Ethereum (ETH) experienced slight improvements over the past week, increasing by 2.80%. However, the leading altcoin is still far from escaping a downtrend that dates back to December. In the midst of this bearish market condition, distinguished market analyst Ali Martinez has pointed out crucial price levels that will determine if ETH’s correction is finished and if market entry is advisable.

Ethereum: An Investment Opportunity Or More Decline On The Horizon?

In a comprehensive analysis post on X, Martinez conveys that Ethereum has plummeted by 57% from its recent peak of $4,100 in December. This downturn has been linked to significant distributions by large Ethereum holders, particularly the whales. In the last four months, wallets containing 10,000 ETH have diminished by 80%. Simultaneously, ETH whales, i.e., wallets with 100,000 ETH and more, have unloaded 130,000 ETH during this timeframe.

Throughout ETH’s decline, the Ethereum Spot ETFs have also faced significant outflows, evidenced by a net withdrawal of $760 million in just the past month. Additionally, investors have moved 100,000 ETH to individuals intending to sell due to concerns over potential losses in price.

Looking ahead, Martinez indicates that various technical indicators further imply a descent for Ethereum amid this substantial selling pressure. For instance, a breakdown from an ascending triangle on the 3-day charts suggests that ETH could be approaching a price target of approximately $1,000.

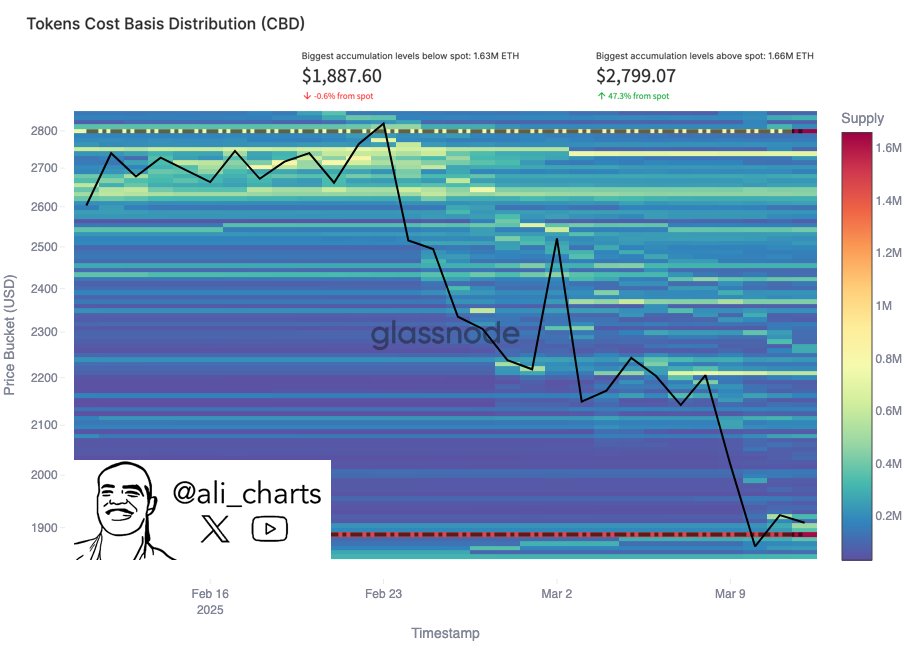

Meanwhile, the ETH price bands have also identified $1,440 as another downside target, indicating a potential 27.4% drop from current market values. Notably, data from the Cost Basis Distribution supports both bearish forecasts, as Ethereum currently stands above significant support at $1,887. However, a price drop below this threshold would lead to further declines to lower targets such as $1,440, $1250, and $1,000.

Despite this, Martinez mentions that there is a possibility for an ETH market rebound. By examining the quantity of ETH obtained at various price points, the analyst observes that ETH bulls encounter substantial resistance between $2,250-$2,610. If ETH bulls manage to surpass this resistance, it would negate the current bearish market perspective.

Ethereum Price Summary

At the moment of writing, Ethereum was priced at $1,985, reflecting a gain of 1.10% in the last day and 2.10% in the past week. Nonetheless, the altcoin has dropped by 27.32% over the previous month. As the largest altcoin on the market, Ethereum holds a market capitalization of $239 billion, accounting for 8.7% of the total cryptocurrency market.

Featured image from Ledger Insights, chart from Tradingview

Editorial Approach for bitcoinist revolves around providing thoroughly vetted, precise, and impartial content. We adhere to rigorous sourcing standards, and each page undergoes meticulous examination by our panel of leading technology professionals and veteran editors. This process guarantees the integrity, relevance, and significance of our content for our readership.