“`html

These 3 Indicators Statistically Forecast Bitcoin’s Upcoming Major Movement

Throughout a significant portion of this cycle, Global Liquidity has emerged as one of the most precise metrics for anticipating Bitcoin’s valuation movements. The linkage between expansion of the money supply and appreciation of risk-assets has been well documented, and Bitcoin has notably adhered to this narrative. Nonetheless, we have recently focused on a few additional data points that have proven statistically even more reliable in forecasting Bitcoin’s forthcoming direction. Collectively, these metrics assist in illustrating whether Bitcoin’s recent standstill signifies a temporary halt or the onset of a prolonged consolidation phase.

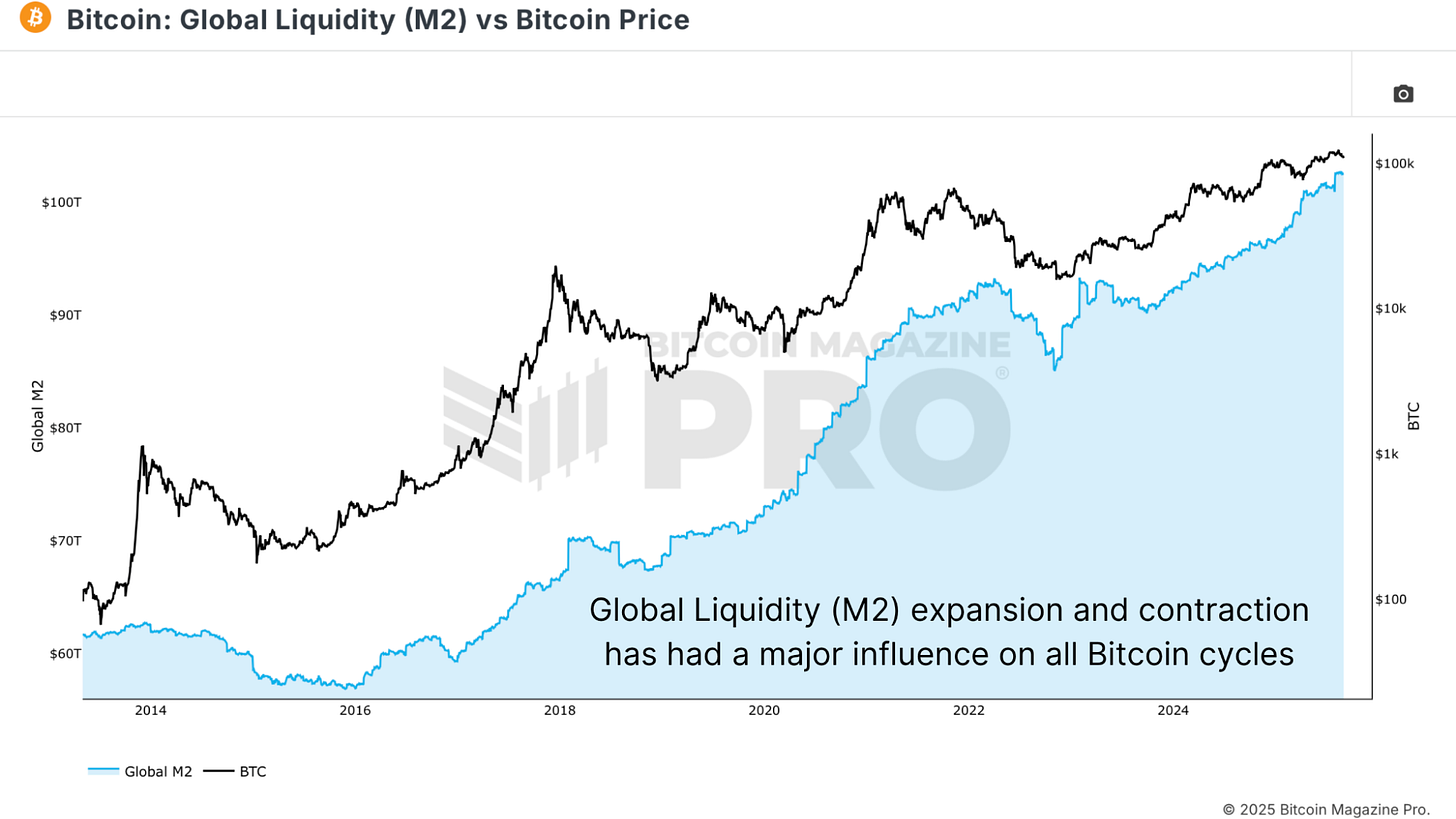

Bitcoin Price Patterns Influenced by Global Liquidity Alterations

The connection between Global Liquidity, specifically M2 money supply, and Bitcoin’s valuation is difficult to overlook. When liquidity increases, Bitcoin typically ascends; conversely, when it diminishes, Bitcoin struggles.

