“`html

Grounds for trust

Robust editorial guidelines emphasizing precision, significance, and neutrality

Developed by sector specialists and carefully examined

The utmost benchmarks in journalism and dissemination

Robust editorial guidelines emphasizing precision, significance, and neutrality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

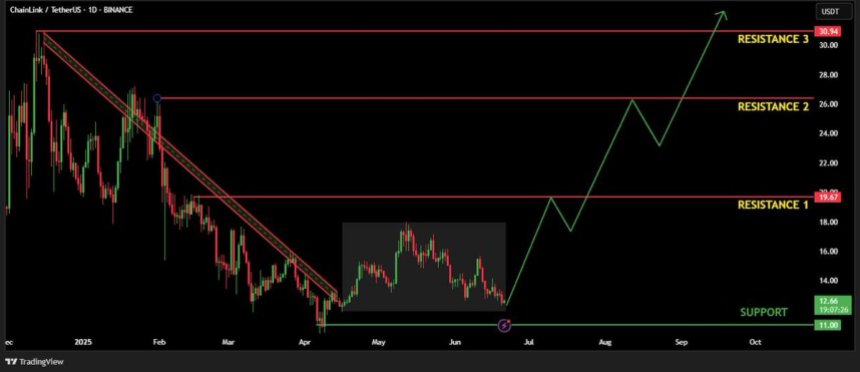

Chainlink (LINK) has risen 21% since its low on Sunday, gaining traction in an otherwise unstable macroeconomic and geopolitical landscape. While worldwide tensions continue to induce volatility across markets, Chainlink has distinguished itself for its robustness, bolstered by a series of solid collaborations and increasing on-chain fundamentals. The recent price movements indicate a potential change in direction, yet analysts caution that a confirmed breakout is still necessary before bulls can fully dominate.

Related Reading

Top analyst Henry Lord of Alts emphasized that LINK has endured extensive months of ongoing decline and remarkably subdued price behavior. Nonetheless, recent actions imply that something is evolving beneath the surface. Volume is rising, volatility is increasing, and LINK is constructing a foundational structure that could signify the conclusion of its accumulation period.

Despite this vigor, Chainlink remains technically trapped within a consolidation range. A clear breakout above vital resistance points will be crucial to initiate the upcoming phase of upward momentum. Until then, traders remain cautiously hopeful as LINK hints at a significant movement.

Chainlink Readies For A Pivotal Move

Chainlink is currently trading more than 25% under its May peak, reflecting the wider market’s impact due to escalating macroeconomic concerns and geopolitical strife, particularly the recent Middle East conflicts. Regardless of these challenges, LINK has successfully maintained a steady consolidation range, indicating resilience as the crypto market anticipates its next decisive action.

Keeping prices above current levels is essential. A fall below could pave the way for more profound corrections. However, analyst Henry believes the currents may be shifting. According to Henry, Chainlink has weathered numerous months of downtrend and tranquility, yet a structural transition is now taking place. His analysis points out that the long-standing downtrend has been disrupted, and LINK has transitioned into a clear accumulation and consolidation phase.

“These areas frequently precede significant movements,” Henry remarks. Historically, such periods have been precursors to explosive surges, and this time may prove no exception. If momentum escalates, a breakout towards the $25–$30 range wouldn’t be astonishing.

Henry also highlights that stretches of inactivity often disguise the maneuvers of savvy investors—quietly purchasing before the broader market becomes aware. While it may be effortless to neglect assets during tranquil intervals, that’s typically when the groundwork for substantial movements is established. For the moment, Chainlink remains under scrutiny.

Related Reading

LINK Price Examination: Signs of Reversal Surface

Chainlink is displaying initial signs of a trend reversal following months of steady decline. As depicted in the 12-hour chart, LINK recently bounced back from the $11.50 range and is currently trading above $13.20. This rebound comes after a sharp decline that marked a new local low, but the uptick has elevated the price above the 50-day simple moving average (SMA), which now serves as short-term support at $13.50.

Crucially, LINK is currently testing the 100-day SMA (around $14.65), which had previously acted as resistance in late May and early June. If bulls succeed in breaking and settling above this level, the next objective lies near the 200-day SMA at $14.16—a convergence zone that may serve as a pivotal decision point for trend continuation or rejection.

Related Reading

While the macro structure remains pessimistic, this short-term accumulation range suggests heightened demand, particularly as the price begins to create higher lows. A decisive break above $14.65 with volume could validate the breakout and signal the initiation of a larger movement towards the $17–$18 range.

Featured image from Dall-E, chart from TradingView

Source link

“`