“`html

As the globe transitions from a U.S.-led unipolar regime to a multipolar environment spearheaded by BRICS countries, the U.S. dollar encounters unparalleled strain due to diminishing bond interest and escalating debt expenses. The Genius Act, ratified in July 2025, indicates a daring U.S. initiative to respond to this by legitimizing Treasury-backed stablecoins, unleashing billions in foreign investment for U.S. bonds.

The blockchain that supports these stablecoins will influence the global economy for years to come. Bitcoin, with its unparalleled decentralization, Lightning Network confidentiality, and formidable security, rises as the optimal option to fuel this digital dollar transformation, guaranteeing minimal switching costs when fiat currency eventually diminishes. This essay investigates why the dollar must transition to digital form via blockchains and why Bitcoin should become its infrastructure for the U.S. economy to achieve a gentle landing from its peak as a global hegemony.

Decline of the Unipolar World

You may have heard that the globe is evolving from a unipolar world framework — where the United States stood as the sole superpower capable of influencing markets and dominating conflicts worldwide — to a multipolar scenario, in which a coalition of Eastern-aligned nations can coordinate despite U.S. foreign strategy. This eastern coalition, known as BRICS, consists of significant nations such as Brazil, Russia, China, and India. The unavoidable outcome of BRICS’s ascendancy is the reconfiguration of geopolitics, challenging the dominance of the U.S. dollar system.

Numerous seemingly unconnected indicators are suggesting this transformation of the world order. For instance, consider the military alliance between the United States and a nation such as Saudi Arabia. The U.S. is no longer upholding the petrodollar arrangement, whereby Saudi oil was exclusively traded for dollars in return for military protection of the region. This petrodollar approach had been a crucial driver of demand for the dollar and was deemed vital to the U.S. economy’s strength since the ’70s, yet it has essentially concluded in recent times — particularly following the onset of the Ukraine conflict, when Saudi Arabia initiated accepting currencies beyond the dollar for oil-related transactions.

The Deterioration of the U.S. Bond Market

Another pivotal indicator of the geopolitical realignment is the weakening of the U.S. bond market. Concerns regarding the long-term credit reliability of the U.S. government are intensifying. Some express worries about the nation’s internal political turbulence, while others doubt that the existing governmental structure can adjust to the swiftly evolving, high-tech landscape and the emergence of BRICS.

Elon Musk, reportedly the wealthiest individual on the planet and arguably the most proficient CEO in history, capable of managing multiple seemingly unfeasible enterprises concurrently — including SpaceX, Tesla, The Boring Company, and X.com — stands among these skeptics. Musk recently dedicated months with the Trump administration contemplating how to reform the federal government and the nation’s fiscal stance via DOGE, the Department Of Government Efficiency, before a sudden withdrawal from political affairs in May.

Musk recently astonished the internet during an All-In Summit appearance, where he reflected on his experiences, stating, “I haven’t been to DC since May. The government is, for all intents and purposes, unfixable. I commend David (Sacks’) admirable initiatives… but ultimately, if you examine our national debt… if AI and robots don’t address our national debt, we’re finished.”

If Elon Musk is unable to steer the U.S. government away from financial calamity, who possesses that capability?

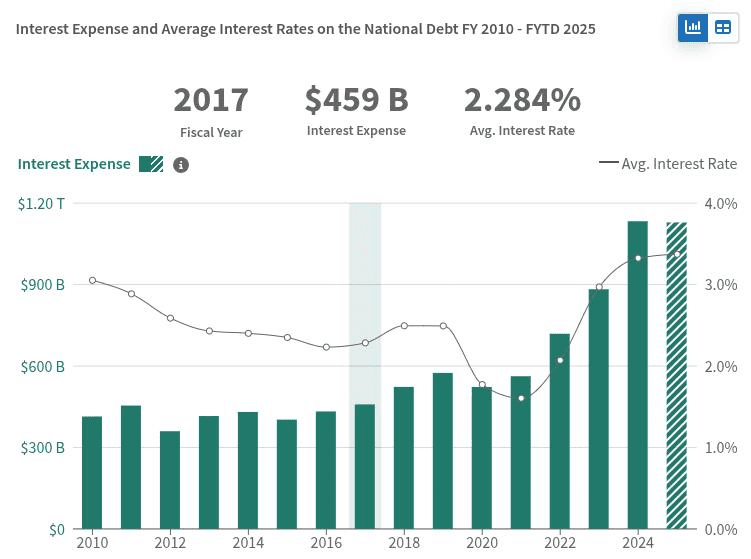

Such anxieties are mirrored in the scant demand for long-term U.S. bonds, evident in the necessity for elevated interest rates to attract investors. Currently, the US30Y stands at 4.75%, a peak not seen in 17 years. Interest in long-dated auctions of U.S. bonds, like the US30Y, has also shown a downward trend with “disappointing” demand in 2025, as reported by Reuters.

