized by governments to manage monetary crises. Another is capital controls, which impede the exchange of a localcurrency for another currency or reserve asset.

In 1933, amidst the Great Depression, President Franklin Delano Roosevelt (commonly referred to as FDR) utilized a World War I-era statute to prevent Americans from escaping the dollar for gold. Through Executive Order 6102, he forbade Americans from holding gold coins, gold bars, and gold certificates, mandating that individuals surrender their gold to the US government in return for $20.67 per troy ounce.[21] Nine months later, Congress devalued the dollar by adjusting the price of a troy ounce to $35.00, effectively compelling Americans to recognize an immediate 41 percent devaluation of their savings while blocking them from avoiding that decline through a superior store of value.[22]

Capital controls are hardly a relic of the past. Argentina has long restricted its citizens from converting more than $200 worth of Argentine pesos into dollars each month, ostensibly to decelerate the depreciation of its currency.[23] China enforces stringent capital controls on its populace — necessitating government approval for any foreign currency exchange — to avert capital outflow to other regions.[24]

Progressively, mainstream economists consider these contemporary instances of capital controls as successful. The International Monetary Fund, which emerged from the 1944 Bretton Woods Agreement, had traditionally opposed capital controls, largely due to the influence of the United States, which benefits from the global utilization of the US dollar. However, in 2022, the International Monetary Fund modified its “institutional view” concerning capital controls, designating them as a suitable instrument for “managing . . . risks in a manner that maintains macroeconomic and financial stability.”[25]

In my restrictive 2044 scenario, the US implements capital controls to stop Americans from abandoning the dollar for bitcoin. The federal government could accomplish this through several methods:

- Proclaiming a supposedly temporary, yet ultimately lasting, cessation of the dollar-to-bitcoin exchange and compelling the conversion of all bitcoin assets held in cryptocurrency exchanges into dollars at a predetermined exchange rate. (Based on my anticipated market price where bitcoin’s liquidity competes with Treasuries, it would be around $1.5 million per bitcoin, although there is no assurance that a forced conversion would take place at market rates.)

- Prohibiting businesses under US jurisdiction from maintaining bitcoin on their balance sheets and from accepting bitcoin as payment.

- Dismantling bitcoin exchange-traded funds (ETFs) by obliging them to convert their assets to US dollars at a fixed exchange rate.

- Mandating bitcoin custodians to sell their bitcoin to the US government at a fixed exchange rate.

- Obliging those who self-custody their bitcoin to sell it to the government at a fixed exchange rate.

- Introducing a central bank digital currency to comprehensively monitor all US dollar transactions and guarantee that none are utilized to acquire bitcoin.

The US government would likely struggle to implement all of these strategies successfully. In particular, the US will find it difficult to compel all individuals who self-custody bitcoin to relinquish their private keys. Nonetheless, many law-abiding citizens would probably comply with such an edict. However, this would be a pyrrhic victory for the government: The enforcement of capital controls would result in a further erosion of confidence in the US dollar, and the expense for the US government in acquiring all the bitcoin held by American citizens and residents could surpass $10 trillion, amplifying the US fiscal challenges. Despite this, the government in the restrictive scenario will have determined that these are the least detrimental options.

Expropriative Taxation

The US government could likewise employ tax policy to limit the utility of bitcoin and thus curtail its adoption.

In a scenario where one bitcoin is valued at $1.5 million, many of the wealthiest individuals in the United States will be early bitcoin adopters. Technology innovator Balaji Srinivasan has projected that at a valuation of $1 million per bitcoin, the count of bitcoin billionaires will begin to surpass that of fiat billionaires.[26] This does not imply, however, that the wealth distribution among bitcoin holders would be more equitable than among fiat currency holders today.

Fewer than 2 percent of all bitcoin addresses possess more than one bitcoin, and fewer than 0.3 percent contain more than ten bitcoin. Addresses within that top 0.3 percent hold over 82 percent of all bitcoin in existence.[27] (See figure 4.) Considering that numerous individuals manage multiple wallets, and even accounting for the fact that some of the largest bitcoin addresses are owned by cryptocurrency exchanges, these statistics likely undervalue the concentration of bitcoin wealth. They compare unfavorably to the distribution of fiat wealth in the US; in 2019, the top 1 percent owned merely 34 percent of all fiat-denominated wealth in the United States.[28]

If bitcoin ownership remains similarly concentrated in 2044, those who are left behind by this monetary transformation—including disenfranchised elites from the previous era—will not accept their fate silently. Many will criticize bitcoin wealth disparity as fueled by anti-American speculators and will strive to implement policies that diminish the economic power of bitcoin holders.

