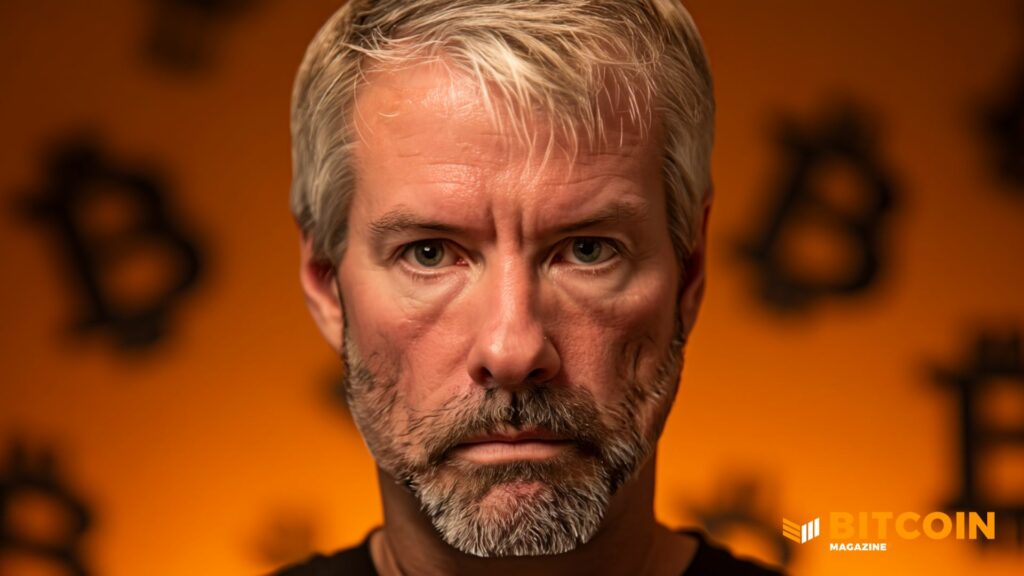

Michael Saylor is standing strong against recent buzz suggesting that Strategy might lose billions in passive investments if MSCI decides to drop the company from key equity indices.

In a message on X, Saylor shared that Strategy is “neither a fund, nor a trust, nor a holding company.” He described it as a publicly traded operating company with a thriving $500 million software business and a one-of-a-kind treasury strategy that turns Bitcoin into productive capital.

Saylor shined a light on the company’s latest moves, including five public offerings of digital credit securities — $STRK, $STRF, $STRD, $STRC, and $STRE — which together add up to over $7.7 billion!

He also mentioned Stretch ($STRC), a Bitcoin-backed credit product that offers monthly USD returns to both institutional and retail investors.

“Funds and trusts just hold assets. Holding companies sit on investments. We’re all about creation, structure, issuance, and operation,” Saylor wrote. “No passive fund or holding company can do what we’re doing.”

He sees Strategy as a groundbreaking new kind of business: a Bitcoin-backed structured finance company innovating in both finance and software.

Saylor confidently stated that how the company is classified doesn’t define it. “Our vision is long-term, our belief in Bitcoin is rock solid, and our goal remains the same: to establish the world’s first digital monetary institution based on sound money and financial innovation.”

Will Strategy be Kicked Off Nasdaq 100?

This comes as JPMorgan analysts warned that if MSCI excludes Strategy from major indices, it could lead to a whopping $2.8 billion in outflows, and this could balloon to $8.8 billion if other indices follow suit.

Currently, Strategy has a market cap of about $59 billion, with nearly $9 billion invested in passive index-tracking vehicles. Experts say that any exclusion could ramp up selling pressure, widen funding spreads, and reduce trading liquidity.

Being included in indices like the Nasdaq 100, MSCI USA, and MSCI World has long helped incorporate Bitcoin into mainstream portfolios. But, MSCI is reportedly considering whether firms with big digital-asset holdings should stay in traditional equity benchmarks.

Market players are starting to view companies with a lot of digital assets as more like investment funds, which don’t qualify for index inclusion.

Despite the recent volatility in Bitcoin and concerns about possible outflows, the company remains committed to its long-term vision of a Bitcoin-backed financial enterprise, focused on creating new financial tools and a digitally native monetary institution.

On October 10, the crypto market took a hit. Some say it was due to Trump threatening tariffs on China, but others argue that it was triggered when MSCI announced they were reviewing whether companies, like MSTR, that hold crypto as a core business should be categorized as “funds” instead of operating companies. This led to immediate reactions from ‘smart money,’ causing the sharp market drop, with all eyes now on MSCI for their January 15, 2026 decision.

Trillions of Dollars in Bitcoin!

Earlier this year, in an interview with Bitcoin Magazine, Saylor detailed an ambitious plan to build a trillion-dollar Bitcoin balance sheet, using it to redefine global finance.

His vision includes gathering $1 trillion in Bitcoin and aiming for a 20–30% annual growth, using this as a foundation for a massive digital collateral store.

From this base, Saylor seeks to issue Bitcoin-backed credit at yields much higher than traditional fiat systems—possibly 2–4% more than corporate or sovereign debt—offering safer, over-collateralized options.

He believes this will breathe new life into credit markets, equity indices, and corporate balance sheets while creating exciting new financial products, including high-yield savings accounts, money market funds, and Bitcoin-denominated insurance services.

As we write this, Bitcoin is facing intense sell pressure, and its price is falling close to the $80,000 mark. Just six weeks ago, it reached an all-time high of over $126,000!

Currently, Strategy’s stock, $MSTR, is at $167.95, down over 5% for the day and more than 15% over the last five trading days.