The diminishing interest in long-term U.S. bonds has profound implications for the U.S. economy. The U.S. Treasury must offer elevated interest rates to attract investors, consequently raising the payments the U.S. government must fulfill on the interest of the national debt. Presently, the U.S. interest disbursements approach one trillion dollars annually, surpassing the total military budget of the nation.

Should the United States be unable to discover sufficient purchasers for its impending debt, it could face challenges in settling its urgent expenses, necessitating dependence on the Fed to acquire that debt, which enhances its balance sheet and the monetary supply. The ramifications, albeit intricate, would likely induce inflationary pressure on the dollar, further detrimental to the U.S. economy.

How Sanctions Impaired the Bond Market

In 2022, further degrading the U.S. bond market, the United States manipulated the U.S.-governed bond market systems against Russia in reaction to its assault on Ukraine. As the Russians invaded, the U.S. immobilized Russian treasury reserves kept abroad, which were partially intended to fulfill its national debt obligations to Western investors. In what appears to be an effort to compel Russia into default, the U.S. allegedly commenced obstructing all efforts made by Russia to settle its own debts owed to foreign bondholders.

A spokesperson from the U.S. Treasury confirmed at that moment that specific payments were being disallowed.

“Today marks the deadline for Russia to execute another debt payment,” the spokesperson stated.

“Commencing today, the U.S. Treasury will not authorize any dollar debt payments to be processed from Russian government accounts at U.S. financial institutions. Russia must decide between exhausting remaining substantial dollar reserves or incoming new revenue, or default.”

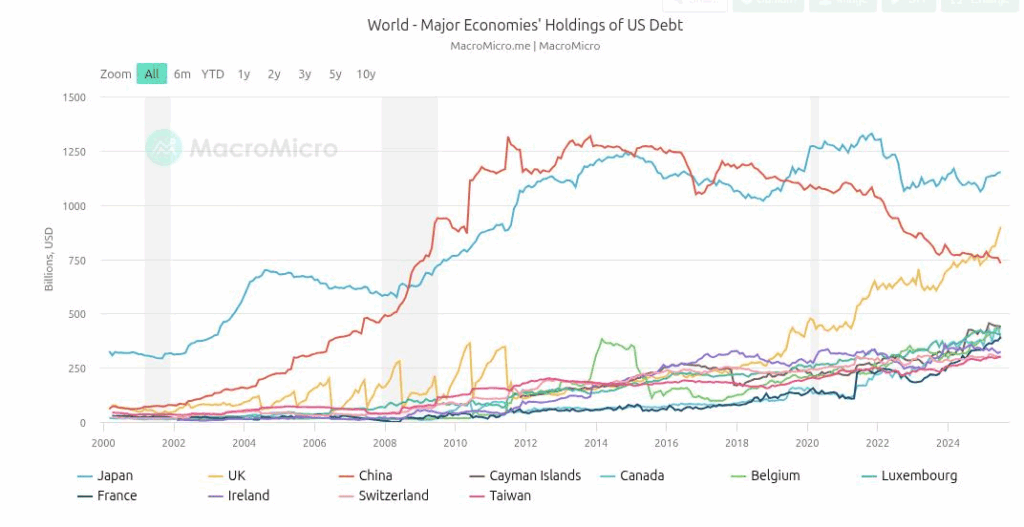

The U.S. effectively weaponized the bond market against Russia through an innovative application of its foreign policy sanctions regime. However, sanctions can have a boomerang effect: since then, foreign interest in U.S. bonds has diminished as countries non-aligned with U.S. foreign policy sought to diversify their risk. China has spearheaded this shift away from U.S. bonds, peaking its holdings in 2013 at over 1.25 trillion dollars and has seen a notable decline since the onset of the Ukraine conflict, currently sitting near 750 billion.