View the original article to see embedded media.

Figure 4. Distribution of bitcoin ownership

Credit: Avik Roy, https://public.flourish.studio/visualisation/18651414/.

In 2021, speculation surfaced that Treasury Secretary Janet Yellen had suggested to President Joe Biden the implementation of an 80 percent tax on cryptocurrency capital gains, a significant boost from the current top long-term capital gains tax rate of 23.8 percent.[29] In 2022, President Biden, following a proposal by Massachusetts Senator Elizabeth Warren, indicated the taxation of unrealized capital gains—meaning the on-paper increases in asset value that the holder has not yet sold.[30] This would represent an unprecedented move as it would necessitate individuals to pay taxes on earnings they have yet to realize.

It has long been contended that taxing unrealized capital gains would breach the US Constitution because unrealized gains do not fit the legal definition of income. Article I of the Constitution stipulates that non-income taxes must be imposed in proportion to states’ respective populations.[31] A recent case before the Supreme Court, Moore v. United States, presented the court an opportunity to clarify its stance on this issue; it opted not to do so.[32] Consequently, it remains entirely plausible that a future Congress, bolstered by a future Supreme Court, will agree to the taxation of unrealized capital gains, particularly relating to cryptocurrency.

Furthermore, an administration that disagrees with the constitutional interpretations of an existing Supreme Court could simply appoint additional justices to ensure more favorable verdicts. The FDR administration threatened to do just that during the 1930s. The conservative Supreme Court of that time had frequently ruled that FDR’s economically interventionist policies contravened the Constitution. In 1937, Roosevelt reacted by threatening to appoint six new justices to the Supreme Court in addition to the nine already present. Although he eventually had to abandon his court-packing plans, the Supreme Court was sufficiently intimidated and began to endorse New Deal legislation rapidly thereafter.[33]

A distinctive characteristic of US tax policy is that US citizens residing abroad are still obligated to pay US income and capital gains taxes, along with the taxes

they contribute in the nation of their domicile. (In all other developed economies, expatriates only contribute taxes once, depending on their location. For instance, a French citizen residing and employed in Belgium adheres to Belgian tax laws, not French ones, while an American in Belgium is liable for both Belgian and US taxes.) This generates a counterproductive incentive for Americans residing overseas to relinquish their US citizenship. Annually, a few thousand Americans make this choice. However, they must first obtain authorization from a US consulate abroad and pay taxes on all unrealized capital gains. In a restrictive environment, where the US Treasury struggles for income, it is easy to envision the government halting the ability of Americans to renounce their nationality, ensuring that expatriates’ earnings remain taxable regardless of their residence.

Right-Wing Financial Limitations

Although numerous restrictive measures mentioned earlier have been suggested by politicians associated with the Democratic Party, Republican Party leaders and representatives in 2044 may equally engage in amplifying populist discontent towards the bitcoin elite. The United States already hosts a vocal faction of both American and European thinkers constructing a new ideology broadly termed national conservatism, where the curtailment of individual rights is deemed acceptable for the sake of the national advantage.[34] For example, certain national conservatives support monetary and fiscal policies that safeguard the US dollar against bitcoin, even to the detriment of individual property rights.[35]

The USA PATRIOT Act was enacted by considerable bipartisan congressional majorities shortly after the terrorist incidents of September 11, 2001. It was ratified by Republican President George W. Bush and encompassed various provisions aimed at combating the funding of international terrorism and criminal activities, particularly by bolstering anti-money-laundering and know-your-customer regulations, alongside reporting obligations for foreign bank account holders.[36]

While the PATRIOT Act may have contributed to decreasing the threat of terrorism against the US, it has achieved this at a significant expense to economic liberties, particularly for American expatriates and others utilizing non-US bank accounts for personal or business purposes. Just as FDR leveraged a law from World War I to confiscate Americans’ gold reserves, in 2044, a restrictive administration from either political party will find many tools of the PATRIOT Act advantageous for tightening control over bitcoin ownership and utilization.