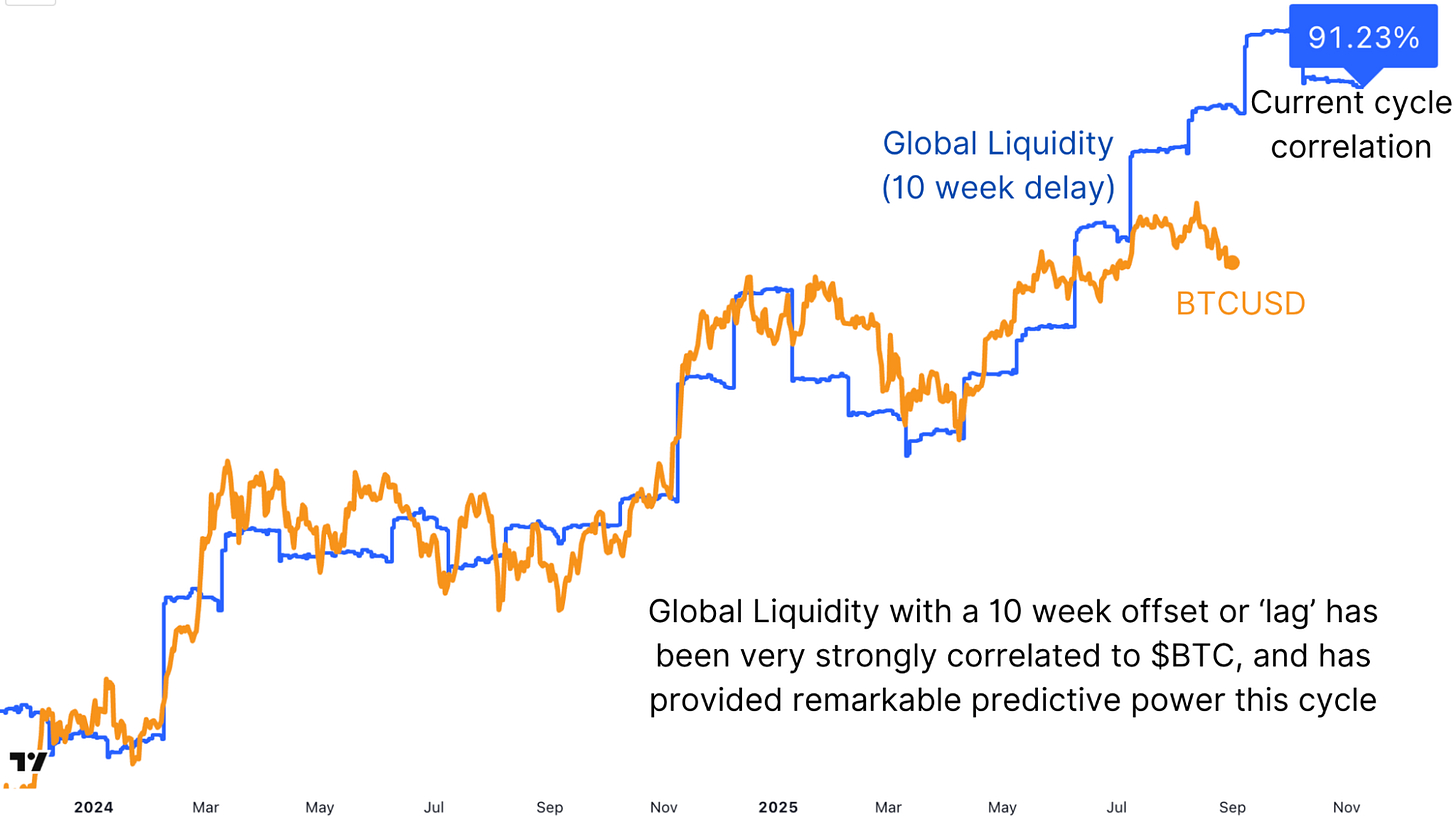

Analyzed across this ongoing cycle, the correlation measures an impressive 88.44%. Introducing a 70-day lag enhances that correlation even further to 91.23%, indicating that changes in liquidity often precede Bitcoin’s movements by slightly more than two months. This framework has proven extremely accurate in capturing the overarching trend, with dips in cycles aligning with contractions in Global Liquidity, and subsequent recoveries reflecting renewed expansions.

Nonetheless, there has been a marked divergence lately. Liquidity continues to rise, indicating support for higher Bitcoin valuations, yet Bitcoin itself has stalled after reaching new all-time highs. This divergence merits observation, but it doesn’t undermine the broader linkage. In fact, it may indicate that Bitcoin is merely lagging behind liquidity conditions, as has occurred during other moments in the cycle.