While this situation highlighted the devastating effectiveness of sanctions, it also severely damaged trust in the bond market. Not only was Russia obstructed from fulfilling its debt under the sanctions imposed by the Biden administration, adversely affecting investors as collateral damage, but the immobilization of its foreign treasury reserves demonstrated globally that should you, as a sovereign nation, defy U.S. foreign policy, all wagers are off — including within the bond market.

In the wake of what could be seen as overextending sanctions by the preceding administration, the Trump administration has shifted away from sanctions as a tactic, recognizing their negative impact on the U.S. financial sector, and transitioned to a tariff-based policy for international relations. The results of these tariffs have been mixed thus far. While the Trump administration claims record revenue and infrastructure investments from the private sector in the nation, Eastern countries have intensified their cooperation via the BRICS alliance.

The recent SCO summit in Tianjin, China, convened world leaders, including Chinese President Xi Jinping, Russian President Vladimir Putin, and Prime Minister of India Narendra Modi, among others. The most noteworthy announcement emerging from the SCO summit was a collective vow by India and China to be “partners not rivals,” marking a progression toward a multipolar world structure.

The Stablecoin Strategy

Although China has withdrawn from U.S. bonds over the last ten years, a fresh buyer has surfaced, swiftly ascending to the upper echelons of influence. Tether, a fintech firm established in the nascent era of Bitcoin and originally constructed on its network through the Mastercoin layer-two protocol, presently possesses $171 billion worth of

“““html

U.S. bonds, approximately a quarter of the total that China possesses and exceeding those of most other nations.

Tether is the provider of the most esteemed stablecoin, USDT, boasting a market capitalization of 171 billion dollars circulating in value, matching its disclosed bond assets. The organization declared $1 billion in earnings for Q1 of 2025, utilizing a straightforward yet ingenious business approach: acquire short-term U.S. bonds, issue USDT tokens fully collateralized, and retain the coupon interest payments from the U.S. Treasury. Beginning the year with 100 staff members, Tether is recognized as one of the most lucrative enterprises per employee globally.