The Conclusion of America’s Exorbitant Advantage

Bitcoin is extraordinarily robust in its architecture; its decentralized network will probably continue to operate effectively despite restrictive actions implemented by governments against its utilization. Presently, for example, a significant quantity of bitcoin trading volume and mining operations takes place in China, despite that nation’s ban on it, due to the use of virtual private networks (VPNs) and various tools that obscure a user’s geographic position.[37]

If we posit that half of the global bitcoin is possessed by Americans and further assume that 80 percent of American bitcoin is owned by early adopters and other substantial holders, it is plausible that the majority of that 80 percent is already shielded against confiscation through self-custody and offshore contingency arrangements. Capital controls and limitations could collapse institutional bitcoin trading volume in the US, but much of this activity would likely shift to decentralized exchanges or to jurisdictions outside of the US where policies are less prohibitive.

A fiscal failure of the US in 2044 will inevitably be accompanied by a decline in US military strength since such power is based on massive levels of deficit-financed defense expenditure. Therefore, the US government will not be as capable in 2044 as it is today of imposing its economic will on other nations. Smaller countries, such as Singapore and El Salvador, might opt to welcome the bitcoin-based capital that the US turns away.[38] The mass migration of bitcoin-based wealth from the US would, undoubtedly, render America poorer and further diminish the government’s capacity to meet its spending obligations.

Moreover, US restrictions on bitcoin’s viability will not suffice to convince international investors that US Treasuries are a worthy investment. The primary means by which the US government could render investment in US bonds more appealing would be for the Federal Reserve to significantly increase interest rates since elevated interest rates signify higher yields on Treasury securities. However, this would consequently elevate the cost of financing the national debt, exacerbating the US fiscal crisis.

Ultimately, international investors may insist that the US denominate its bonds in bitcoin, or in a foreign currency supported by bitcoin, as a prerequisite for further investment. This monumental alteration would terminate what former French Finance Minister and President Valéry Giscard d’Estaing famously termed America’s privilège exorbitant: Its enduring capacity to borrow in its own currency, which has allowed the US to diminish the value of its debts by devaluing the dollar.[39]

If and when US bonds are denominated in bitcoin, the United States will be compelled to borrow money as other nations do: In a currency not of its own creation. Under a bitcoin standard, future devaluations of the US dollar would escalate, rather than lessen, the liabilities of America to its creditors. America’s creditors—holders of US government bonds—would then be in a position to demand various austerity measures, such as necessitating that the US rectify its budget deficits through a combination of substantial tax hikes and spending reductions for Medicare, Social Security, national security, and other federal programs.

A significant reduction in America’s ability to finance its military would carry profound geopolitical consequences. A century ago, when the United States surpassed the United Kingdom as the world’s preeminent power, the transition was relatively smooth. We have no guarantees that a future transition will unfold in a similar manner. Historically, multipolar environments featuring competing major powers often lead to world wars.[40]

2. The Palsy Scenario

In the medical field, a palsy refers to a type of paralysis accompanied by involuntary tremors. This term precisely characterizes my second scenario, wherein the macroeconomic tremors accompanying bitcoin’s ascent are coupled in the US with partisan division, bureaucratic discord, and waning American influence. In the palsy scenario, the US is incapable of taking aggressive action against bitcoin, yet it also cannot bring its fiscal matters under control.

Currently, partisan polarization in the US is at a contemporary peak.[41] Republicans and Democrats are increasingly divided along cultural lines: Republicans tend to be more rural, high school graduates, and predominantly white; Democrats are increasingly urban, educated, and diverse. Independents, who now constitute a plurality of the electorate, find themselves compelled to select from the candidates nominated for general elections by the partisan base voters of the Republican and Democratic parties in contentious primaries.[42]

While we can aspire for these trends to be reversed over time, there are justifications to suspect they will not. Among other factors, the rapid development of software capabilities that influence behavior at scale, including artificial intelligence—for all of their potential—brings significant dangers in the political realm. The possibility for deepfakes and other forms of large-scale deceit could diminish

trust in political parties, elections, and governmental institutions, while simultaneously further dividing the US political landscape into smaller subcultural factions. The cumulative outcome of this division could result in a failure to reach consensus on most matters, much less contentious issues such as curtailing federal entitlement expenditures.