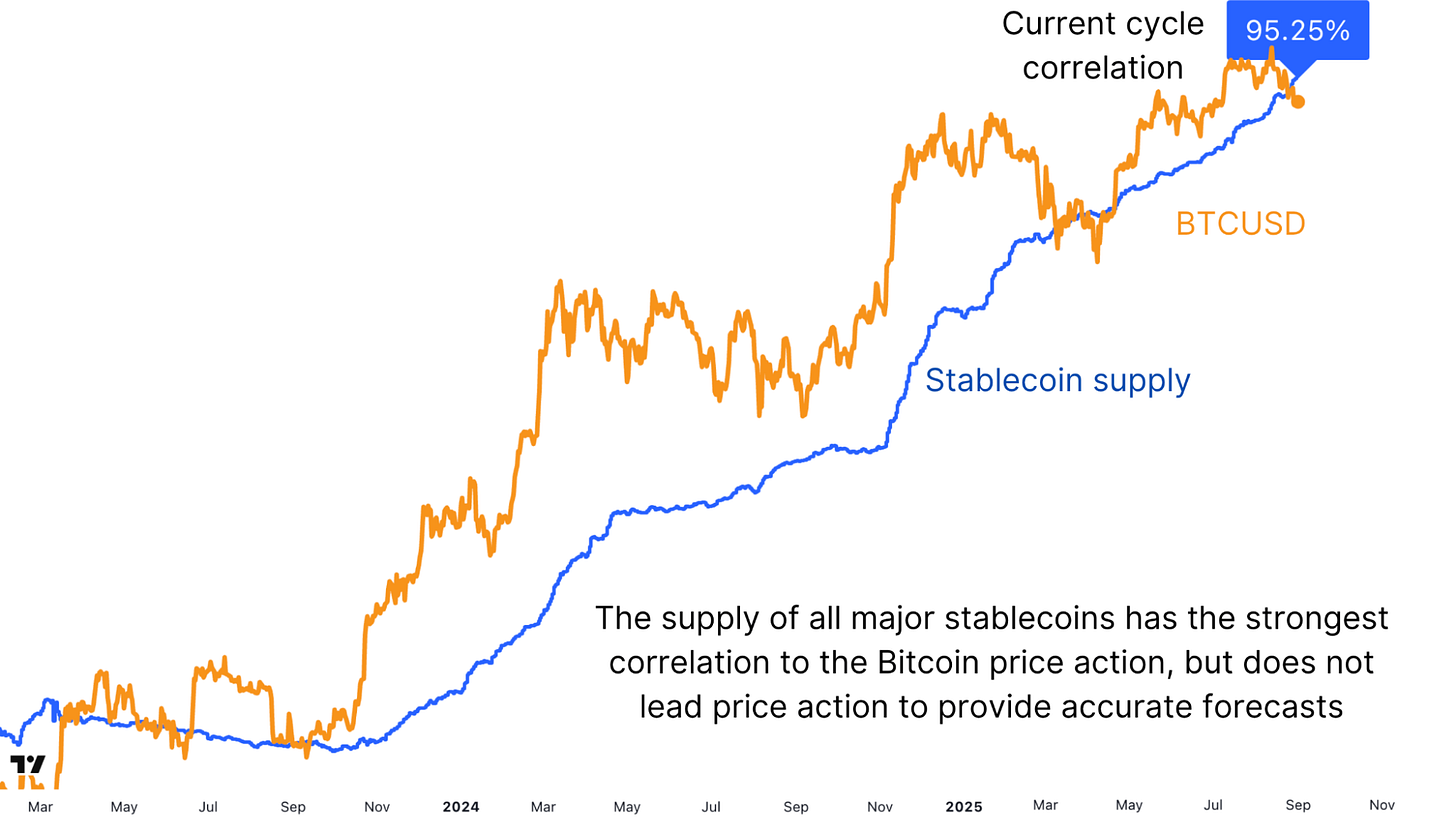

Stablecoin Supply Indicating Bitcoin Market Upswings

While Global Liquidity reflects the wider macro environment, the supply of stablecoins offers a more immediate perspective on capital poised to enter digital assets. When USDT, USDC, and other stablecoins are issued in significant quantities, this signifies “dry powder” waiting to flow into Bitcoin, eventually moving towards more speculative altcoins. Surprisingly, the correlation here exceeds M2 at 95.24% without any offset. Each substantial influx of stablecoin liquidity has preceded or coincided with a rise in Bitcoin’s price.

What renders this metric powerful is its specificity. Unlike Global Liquidity, which encompasses the entire financial ecosystem, the growth of stablecoins is inherently crypto-native. It represents direct potential demand within this sector. Yet here, too, we observe a divergence. Stablecoin supply has been growing robustly, achieving new peaks, while Bitcoin has been consolidating. Historically, such divergences are short-lived, as this capital ultimately seeks returns and flows into risk assets. Whether this indicates imminent upside or a slower transition remains to be observed, but the robustness of the correlation positions it as one of the most crucial metrics to monitor in the near to medium term.