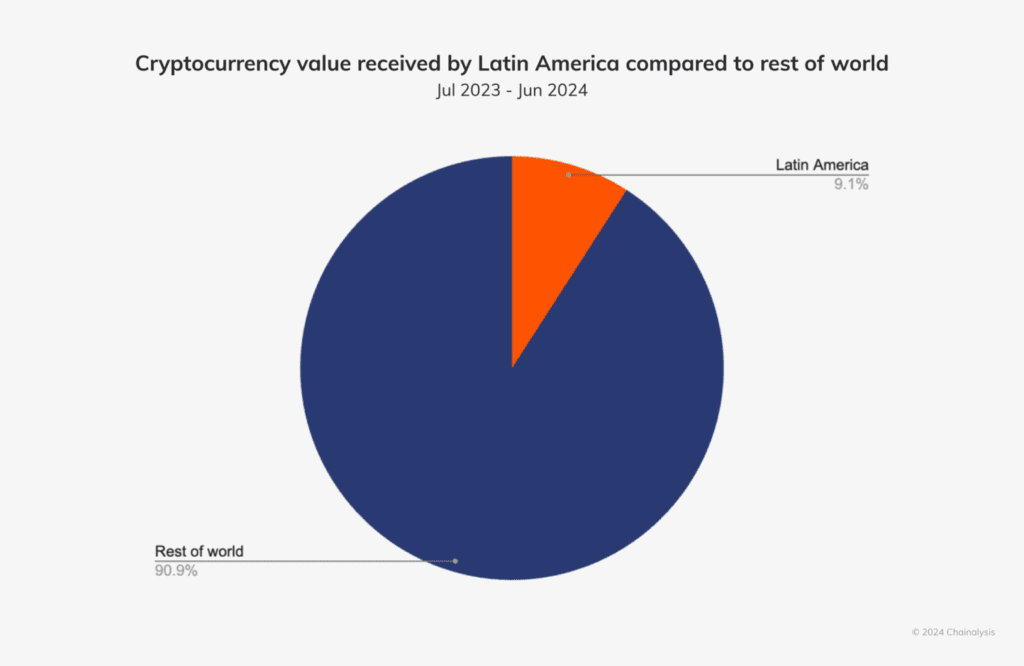

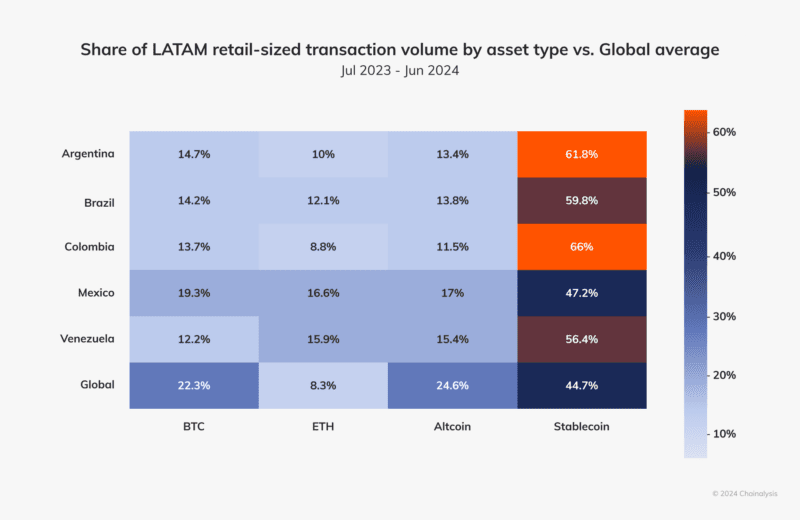

Circle, the issuer of USDC and the second-most favored stablecoin in the marketplace, similarly holds around $50 billion in short-term treasuries. Stablecoins find utility across the globe, especially in Latin America and emerging nations, serving as an alternative to domestic fiat currencies, which experience significantly higher inflation than the dollar and are frequently restricted by capital controls.

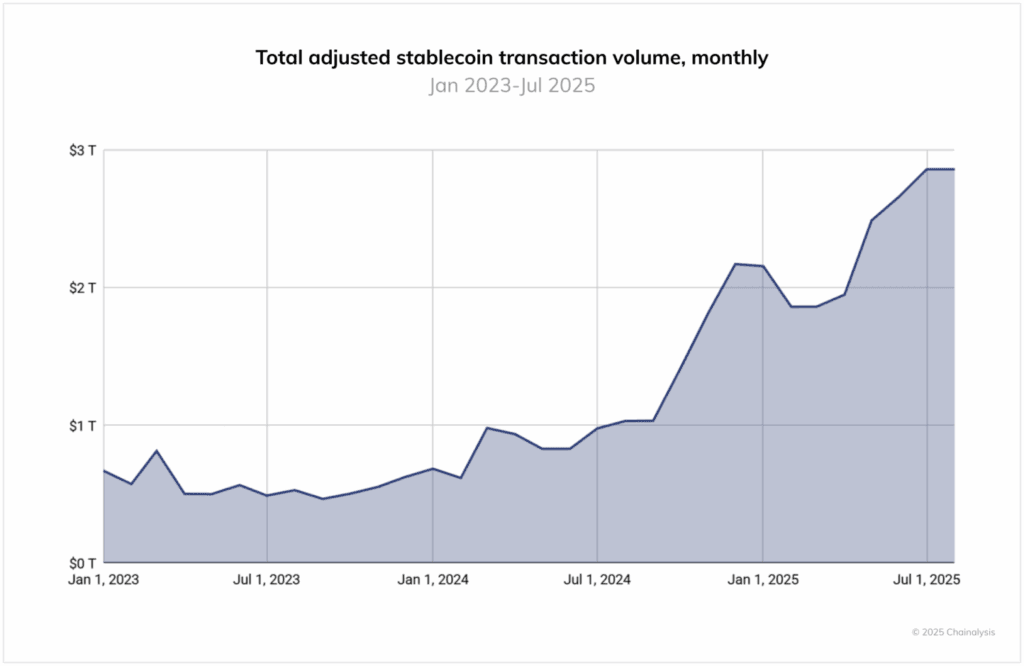

The transactions facilitated by stablecoins today have transcended being a niche, geek financial gadget; they have reached trillions of dollars. A 2025 Chainalysis report asserts, “From June 2024 to June 2025, USDT processed over $1 trillion monthly, peaking at $1.14T in January 2025. USDC, on the other hand, varied between $1.24T and $3.29T monthly. These figures emphasize the ongoing significance of Tether and USDC within crypto market infrastructure, especially concerning cross-border transactions and institutional operations.”

