“`html

Reasons to Rely On

Rigorous editorial guidelines emphasizing precision, significance, and neutrality

Developed by field specialists and thoroughly examined

The utmost criteria in journalism and publication

Rigorous editorial guidelines emphasizing precision, significance, and neutrality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is at a critical crossroads after several days of persistent selling pressure, which has led to a price decline exceeding 12% since last Tuesday. Currently, trading around the $2,400 mark, ETH is finding it challenging to sustain bullish momentum, with many analysts cautioning that a more profound correction could ensue if buyers do not defend this vital support level. The recent decline mirrors broader market uncertainty, as increased volatility undermines investor confidence just when ETH seemed poised to participate in a broader altcoin rally.

Related Reading

Despite this weakness, there is rising optimism in certain sectors of the market. Leading analyst Ted Pillows has shared a technical evaluation indicating that a Golden Cross has been established on Ethereum’s 12-hour chart—a signal commonly interpreted as indicative of significant bullish movements. This crossing, occurring when the 50-period moving average surpasses the 200-period moving average, frequently marks the initiation of an extended upward trend.

If bulls manage to sustain current levels and reclaim higher resistance near $2,600, the Golden Cross could signal a turning point. Until that happens, the upcoming days will be crucial in determining whether Ethereum can rebound or sink into a prolonged consolidation phase.

Volatility Impacts Ethereum Amid Golden Cross Signal

Ethereum experienced significant volatility over the weekend, surging past $2,550 before swiftly reversing and returning to the $2,400 region within hours. This abrupt movement has generated renewed uncertainty, as analysts become cautious about the dwindling bullish momentum and escalating selling pressure. Though ETH remains one of the more robust performers within the broader altcoin market, it is still down by 36% from its December peak of approximately $4,100. This poses a clear challenge for bulls: to maintain current levels and regain control by driving prices above $2,800 to spark a sustained rally.

The $2,400 threshold is currently serving as a critical support area. A breach below this level could instigate a more profound retraction, potentially pushing Ethereum into a consolidation range or even toward lower support levels. Nevertheless, technical indicators provide a sliver of hope.

According to Pillows, Ethereum has recently confirmed a Golden Cross on the 12-hour chart—a bullish configuration formed when the 50-period moving average crosses above the 200-period moving average. Historically, such indicators have preceded considerable upward shifts, and Pillow is optimistic that this one could clear a path for Ethereum to achieve $3,000 in the near future.

However, for this scenario to unfold, buyers need to engage decisively. Volume has diminished, and sentiment seems delicate following last week’s downturn. If bulls can protect the $2,400 region and quickly retake higher resistance, the Golden Cross might signify the onset of Ethereum’s next upward movement. Until then, the market remains in a cautious observational state, assessing whether the bullish signal can surpass the increasing pressure from sellers.

Related Reading

ETH Evaluates Key Support After Decline from Local Peaks

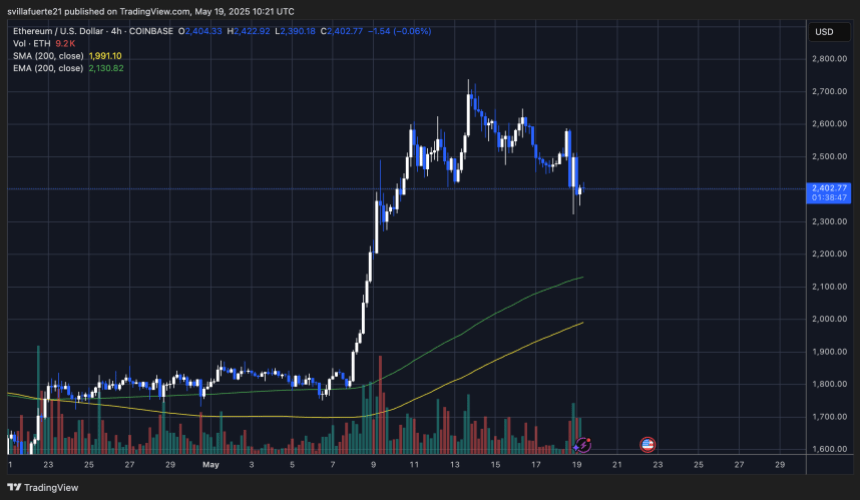

Ethereum is trading at $2,402 following a sharp sell-off on Sunday, where the price surged to $2,670 before retracting over 10% in under 24 hours. As observed in the 4-hour chart, ETH is now consolidating just above the $2,390–$2,400 range, a crucial level for bulls to maintain. This zone aligns with a previous consolidation area and may serve as a temporary support foundation.

The 200-period EMA on the 4-hour chart is presently situated at $2,130, while the 200 SMA hovers around $1,991 — both significantly beneath the existing price, providing long-term trend support. Nonetheless, the volume profile indicates a surge in sell-side activity during the downturn, implying that short-term traders are realizing profits. Should the price fall beneath $2,390, a more substantial retracement toward the $2,200–$2,300 area becomes probable.

Associated Reading

On the upside, ETH needs to reclaim $2,550 to regain momentum. A failure to achieve this could indicate a local peak. The price movement is evidently ambiguous, and this range-bound pattern may continue unless bulls reaffirm their strength with a decisive breakthrough above $2,600. Until that occurs, the $2,400 mark remains a contentious zone between buyers and sellers amidst heightened volatility.

Featured image from Dall-E, chart from TradingView

Source link

“`