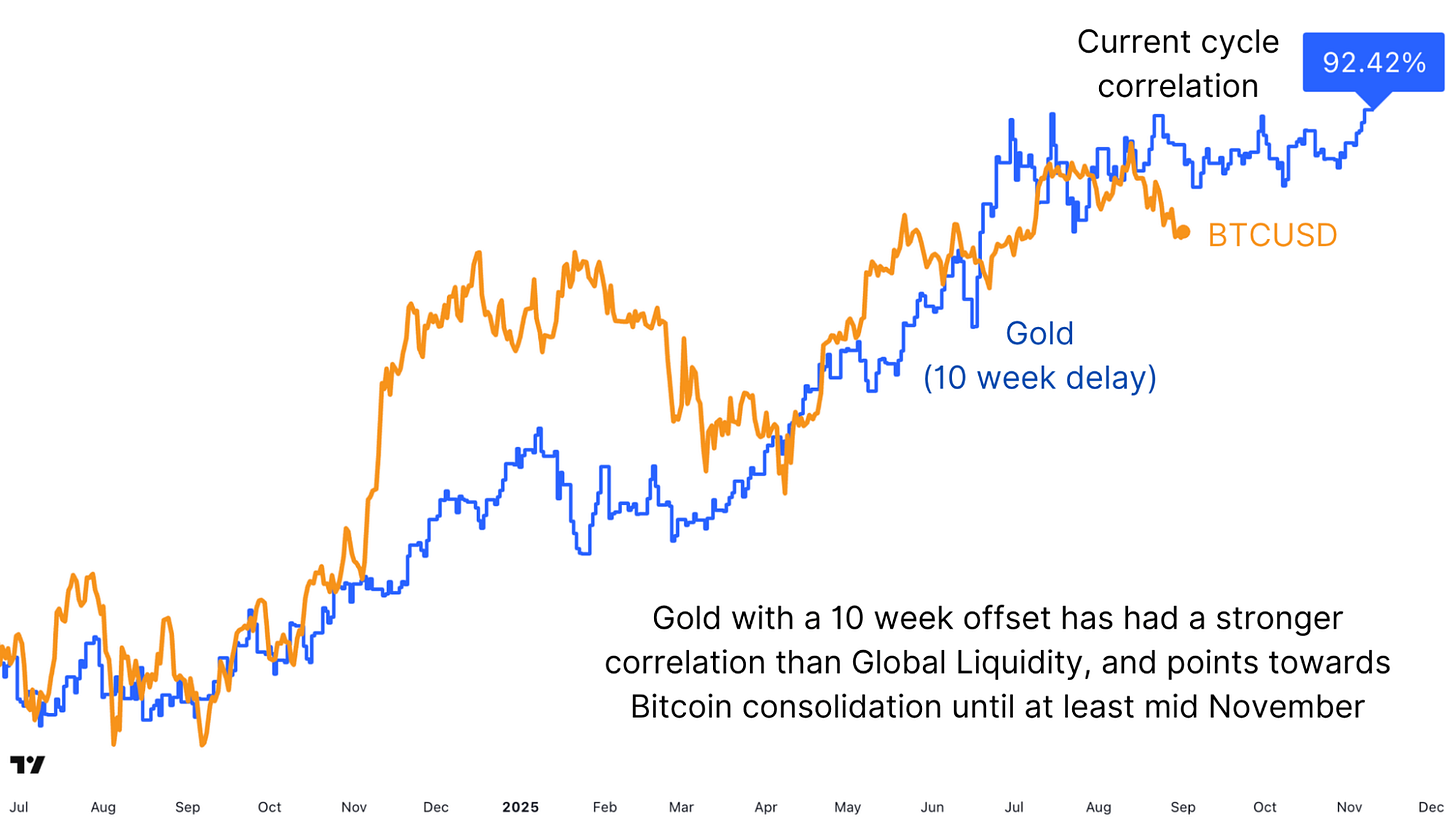

Bitcoin’s Predictive Capacity of Gold’s High-Correlation Delay

At first glance, Bitcoin and Gold do not exhibit a consistently strong correlation. Their relationship is inconsistent, sometimes moving in sync, while other times diverging. However, by applying the same 10-week lag we used for the Global Liquidity data, a clearer perspective materializes. Throughout this cycle, Gold with a 70-day offset displays a 92.42% correlation with Bitcoin, surpassing Global M2 itself.

The alignment has been remarkable. Both assets hit their lows at almost the same moment, and since then, their major rallies and consolidations have adhered to similar paths. Recently, Gold has been trapped in an extended consolidation phase, while Bitcoin appears to be echoing this with its own erratic sideways movements. If this correlation persists, Bitcoin may stay within a range until at least mid-November, reflecting Gold’s stagnant behavior. However, with Gold now appearing technically robust and poised for new all-time highs, Bitcoin could soon follow if the “Digital Gold” narrative reestablishes itself.

Bitcoin’s Upcoming Movement Anticipated by Crucial Market Indicators

When examined collectively, these three indicators—Global Liquidity, stablecoin supply, and Gold—form a robust framework for predicting Bitcoin’s forthcoming movements. Global M2 has consistently served as a dependable macro reference, particularly with a 10-week delay. The growth of stablecoins presents the most apparent and immediate indication of impending crypto demand, and its rapid increase hints at intensifying pressure for price elevation. Concurrently, Gold’s lagging correlation offers an unexpected yet valuable forecasting perspective, suggesting a phase of consolidation prior to a potential breakthrough in the upcoming weeks.

In the near term, this convergence of signals indicates that Bitcoin could persist in moving sideways, reflecting Gold’s inertia even as liquidity expands behind the scenes. However, should Gold ascend to new peaks and stablecoin issuance maintains its current momentum, Bitcoin might be gearing up for a significant year-end surge. For the present, exercising restraint is essential, but the indicators imply that the foundational conditions remain advantageous for Bitcoin’s long-term path.

Appreciate this comprehensive examination of bitcoin price dynamics? Subscribe to Bitcoin Magazine Pro on YouTube for additional expert market analysis and insights!

For further in-depth research, technical indicators, real-time market notifications, and access to expert assessments, visit BitcoinMagazinePro.com.

Disclaimer: This article is intended for informational purposes exclusively and should not be interpreted as financial guidance. Always conduct your own investigation before making any investment decisions.

This post These 3 Signals Statistically Predict Bitcoin’s Next Big Move first appeared on Bitcoin Magazine and is authored by Matt Crosby.

Source link

“`