In the paralyzed scenario, the US government is incapable in 2044 of implementing most of the restrictive measures outlined in the preceding section. For instance, gridlock might prevent Congress and the Federal Reserve from creating a central bank digital currency due to staunch resistance from activists and particularly from banking institutions, which accurately perceive such a currency as a serious threat to their business models. (A retail central bank digital currency eliminates the necessity for individuals and businesses to deposit their funds at banks, as they could instead maintain accounts directly with the Federal Reserve.)[43]

Similarly, under the paralyzed scenario, Congress would also be unable in 2044 to put in place confiscatory taxes against bitcoin holders and the affluent more generally. Congress would struggle to implement these measures for the same reasons it has failed up until now: Concerns regarding the constitutionality of such taxes; opposition from influential economic players; and acknowledgment that direct assaults on bitcoin-based capital would push that capital overseas, ultimately harming the United States.

The paralyzed scenario is not a libertarian paradise, however. In this context, the federal government would still possess the capacity to regulate centralized exchanges, ETFs, and other financial services that facilitate the conversion of US dollars into bitcoin. If a significant portion of US-held bitcoin is managed through ETFs, federal regulatory bodies would retain the authority to limit the conversion of bitcoin ETF securities into actual bitcoin, severely restricting the movement of capital out of US-controlled products.

Most crucially, though, partisan gridlock means that Congress will be incapable of addressing America’s fiscal crisis. Congress will not have the necessary votes for entitlement reform or other spending reductions. And by 2044, federal expenditures will continue escalating at such a swift pace that no quantity of tax revenue will be able to keep up.

In the paralyzed scenario, Americans who own bitcoin will be more capable of safeguarding their savings from governmental intrusion than in the restrictive scenario. They will not need to leave the country to possess bitcoin, for instance. This indicates that a notable segment of the bitcoin community—comprising both individuals and entrepreneurs—will stay in the United States and likely emerge as an economically influential group. Yet, the institutional environment they inhabit and operate within will remain stuck in dysfunction. Anti-bitcoin policymakers and pro-bitcoin political benefactors may ultimately find themselves in a deadlock.

As with the restrictive scenario, in the paralyzed scenario, the collapse of the dollar-denominated Treasury bond market could compel the United States to finally get its fiscal affairs in order. In both scenarios, creditors might well demand that the Treasury Department issue debt securities that are backed by hard assets. By 2044, bitcoin will have over three decades of validation as a leading store of value, and the American bitcoin community will be adeptly positioned to assist the US in adjusting to its new circumstances.

3. The Generous Scenario

The generous scenario is both the least predictable and the most hopeful scenario for America in 2044. In this context, US policymakers respond to the fiscal and monetary crisis of 2044 by proactively staying ahead of developments, rather than being forced to react to forces seemingly beyond their control.

The generous scenario entails the US taking actions in 2044 akin to what El Salvador did in 2019 or Argentina did in 2023 when those nations elected Nayib Bukele and Javier Milei, respectively, as their presidents. While Bukele and Milei are distinct leaders with somewhat differing ideologies, both have explicitly demonstrated affirmation for bitcoin; with Bukele designating bitcoin as legal tender in El Salvador[44] and Milei committing to substitute the Argentine peso with the dollar[45] while legalizing bitcoin.[46] Milei has also exercised his presidential powers to significantly decrease Argentine public spending in inflation-adjusted terms, thereby achieving a primary budget surplus.[47]

Envision that in November 2044, the US elects a dynamic, pro-bitcoin president who vows to adopt bitcoin as legal tender alongside the dollar (similar to Bukele) and collaborates with Treasury bondholders to alleviate the US debt burden (as Milei did). One could foresee a monumental fiscal agreement wherein Treasury bondholders consent to a one-time, partial default in exchange for reforms in Medicare and Social Security along with a pledge to back the US dollar with bitcoin moving forward, at a rate of sixty-seven satoshis to the dollar (equating to $1.5 million per bitcoin). Bondholders are likely to be willing to accept a partial default in return for substantial reforms that position the US on a sustainable fiscal and monetary trajectory for the future.

