The U.S. administration has officially commenced the release of gross domestic product (GDP) information on public blockchains. As reported by Bloomberg, the Department of Commerce’s announcement on Thursday integrates blockchain into the essence of America’s economic reporting, making GDP accessible on nine networks, including Bitcoin, Ethereum, and Solana.

Commerce representatives underscored that the blockchain initiative is not meant to substitute conventional economic data releases, but rather “an additional channel” for dissemination, according to Bloomberg. Nonetheless, this action carries substantial symbolic significance, effectively providing the government’s endorsement on technology that was once met with considerable skepticism in Washington.

“The whole administration has embraced this,” stated Mike Cahill, chief executive officer of Douro Labs, who confirmed his collaboration with the Commerce Department on the project for the last two months. “With today’s announcement, we enter a phase where government data resides on blockchains, and market participants can engage in real time.”

The blockchain initiative involves uploading cryptographic hashes of GDP data, which function as digital identifiers to authenticate the information’s accuracy. While initially limited in scope, Commerce Department officials affirmed that President Donald Trump’s administration plans to broaden the program further, as reported by Bloomberg.

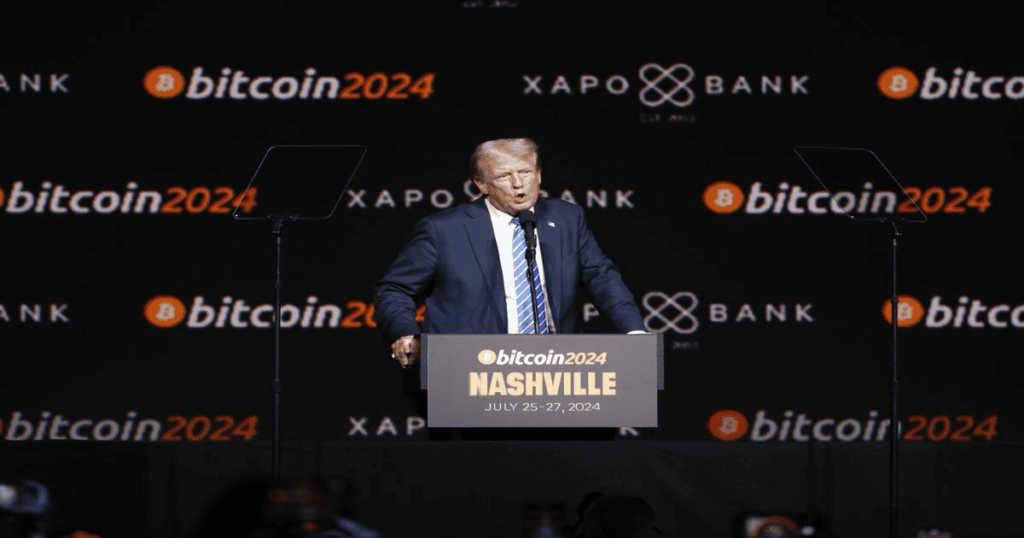

Commerce Secretary Howard Lutnick led the project, informing Trump earlier this week that statistics would be released via blockchain “because you are the crypto president.” Lutnick previously proposed redesigning GDP reporting by excluding the effects of government expenditure.

This initiative indicates a significant shift from the previous administration. Under former President Joe Biden, regulators maintained a cautious approach toward crypto, frequently conflicting with exchanges and imposing limitations on digital assets. In contrast, Trump has rapidly moved to incorporate Bitcoin into governmental policy. Since assuming office, he has established a U.S. Bitcoin reserve, amassed coins such as Ether and Solana, signed laws regulating stablecoins, and appointed crypto-friendly regulators who ceased enforcement actions against Coinbase.

Trump’s family has also enhanced its involvement in the digital asset sector, supporting initiatives like World Liberty Financial. The growing political influence of the industry is apparent: crypto firms made significant contributions to Trump’s reelection campaign and provided over $133 million to super PACs backing pro-crypto candidates in 2024, according to OpenSecrets.

By utilizing public blockchains, the Commerce Department joins other entities exploring crypto technology. The Department of Homeland Security has considered blockchain for airport passenger screening, while California’s DMV has transitioned car titles to digital forms on cryptocurrency, according to Bloomberg.

As Trump establishes himself as the “crypto president,” the adoption of blockchain for GDP distribution marks a significant transformation in U.S. economic policy—and further solidifies Bitcoin as a formidable political and financial power in Washington.