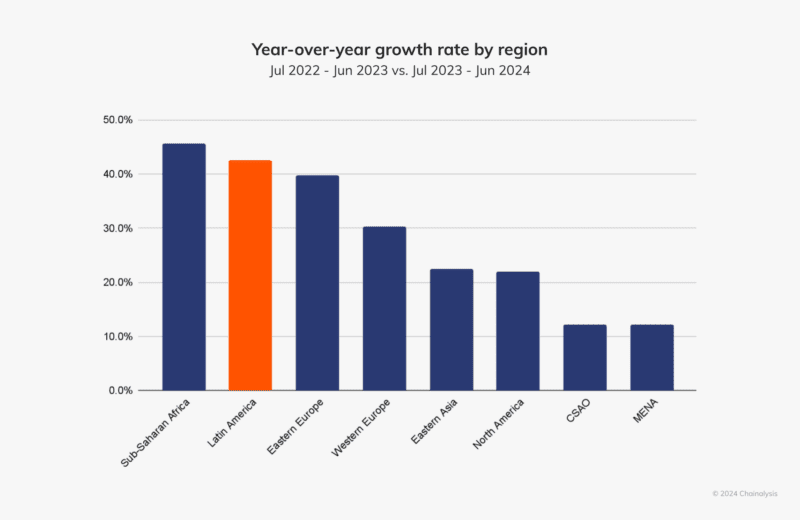

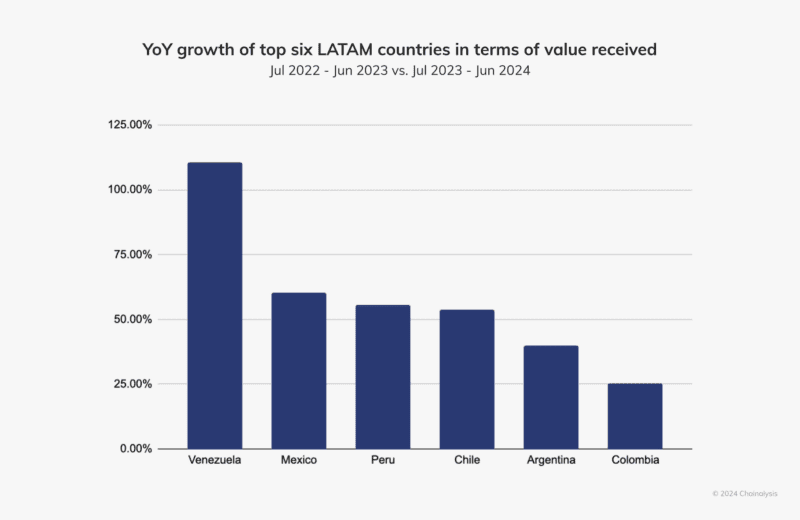

As an instance, Latin America represented 9.1% of the overall crypto value received from 2023 to 2024, experiencing annual usage growth rates of 40-100%, with over 50% being stablecoins, according to a 2024 Chainalysis report focused on Latin America, highlighting the substantial demand for alternative currencies in developing regions.

The U.S. requires fresh demand for its securities, and that need arises from the appetite for the dollar, particularly as many individuals globally are tied to fiat currencies that are considerably subpar compared to those of the United States. Should a global geopolitical framework emerge that forces the dollar to vie on equitable terms with other fiat currencies, it may still uphold its status as the finest among them. The United States, despite its shortcomings, continues to be a superpower, boasting remarkable wealth, human resources, and economic promise, especially when juxtaposed with numerous smaller nations and their dubious currencies.

Latin America has exhibited a strong desire for the dollar, but faces a supply challenge as local countries resist traditional banking dollar pathways. Accessing dollar-denominated accounts in various countries outside of the United States is challenging. Domestic banks are often heavily regulated and operate at the direction of local authorities, which have their own interests in safeguarding their currency. It’s worth noting that the U.S. is not the only government that recognizes the significance of currency creation and protecting its value.

