“`html

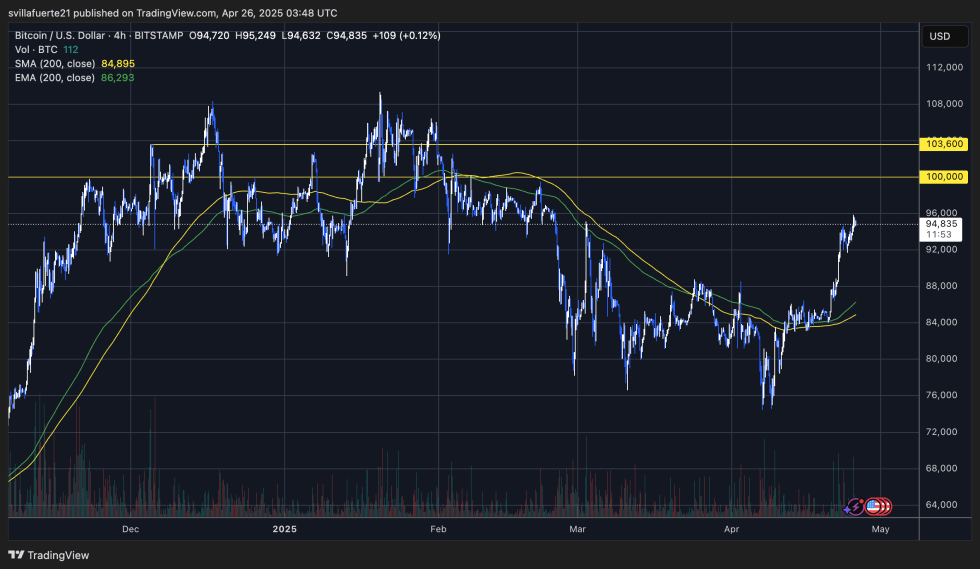

Bitcoin is currently trading over the $94,000 threshold, demonstrating robust momentum following a significant rebound from recent troughs. Buyers are vigorously striving to recapture the $95,000 level, a vital threshold that may indicate the continuation of an uptrend towards new all-time peaks. Nonetheless, despite the rising optimism, hazards remain pronounced as global trade disputes and macroeconomic unpredictability continue to put pressure on financial markets.

Tensions between the US and China continue, fostering a precarious climate that could swiftly alter investor sentiment. Nevertheless, Bitcoin has exhibited resilience, detaching from conventional markets in recent sessions and preserving strong price performance even as equities decline.

According to CryptoQuant statistics, a significant bullish indicator is developing: the Coinbase Premium Gap has remained positive for 265 consecutive hours. Historically, a favorable premium signifies potent buying force from US-based stakeholders, often preceding substantial price surges. This ongoing pattern indicates that institutional interest remains robust, bolstering the current upward movement.

While the short-term forecast is optimistic, Bitcoin must decisively surpass $95,000 to validate the subsequent stage of the rally. Until that occurs, traders should proceed with caution, as volatility may return abruptly.

Bitcoin Strengthens But Caution Persists Amid Global Hazards

Bitcoin has surged over 28% in value since April 9, rekindling hope throughout the crypto sector. Following weeks of bearish pressure and fluctuation, BTC’s recent ascent above the critical $90,000 threshold signifies a significant shift in sentiment. Buyers are presently in short-term command, and momentum continues to build as Bitcoin strives to reclaim elevated territory and challenge historical peaks.

However, in spite of the bullish price fluctuations, risks remain considerable. Global trade dynamics continue to generate instability, and broader economic uncertainty still casts a shadow over investor confidence. Since US President Donald Trump’s election triumph in November 2024, volatility has pervaded global financial landscapes, and crypto assets have not been spared from these upheavals.

Anxiety lingers even as Bitcoin ascends. Many investors tread carefully, observing key thresholds closely to assess whether this rally can genuinely be upheld. Analysts emphasize that any regression in trade discussions could trigger sharp downturns.

On a positive note, top analyst Maartunn shared insights on X, indicating that the Coinbase Premium Gap (30-hour moving average) has remained positive for 265 consecutive hours—roughly 11 straight days. This marks the fifth-longest buying spree since ETF trading commenced, suggesting that substantial demand from US-based investors continues to drive the rally.

If Bitcoin sustains this momentum and recaptures $95,000 soon, the trajectory toward $100,000 could become feasible. Until then, cautious optimism remains the prevailing sentiment among investors.

BTC Price Activity: Bulls Target $100K But Must Guard Key Levels

Bitcoin is priced at $94,800 after spending several hours hovering near the $95,000 level, a critical short-term resistance area. Bulls have demonstrated remarkable strength since early April, but now the actual challenge begins: maintaining gains and pushing towards new peaks.

To validate a sustained rally, BTC must firmly hold above the $90,000 threshold and make a decisive leap toward reclaiming $100,000 in the upcoming days. The $90K level has become a psychological and technical foundation for bulls, and defending it will be essential to sustaining momentum. A clean breach above $95K could pave the way for a rapid move into uncharted territory.

However, should Bitcoin fail to uphold support at $90K, a prolonged consolidation phase is probable. Such a phase might see BTC trading within the $85K–$90K range for several weeks as the market digests recent gains and assesses broader economic conditions.

Investors should remain vigilant, as volatility is expected to persist amid ongoing global tensions and uncertainty. The forthcoming days will be crucial in determining whether this rally can evolve into a full breakout or stagnate into sideways consolidation.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is focused on providing meticulously researched, precise, and unbiased content. We maintain rigorous sourcing protocols, and every page is subject to thorough review by our team of leading technology experts and experienced editors. This procedure guarantees the integrity, relevance, and value of our content for our audience.

Source link

“`