“`html

Bitcoin is exhibiting indications of resurgence after facing weeks of selling pressure, which peaked in a steep flash crash on October 10, when the price momentarily fell to approximately $103,000. Since that event, BTC has seen a modest recovery, currently testing resistance around $111,000, a region historically frequented by sellers. Despite this rebound, market sentiment remains delicate, with traders reluctant to declare a definitive bottom.

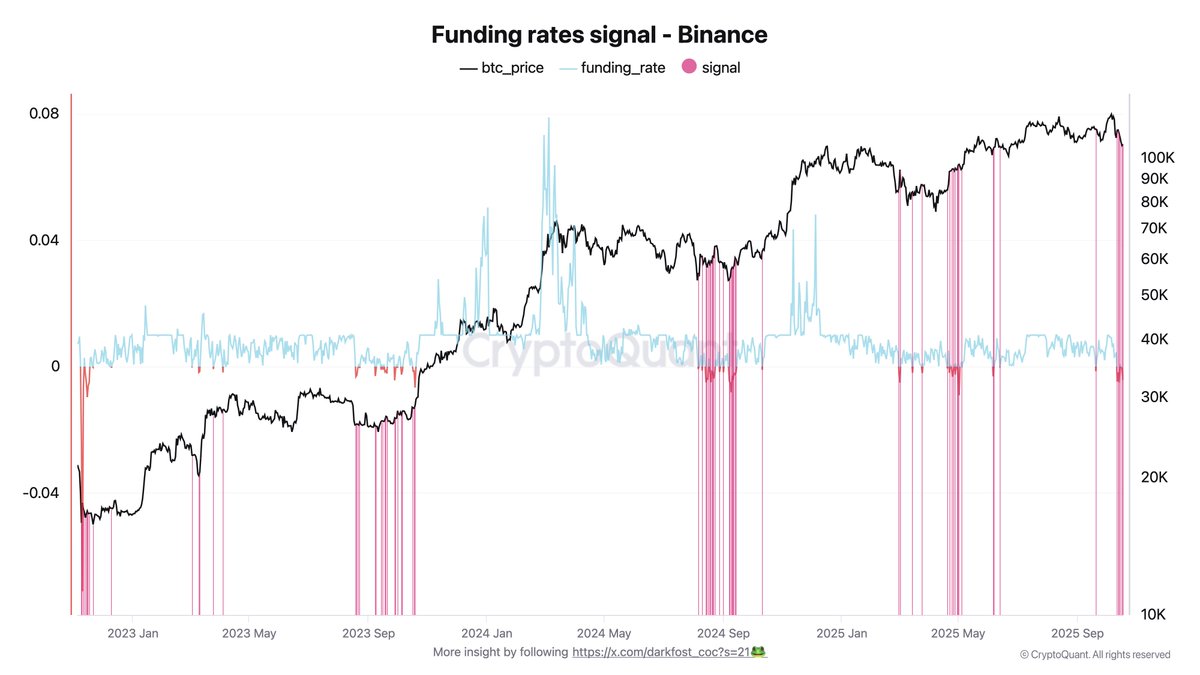

Leading analyst Darkfost suggests that Bitcoin might be transitioning into a new disbelief phase — a season often observed at the conclusion of significant corrections, when investors find it hard to believe any signs of rebound. This transformation is becoming increasingly apparent in the derivatives market, especially through funding rates, which indicate trader positioning and market sentiment.

On Binance, which continues to lead in global futures trading volume, funding rates have stayed negative for six out of the last seven days, presently hovering around -0.004%. This ongoing bearish stance implies that short positions continue to dominate over longs, as traders proceed with caution following the recent liquidation wave. Historically, such enduring disbelief and short dominance have frequently preceded substantial short squeezes or relief uptrends.

Disbelief May Pave The Way for The Upcoming Major Surge

As per Darkfost, the current period of disbelief could ironically serve as the groundwork for Bitcoin’s next significant surge. When traders remain excessively bearish despite early indications of recovery, the build-up of short positions can create conditions for a potent short squeeze. In such circumstances, even a slight upward movement can compel short sellers to close their positions, amplifying buying pressure and triggering a swift price breakout.

If the current upward trend continues to gather strength, this surge of liquidations could propel Bitcoin significantly higher. Darkfost highlights essential liquidity zones around $113,000 and $126,000, both locations currently housing substantial short positions. As these positions unwind, BTC could experience a chain reaction of forced buying — a dynamic that has historically inspired explosive movements.

Similar trends have manifested previously. In September 2024, Bitcoin dropped to $54,000 before rebounding above $100,000 for the first occasion, fueled by a significant short squeeze. Once more, in April 2025, BTC skyrocketed from $85,000 to $111,000, and eventually to $123,000, adhering to the same pattern.

Darkfost implies that the market could presently be entering another such disbelief stage, where pervasive skepticism conceals underlying strength. If history repeats, this doubt-laden environment may once again convert fear into momentum — positioning the ground for Bitcoin’s next significant upward movement.

Editorial Procedure for bitcoinist focuses on providing thoroughly investigated, accurate, and impartial content. We adhere to stringent sourcing standards, and every page is meticulously reviewed by our team of senior technology specialists and experienced editors. This procedure guarantees the integrity, relevance, and worth of our content for our readers.

Source link

“`