By utilizing the censorship-resistant features of their foundational blockchains, stablecoins can afford users plausible deniability and privacy from their local governments, something local banks fail to offer. Consequently, the U.S., by promoting stablecoins, can tap into foreign markets yet to be explored, broadening its demand and user demographics, while also transmitting dollar inflation to countries with limited ties to American politics — a longstanding tradition in the history of the USD. Strategically, this seems advantageous for the United States, representing a straightforward evolution of how the USD has functioned for decades, now enhanced by new financial technologies.

The U.S. government is aware of this opportunity. As noted by Chainalysis, “The stablecoin regulatory landscape has significantly transformed over the last year. Although the GENIUS Act in the U.S. (which legalized U.S. bond-backed stablecoins) has not yet come into effect, its enactment has sparked robust institutional interest.”

Why Stablecoins Should Be Built On Bitcoin

The optimal way to ensure Bitcoin benefits from the uplift of the developing world from mediocre fiat currencies is to ensure the dollar utilizes Bitcoin as its infrastructure. Every dollar stablecoin wallet ought to simultaneously be a Bitcoin wallet.

Detractors of the Bitcoin dollar strategy might argue that it contradicts Bitcoin’s libertarian principles, asserting that Bitcoin was intended to replace the dollar — not improve it or transition it into the modern age. Nevertheless, this apprehension largely centers on a U.S. perspective. Criticism of the dollar is straightforward when one receives payments in dollars and maintains bank accounts denominated in USD. It’s easy to disparage a 2-8% dollar inflation rate (based on one’s measurement method) when it pertains to one’s local currency. In far too many nations outside the U.S., experiencing 2-8% annual inflation would be considered advantageous.

A considerable segment of the global populace endures fiat currencies that are significantly inferior to the dollar, facing inflation rates ranging from low to high double digits, and even touching on triple digits. This explains why stablecoins have experienced substantial adoption across the developing world. The priority for the developing world is to escape the sinking vessel first. The aspiration is that once they secure a stable alternative, they may begin exploring options to elevate to the Bitcoin “yacht”.

Regrettably, most stablecoins are not built on Bitcoin presently, despite their origins in Bitcoin—a technical reality that creates significant friction and risk for users. Currently, the majority of stablecoin activity is conducted on the Tron blockchain, a centralized network managed by a limited number of servers operated by Justin Sun, a Chinese national vulnerable to foreign governments that disapprove of the proliferation of dollar stablecoins within their jurisdictions.

Moreover, many of the blockchains facilitating stablecoins today are entirely transparent. Public addresses, which function as account numbers for users, are publicly traceable, often connected by local exchanges to individual personal information, and readily obtainable by local authorities. This provides leverage for foreign nations to push back against the distribution of dollar-denominated stablecoins.

Bitcoin illustrates none of these issues…

“““html

infrastructure hazards. Unlike Ethereum, Tron, Solana, etc., Bitcoin is exceptionally decentralized, with numerous duplicates of itself scattered around the globe and a sturdy peer-to-peer network utilized for relaying transactions in a manner that can effortlessly navigate around any obstructions or congestion points. Its proof-of-work mechanism establishes a balance of authority that other proof-of-stake blockchains lack. Michael Saylor, for instance, in light of his substantial holding of bitcoins, 3% of the overall supply, does not possess a direct vote in the consensus governance of the network. The same cannot be claimed for Vitalik, or the proof-of-stake consensus governance of Ethereum, or Justin Sun and Tron.

Moreover, the Lightning Network layered over Bitcoin facilitates immediate transaction settlement, benefiting from the security of Bitcoin’s foundational blockchain. Additionally, it provides users with considerable confidentiality, as all Lightning Network transactions are off-chain by design, leaving no lasting trace on its public blockchain. This essential difference in payment methodology grants users anonymity from those to whom they send funds, as well as from third-party observers who do not operate Lightning wallets or high-liquidity Lightning nodes. This diminishes the number of threats to user privacy from anyone who might look at the blockchain, reducing it to a few highly skilled entrepreneurs and technology firms, at worst.

Users may also operate their own Lightning nodes locally and select their connection to the network, and many individuals do, taking their privacy and security into their own hands. None of these characteristics can be found in the blockchains that the majority of people currently utilize for stablecoins.

Compliance regulations and even sanctions could still be imposed on dollar stablecoins, their governance rooted in Washington, employing the same analytics and smart-contract-driven strategies currently used to curb criminal exploitation of stablecoins. There’s no fundamental means to decentralize something like the dollar; after all, it is inherently centralized. However, should a majority of the stablecoin value be transitioned over the Lightning Network instead, user confidentiality could also be preserved, shielding users in developing nations from organized crime and even their local authorities.