Such reforms do not have to adversely affect the elderly and other at-risk populations. An increasing body of research indicates that fiscal viability need not clash with social welfare. For instance, the Foundation for Research on Equal Opportunity published a healthcare reform proposal introduced by Arkansas Rep. Bruce Westerman and Indiana Sen. Mike Braun in 2020 as the Fair Care Act. This plan could reduce the deficit by over $10 trillion over a thirty-year timeframe and render the healthcare system fiscally sustainable while achieving universal coverage.[48] The bill accomplishes this in two primary methods: First, it means-tests healthcare subsidies ensuring that taxpayers only support the care costs for the impoverished and middle class, not the wealthy. Secondly, it lowers healthcare subsidy costs by fostering competition and innovation. In these manners, the proposal enhances the economic security of lower-income Americans while simultaneously bolstering the fiscal sustainability of the federal government.

In a similar vein, the US could reform Social Security by shifting the Social Security trust fund from Treasury bonds to bitcoin (or bitcoin-denominated Treasury bonds).[49] While this concept is less feasible in an era defined by high volatility that has typified bitcoin’s initial history, by 2044, the bitcoin-dollar exchange rate is likely to stabilize. The post-ETF maturation of bitcoin trading, driven by the introduction of traditional hedging practices from large financial institutions, has markedly diminished bitcoin’s price volatility against the dollar. Soon, the price fluctuations of bitcoin may mirror those of stable assets like gold. By securing Social Security with bitcoin, the US could ensure that Social Security fulfills its purpose—providing genuine economic security to American retirees in their later years.

The generous scenario brings further advantages. By directly aligning itself with bitcoin’s monetary principles, the US government could help usher in another era dominated by American values in the twenty-first century. It is highly improbable that America’s primary geopolitical adversary, China, will legalize a currency such as bitcoin that it cannot govern. America’s entrepreneurial culture, coupled with sound money principles, could usher in an unparalleled period of economic growth and prosperity for the United States. However, this would demand that US leadersto prioritize the country’s long-term goals over immediate political allurements.

The Satoshi Papers is currently up for pre-order at the Bitcoin Magazine Store.

[1] A commonly accepted perspective among scholarly economists asserts that for an entity to qualify as money, it must function as a store of value, a medium of exchange, and a unit of account. These characteristics of money exist on a spectrum rather than being absolute; certain forms of money excel as stores of value, while others may be more prevalent in trade and commerce. The introduction of Bitcoin as the leading store of value represents a pivotal advancement because this is where fiat currencies falter the most. Refer to Friedrich Hayek, Denationalisation of Money, 2nd ed. (London: Profile Books, 1977), 56–57.

[2] Congressional Budget Office, “The Long-Term Budget Outlook: 2024 to 2054,” March 20, 2024, https://www.cbo.gov/publication/59711.

[3] Congressional Budget Office, “Long-Term Economic Projections,” March 2024, https://www.cbo.gov/system/files/2024-03/57054-2024-03-LTBO-econ.xlsx.

[4] Congressional Budget Office, “The Long-Term Budget Outlook Under Alternative Scenarios for the Economy and the Budget,” May 21, 2024, https://www.cbo.gov/publication/60169.

[5] Credit Suisse AG, “Credit Suisse Global Wealth Report 2023,” accessed June 16, 2024, https://www.credit-suisse.com/about-us/en/reports-research/global-wealth-report.html.

[6] Avik Roy, “Bitcoin and the U.S. Fiscal Reckoning,” National Affairs, Fall 2021. https://nationalaffairs.com/publications/detail/bitcoin-and-the-us-fiscal-reckoning.

[7] Federal Reserve Bank of St. Louis, “Federal Debt Held by Federal Reserve Banks,” accessed June 16, 2024, https://fred.stlouisfed.org/graph/?g=jwFo.

[8] Lowell R. Ricketts, “Quantitative Easing Explained,” Federal Reserve Bank of St. Louis, accessed June 16, 2024, https://files.stlouisfed.org/files/htdocs/pageone-economics/uploads/newsletter/2011/201104.pdf.

[9] Atish R. Ghosh et al., “Fiscal Fatigue, Fiscal Space and Debt Sustainability in Advanced Economies,” Economic Journal 123, no. 566 (February 2013): F4–F30, https://onlinelibrary.wiley.com/doi/full/10.1111/ecoj.12010.

