“`html

The stablecoin sector noted its most significant quarterly growth since 2021, with $41 billion in net inflows during the third quarter of 2025.

As per Orbital’s Stablecoin Retail Payments Index, the retail acceptance of stablecoins has transitioned into a new stage of steadiness following a year of vigorous growth, largely due to the crypto industry shifting from speculative trading to pragmatic, daily utilization in emerging markets.

Retail Engagement Stabilizes As Crypto Market Achieves Balance

Stablecoin operations have started to equalize after a 69% rise in user engagement from mid-2024 to mid-2025. As per the newest report data from Orbital, there were approximately 3.6 million daily active users in Q3, signifying that the market is normalizing after the previous months’ excitement.

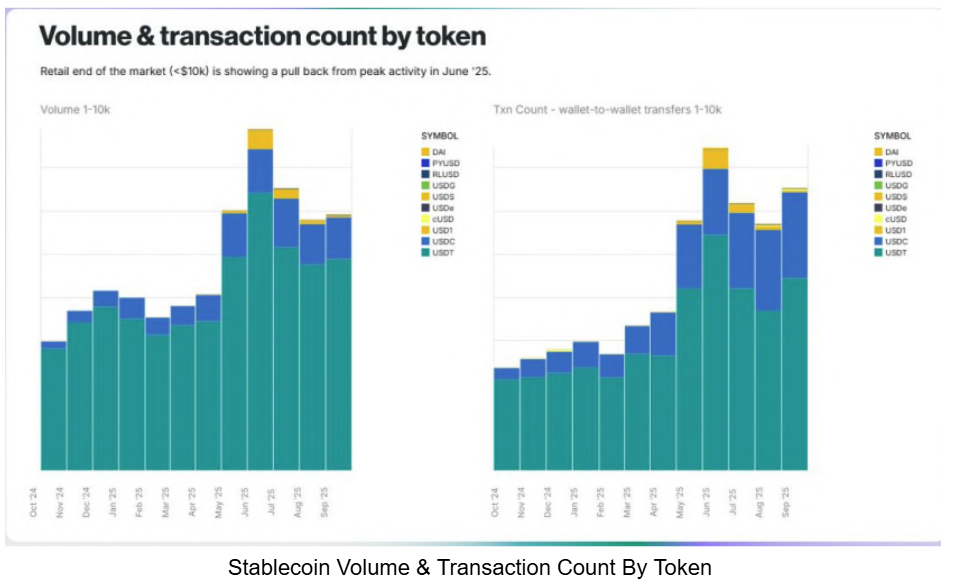

Nonetheless, it’s noteworthy that retail payment totals still increased slightly, rising 4% to $1.77 trillion, despite the number of transactions dipping somewhat from 1.33 billion to 1.21 billion. This pattern suggests that larger, more substantial transfers are replacing the smaller ones below $10,000, which dominated previous quarters.

Tether’s primary token, USDT, remains the leader in the retail sector, making up 83% of overall transactions. Conversely, USDC is preferred among DeFi users, holding over 50% of the DeFi market. In terms of crypto exchange, Binance plays a crucial role in managing much of the liquidity for both tokens and providing the infrastructure for retail transactions across emerging markets.

Emerging Markets Rely On Stablecoins To Combat Inflation

Stablecoins are increasingly seen as crucial resources in economically challenged regions. Financial analysts have acknowledged this trend, with Ark Invest CEO Cathie Wood recently updating her $1.5 million Bitcoin forecast due to the increasing usage of stablecoins.

Orbital’s analysis reveals that users in Algeria, Bolivia, and Venezuela are facing alarming premiums of 90%, 77%, and 63%, accordingly, to access dollar-linked tokens. This indicates that stablecoins are evolving into digital equivalents of the US dollar in these locales. Mid-tier premiums range from 8% to 18% in nations like Türkiye, Ethiopia, and Argentina.

Conversely, areas such as India, Saudi Arabia, and South Africa experience lower premiums, as enhanced financial infrastructure facilitates the buying and selling of stablecoins at nearly market rates. Some nations, including Colombia and Peru, even trade below parity, indicating stronger liquidity and evolving market sophistication.

Leading countries by stablecoin premium.

Significantly, a new wave of blockchains is vying for a portion of stablecoin traffic. Binance Smart Chain continues to head in retail transfers but experienced a slowdown in growth by half in Q3.

Aptos has now achieved stabilization following its substantial surge earlier in the year, while Plasma, the latest newcomer, recorded an unprecedented $7 billion in deposits within days of launching its native token, XPL.

Tron also maintained its consistent ascent due to its significant USDT utilization, while Ethereum witnessed its total stablecoin supply increase by $35 billion.

Stablecoin Wallet-to-wallet Transfers

Data from CoinGecko indicates that the stablecoin market cap today is approximately $311 billion.

Featured image from Unsplash, chart from TradingView

Editorial Methodology for bitcoinist focuses on providing extensively researched, precise, and impartial content. We adhere to rigorous sourcing standards, and every page undergoes meticulous review by our team of leading technology specialists and experienced editors. This process guarantees the integrity, relevance, and value of our content for our audience.

Source link

“`