Ultimately, what users prioritize is transaction costs — the expense of transferring their funds — which explains why Tron has led the market thus far. However, with USDT launching on top of the Lightning Network, that could change soon. In the Bitcoin dollar world order, the Bitcoin network would become the medium of exchange for the dollar, while the dollar would persist, for the foreseeable future, as the unit of account.

Can Bitcoin Endure This?

Critics of this approach are also wary of the influence the Bitcoin dollar strategy might exert on Bitcoin itself. They question whether placing the extensive incentives of the dollar on top of Bitcoin could distort its foundational structure. The most apparent method through which a superpower like the U.S. government may seek to influence Bitcoin is by coercing it into compliance with sanctions regimes, a scenario they could potentially execute at the proof-of-work layer.

Nonetheless, as previously mentioned, the sanctions regime has arguably reached its peak, giving way to a period of tariffs, which aim to regulate the flow of goods rather than the flow of finances. This shift in U.S. foreign policy strategy, following Trump and the Ukraine war, actually alleviates pressure off Bitcoin.

https://bitcoinmagazine.com/culture/the-birth-of-the-bitcoin-dollar

Furthermore, as prominent Western corporations, such as BlackRock, and even the U.S. government, progressively embrace bitcoin as long-term investments, or, in the words of President Donald J. Trump, a “Strategic Bitcoin Reserve,” they also begin to align with the future prosperity and endurance of the Bitcoin network. Challenging Bitcoin’s censorship-resistant attributes would not only jeopardize their investment in the asset but would also diminish the network’s capability to deliver stablecoins to the developing world.

The most recognizable concession that Bitcoin would have to accept in the Bitcoin dollar world order is relinquishing the unit of account aspect of money. This is disappointing news for many Bitcoin enthusiasts, and understandably so. Unit of account is the pinnacle of hyperbitcoinization, and numerous users inhabit that reality today, as they gauge their economic choices based on the ultimate impact on the number of sats they possess. Nevertheless, nothing can truly strip that away from those who regard Bitcoin as the most stable form of currency to ever exist. In fact, the conviction of Bitcoin as a store of value and a medium of exchange will be reinforced with this Bitcoin dollar strategy.

Regrettably, after 16 years of efforts to establish bitcoin as a unit of account as prevailing as the dollar, some are beginning to acknowledge that in the medium term, the dollar and stablecoins will probably fulfill that role. Bitcoin payments will never vanish, and companies led by bitcoin enthusiasts will persist and should continue to accept bitcoin as payment to build their bitcoin reserves — however, stablecoins and dollar-based value will likely dominate crypto commerce in the coming decades.

Nothing Stops This Train

As the world continues to adjust to the ascendant powers in the east and the advent of a multipolar world order, the United States will likely face challenging and crucial decisions to avert a protracted financial crisis. The nation could, in theory, reduce its expenditures, shift, and restructure in order to become more effective and competitive in the 21st century. The Trump administration is indeed striving to do just that, as evidenced by the tariff regime and other associated efforts, which try to bring back manufacturing of essential industries into the United States and enhance its local talent. However, in the now-renowned words of Lyn Alden, nothing stops this train.

While there are a few miracles that could perhaps resolve the United States’ financial troubles, such as the science-fiction-like automation of labor and intellect, and even the Bitcoin dollar strategy, ultimately, even placing the dollar on the blockchain won’t alter its destiny: to become a relic for history enthusiasts, a rediscovered token of an ancient empire destined for a museum.

The dollar’s centralized architecture and reliance on American politics ultimately condemn the dollar as a currency, but if we are realistic, its decline may not be apparent for another 10, 50, or even 100 years. When that moment does arrive, if history is any indicator, Bitcoin should be there as the foundation, ready to gather the remnants and fulfill the prophecy of hyperbitcoinization.

BM Big Reads are weekly, in-depth essays on some current topic relevant to Bitcoin and Bitcoiners. Views expressed are those of the authors and do not necessarily reflect those of BTC Inc or Bitcoin Magazine. If you possess a submission you believe fits the model, feel free to reach out at editor[at]bitcoinmagazine.com.

Source link

“`