[10] Paul Winfree, “The Looming Debt Spiral: Analyzing the Erosion of U.S. Fiscal Space,” March 5, 2024, https://epicforamerica.org/wp-content/uploads/2024/03/Fiscal-Space-March-2024.pdf.

[11] Coinmarketcap.com, “Bitcoin Price Today,” accessed June 16, 2024, https://coinmarketcap.com/currencies/bitcoin/.

[12] Coinmarketcap.com, “Bitcoin Price Today.”

[13] Ray Dalio, Principles for Navigating Big Debt Crises (Westport, CT: Bridgewater, 2018).

[14] When the denarius was established around 211 BC, it comprised approximately 4.5 grams of silver. In AD 64, Roman Emperor Nero lowered the silver content to 3.5 grams. By the era of Diocletian’s rule, the denarius contained nearly no silver, leading to its discontinuation. For additional exploration of hyperinflation in ancient Rome, consult H. J. Haskell, The New Deal in Old Rome: How Government in the Ancient World Tried to Deal With Modern Problems (New York: Alfred A. Knopf, 1947).

[15] Antony Kropff, “An English Translation of the Edict on Maximum Prices, Also Known as the Price Edict of Diocletian,” April 27, 2016, https://kark.uib.no/antikk/dias/priceedict.pdf.

[16] Richard M. Nixon, “Address to the Nation Outlining a New Economic Policy,” August 15, 1971, https://www.presidency.ucsb.edu/documents/address-the-nation-outlining-new-economic-policy-the-challenge-peace.

[17] Richard M. Nixon, “Address to the Nation.”

[18] Vernon Smith and Arlington Williams, “On Nonbinding Price Controls in a Competitive Market,” American Economic Review 71: 467–74.

[19] Swen Lorenz, “3 Lessons I Learned From Jim Grant, the Wall Street Cult Hero,” accessed July 5, 2024, https://www.undervalued-shares.com/weekly-dispatches/3-lessons-i-learned-from-jim-grant-the-wall-street-cult-hero/.

[20] Avik Roy, “Bitcoin and the U.S. Fiscal Reckoning,” National Affairs, Fall 2021.

[21] US Congress, “The Gold Standard Act of 1900,” accessed June 16, 2024, https://www2.econ.iastate.edu/classes/econ355/choi/1900mar14.html.

[22] Gary Richardson, Alejandro Komai, and Michael Gou, “Gold Reserve Act of 1934,” accessed June 16, 2024, https://www.federalreservehistory.org/essays/gold-reserve-act.

[23] Fitch Ratings, “Overview of Argentine Capital Controls (History and Recent Impact on Corporates),” April 6, 2021, https://www.fitchratings.com/research/corporate-finance/overview-of-argentine-capital-controls-history-recent-impact-on-corporates-06-04-2021.

[24] Robert Kahn, “The Case for Chinese Capital Controls,” Council on Foreign Relations, February 2016, https://www.cfr.org/sites/default/files/pdf/2016/02/February%202016%20GEM.pdf.

[25] International Monetary Fund, “Executive Board Concludes the Review of the Institutional View on the Liberalization and Management of Capital Flows,” press release, March 30, 2022. https://www.imf.org/en/News/Articles/2022/03/30/pr2297-executive-board-concludes-the-review-of-the-institutional-view-on-capital-flows.

[26] Balaji Srinivasan, “The Billionaire Flippening,” February 5, 2021, https://balajis.com/p/the-billionaire-flippening.

[27] “Bitcoin Rich List,” accessed July 7, 2024, https://bitinfocharts.com/top-100-richest-bitcoin-addresses.html.

[28] Congressional Budget Office, “Trends in the Distribution of Family Wealth, 1989 to 2019,” September 27, 2022, https://www.cbo.gov/publication/57598.

[29] William White, “80% Crypto Capital Gains Tax? 15 Things We Know About the Rumors,” Yahoo! Finance, April 23, 2021, https://finance.yahoo.com/news/80-crypto-capital-gains-tax-153027836.html#.

[30] Garrett Watson and Erica York, “Proposed Minimum Tax on Billionaire Capital Gains Takes Tax Code in Wrong Direction,” Tax Foundation, March 30, 2022, https://taxfoundation.org/blog/biden-billionaire-tax-unrealized-capital-gains/.

