“`html

Today, H100 Group AB declared that it has secured a SEK 21 million convertible loan from an investment agreement with Adam Back, with the potential to increase his investment to SEK 277 million through a five-part convertible loan structure. The funds will be allocated to purchase Bitcoin in accordance with H100 Group’s long-term Bitcoin treasury strategy.

As per the agreement, Back is permitted to invest a total of SEK 128 million across four additional segments, with a guaranteed participation of at least 50%. Each segment is twice his committed amount, illustrating his commitment to H100’s long-term advancement.

The press release mentioned, “Adam Back may request the Second Segment within 90 days from the signing of the Initial Segment, the Third Segment within 90 days from the signing of the Second Segment, the Fourth Segment within 90 days from the signing of the Third Segment, and the Fifth Segment within 90 days from the signing of the Fourth Segment. If Adam Back does not request a Future Segment within the stipulated time, the right to request future segments will be forfeited.”

The convertible loans carry no interest and have a maturity period of five years. At any point, Back may convert the loans into shares of the Company. Conversion prices are fixed per segment: SEK 1.75 per share for the initial segment, increasing to SEK 5.00 by the fifth segment. H100 reserves the right to enforce conversion if the stock price surpasses the conversion rate by 33% over a 20-day period. Complete conversion of the initial segment would yield 12 million new shares and a 9.3% dilution.

“Upon the request of a segment, Adam Back is obligated to invest in the respective Segment with SEK 15,750,000 in the second segment, SEK 23,625,000 in the third segment, SEK 35,437,500 in the fourth segment, and SEK 53,156,250 in the fifth segment,” stated the press release. “The anticipated size for each segment is twice the eligible amount of Adam Back.”

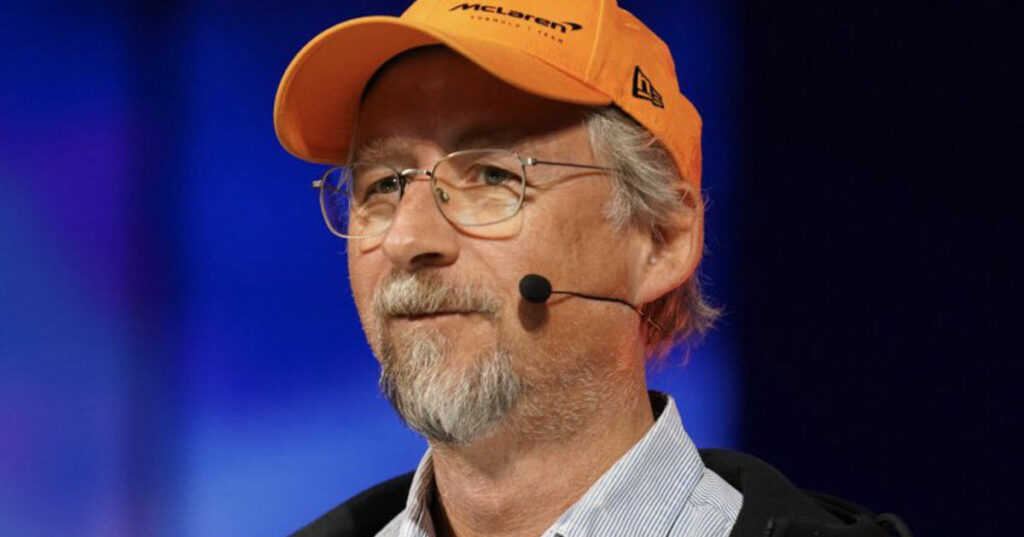

“We have been operational since 2014, collaborating with our investors to incorporate Bitcoin into balance sheets from that point forward,” noted Adam Back at the 2025 Bitcoin Conference. “I believe the appropriate perspective regarding treasury companies is that Bitcoin is essentially the more robust asset. It’s quite challenging to outperform Bitcoin; most individuals investing in various assets since the inception of Bitcoin believed they should allocate to Bitcoin instead of alternatives.”

Source link

“`