“`html

Motives to have faith

Rigorous editorial guidelines emphasizing precision, relevance, and neutrality

Developed by sector specialists and thoroughly evaluated

The utmost standards in journalism and dissemination

Rigorous editorial guidelines emphasizing precision, relevance, and neutrality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Solana has surged more than 22% since the past Thursday, propelled by a resurgence of bullish energy throughout the wider crypto marketplace. As Bitcoin approaches new all-time highs and Ethereum breaks crucial resistance levels, Solana has mirrored this trend with remarkable strength. The price skyrocketed to a local peak of $181 before meeting resistance, where it currently consolidates just below that threshold, seeking support to drive the next upward move.

Related Reading

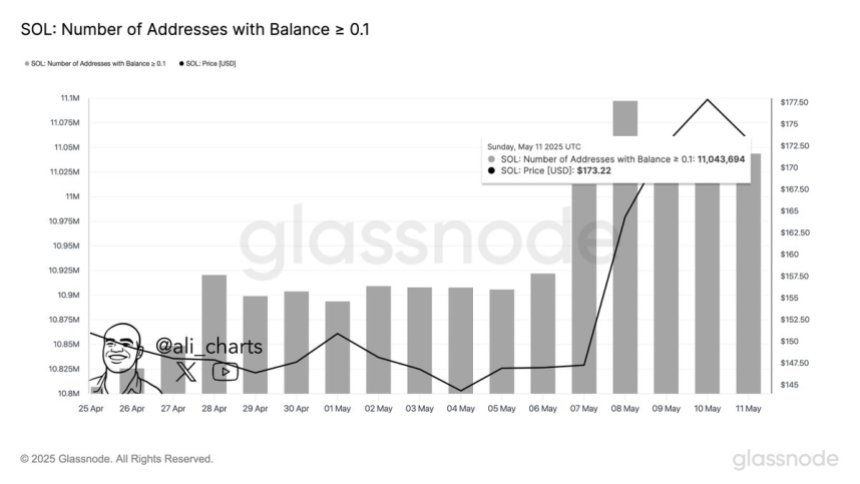

While price activity cools at a critical point, on-chain analytics reflect significant growth in Solana’s user community. As per Glassnode, the count of wallets holding 0.1 SOL or more has escalated to 11.04 million in the recent fortnight. This swift rise in smaller holder wallets indicates a surge in adoption and network engagement, especially as interest in altcoins amplifies.

Solana’s consolidation just beneath $181 may serve as a healthy pause prior to continuation, should bullish momentum remain strong. With the market heating up and retail interest reviving, the current price configuration could lay the groundwork for a strong breakout in the upcoming sessions. The synergy of price performance and increasing user participation suggests Solana might be preparing for a more significant role in the forthcoming phase of the bull market.

Solana Maintains Essential Support As Wallet Growth Indicates Optimism

Solana is currently undergoing a crucial examination as it consolidates just below the $181 resistance zone. Following a sharp 22% rally over the last week, bulls must safeguard current levels to confirm the uptrend and sustain momentum. Staying above the $170–$175 support range would validate strength and could facilitate a renewed push towards the $200 mark. However, the road ahead isn’t devoid of challenges. The overarching macroeconomic landscape remains precarious, laden with continuous concerns about a global slowdown and ongoing uncertainty regarding inflation and interest rate strategies.

In spite of these obstacles, the crypto market is staging a robust recovery, and Solana is amongst the leading performers. This rally may signify more than just a fleeting rebound—it could represent the initial stages of a larger bullish cycle with considerable upside potential. Investor sentiment is on the rise, along with user engagement across key ecosystems.

Leading analyst Ali Martinez shared compelling on-chain insights that reinforce this viewpoint. According to Glassnode, the number of wallets holding 0.1 SOL or more has soared to 11.04 million over the past two weeks. This rapid expansion in smaller holders suggests an increasing retail interest and a broader user base—vital indicators for sustained strength.

If bulls can retain control at current levels and macro conditions don’t deteriorate, Solana could be on the brink of a significant move. The blend of technical momentum and on-chain involvement offers a robust basis for the next upward phase. All attention is now on whether the $181 resistance holds—or if Solana requires more time to strengthen before embarking on the next leg of the rally.

Related Reading

Solana Encounters Resistance As Price Retraces To Retest Support

Solana (SOL) is currently consolidating just below the $181 level following a vigorous 22% rally from the previous week. As illustrated in the chart, price activity climbed above both the 200-day EMA ($161.88) and 200-day SMA ($181.11), indicating a resurgence of bullish momentum. However, the ongoing pullback from $180 to around $173.48 illustrates that the $181 level is functioning as a significant resistance, which has earlier served as a rejection zone on multiple occasions.

The trading volume remains robust, and the recent movements indicate solid market engagement, but bulls must sustain the $170–$172 range to keep dominance. A successful retest of this zone as support may pave the way for a breakout exceeding $181. Conversely, failing to hold above this area could initiate a pullback to the $160–$165 range, close to the 200 EMA.

Related Reading

From a technical perspective, SOL is working to break a prolonged downtrend and is establishing a higher high structure for the first time since late December. The convergence of moving averages implies a crucial juncture. Should buyers engage with determination, a movement towards $200 becomes probable. In the meantime, traders are likely to monitor the $181 level for key breakout or rejection signals.

Featured image from Dall-E, chart from TradingView

Source link

“`