[31] Steven Calabresi, “Taxes on Wealth and on Unrealized Capital Gains Are Unconstitutional,” Reason, October 11, 2023, https://reason.com/volokh/2023/10/11/taxes-on-wealth-and-on-unrealized-capital-gains-are-unconstitutional/.

[32] Wall Street Journal Editorial Board, “A Supreme Court Mistake on Wealth Taxes,” The Wall Street Journal, June 20, 2024, https://www.wsj.com/articles/moore-v-u-s-supreme-court-mandatory-repatriation-tax-brett-kavanaugh-amy-coney-barrett-23d99510.

[33] Charles Lipson, “Packing the Court, Then and Now,” Discourse, April 21, 2021, https://www.discoursemagazine.com/p/packing-the-court-then-and-now.

[34] Avik Roy, “Freedom Conservatism Is Different, and That Matters,” National Review, July 18, 2023, https://www.nationalreview.com/2023/07/freedom-conservatism-is-different-and-that-matters/.

[35] Peter Ryan, “Is Bitcoin ‘America First’?” The American Conservative, February 13, 2024, https://www.theamericanconservative.com/is-bitcoin-america-first/.

[36] USA PATRIOT Act of 2001, Congress.gov, accessed June 16, 2024, https://www.congress.gov/107/plaws/publ56/PLAW-107publ56.htm.

[37] Ryan Browne, “Bitcoin Production Roars Back in China Despite Beijing’s Ban on Crypto Mining,” CNBC.com, May 18, 2022, https://www.cnbc.com/2022/05/18/china-is-second-biggest-bitcoin-mining-hub-as-miners-go-underground.html.

[38] Some bitcoin-derived wealth may be expressed in fiat currencies, such as ownership in digital-asset exchanges like Coinbase and bitcoin-mining enterprises such as Marathon Digital Holdings.

[39] Barry Eichengreen, Exorbitant Privilege: The Rise and Fall of the Dollar andthe Prospects of the Global Monetary Framework (Oxford: Oxford University Press, 2011).

[40] Donald Kagan, On the Roots of Conflict: And the Maintenance of Tranquility (New York: Anchor, 1996).

[41] Ezra Klein, Reasons for Our Polarization (New York: Simon & Schuster, 2020).

[42] Nick Troiano, The Primary Remedy: Safeguarding Our Democracy from the Extremes (New York: Simon & Schuster, 2024).

[43] Avik Roy, “There’s No Such Entity as an ‘American-Style’ Central Bank Digital Currency,” Forbes, April 12, 2023, https://www.forbes.com/sites/theapothecary/2023/04/12/theres-no-such-thing-as-an-american-style-central-bank-digital-currency/.

[44] Avik Roy, “El Salvador Passes Bitcoin Legislation, Marking a New Era of Global Monetary Inclusion,” Forbes, June 9, 2021, https://www.forbes.com/sites/theapothecary/2021/06/09/el-salvador-enacts-bitcoin-law-ushering-in-new-era-of-global-monetary-inclusion/.

[45] Ryan Dubé and Santiago Pérez, “Argentina’s Incoming President Aims to Adopt the U.S. Dollar as the Official Currency,” The Wall Street Journal, November 20, 2023, https://www.wsj.com/world/americas/argentinas-new-president-wants-to-adopt-the-u-s-dollar-as-national-currency-86da3444.

[46] On Twitter/X, Milei’s foreign minister and economic advisor Diana Mondino (@DianaMondino, December 21, 2023) stated, “We reaffirm and assert that in Argentina agreements can be made in Bitcoin.”

[47] “The budget reductions that enabled Milei to revitalize Argentina’s economy,” Buenos Aires Times, April 23, 2024, https://www.batimes.com.ar/news/economy/the-expenses-cut-by-milei-to-achieve-a-fiscal-surplus.phtml.

[48] Avik Roy, “The Fair Care Act of 2020: Market-Driven Universal Coverage,” Foundation for Research on Equal Opportunity, October 12, 2020, https://freopp.org/the-fair-care-act-of-2020-market-based-universal-coverage-cc4caa4125ae.

[49] According to 2024 projections, the Social Security Trust Fund is expected to be entirely exhausted by 2033. For the sake of my scenario analysis, I presume that Congress identifies a temporary resolution before that time which delays Social Security’s challenges beyond 2044.