“`html

Bitcoin’s corporate reserves and the bitcoin mining industry have transformed into two of the pivotal narratives of this cycle. From (Micro)Strategy’s MSTR billion-dollar asset acquisitions to the emergence of MetaPlanet and the rapid expansion of bitcoin mining firms, institutional and industrial embrace have surfaced as formidable structural pillars for the network. Yet now, following years of near-constant buying and market superiority, the data indicates we are approaching a crucial inflection point — one that could ascertain whether Bitcoin’s corporate reserves and mining assets persist in leading or start to trail as the subsequent phase of the cycle develops.

Bitcoin Reserve Accumulation

Our new Bitcoin Treasury Tracker delivers daily insights into how much Bitcoin these major public and private treasury entities possess, when they’ve amassed it, and how their holdings have progressed. These reserves now collectively hold over 1 million BTC, an astonishing figure that accounts for more than 5% of the entire circulating supply.

The magnitude of this accumulation has been fundamental to Bitcoin’s current cycle strength. Nonetheless, some of these firms are encountering rising pressure as their equity valuations struggle to align with Bitcoin’s own price movements.

Valuation Compression Across Bitcoin Reserves

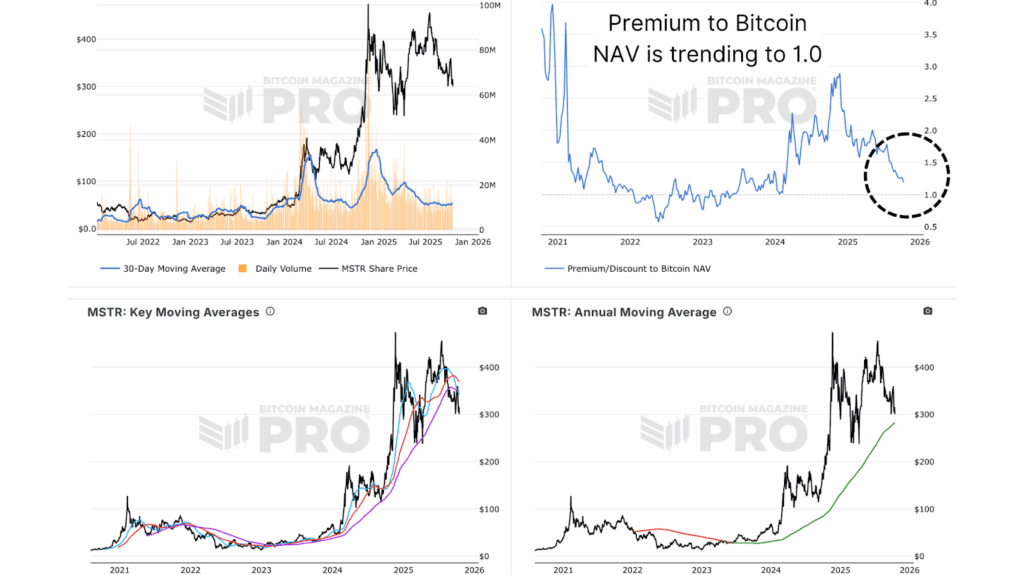

(Micro)Strategy / MSTR, the trailblazer of corporate Bitcoin adoption, stands as the most substantial publicly traded Bitcoin holder. Nevertheless, recent months have witnessed its stock underperform in comparison to Bitcoin’s price fluctuations. While Bitcoin has stabilized within a broad range, MSTR’s equity has plummeted more sharply, nudging its Net Asset Value (NAV) Premium, the ratio between its market value and the Bitcoin it holds, closer to equivalence at 1.0x.

This compression indicates that investors are evaluating the company closer to its direct Bitcoin exposure, with little additional premium for management execution, potential leverage, or strategic creativity. Previously, last cycle and earlier this cycle, MSTR traded with a substantial premium as markets rewarded its leveraged exposure. The trend toward equivalence points to a decline in speculative interest and emphasizes how this cycle’s market psychology closely resembles prior late-stage expansions.

A Cycle-Defining Inflection for Bitcoin and Bitcoin Mining Stocks

The most enlightening perspective arises from the BTCUSD to MSTR ratio, essentially assessing how many MSTR shares can be acquired with one Bitcoin. Currently, the ratio resides around 350 shares per BTC, situating it firmly at a significant historical support level that has turned into resistance, which has characterized price action turning points.

At this moment, this chart resides in a pivotal region. A sustained breakout above the 380–400 range would

“““html

indicate revitalized Bitcoin supremacy and possible underperformance in MSTR. On the other hand, a downward reversal, particularly beneath 330, would imply that MSTR might reclaim its position as a leveraged frontrunner as we advance into the next phase of the bull market.

Bitcoin Mining Stocks Lead the Pack

Alternatively, while treasury firms have lagged behind, Bitcoin miners have been experiencing significant gains. In the last half year, Bitcoin alone has increased approximately 38%, whereas Listed Miner shares have escalated dramatically: Marathon Digital (MARA) is up 61%, Riot Platforms (RIOT) has soared 231%, and Hive Digital (HIVE) has risen an astounding 369%. The WGMI Bitcoin Mining ETF, a collection of major listed miners, has outshined Bitcoin by about 75% since September, highlighting the sector’s newfound momentum.

Focusing on Marathon Digital, the largest publicly traded Bitcoin miner globally, provides further clarity. Traditionally, the MARA chart has served as a dependable leading indicator of market turning points. For instance, at the conclusion of the 2022 bear market, MARA surged over 50% right before Bitcoin commenced a new multi-month upward trend. This trend has been observed repeatedly during this cycle.

Bitcoin Mining Stocks vs. Corporate Treasuries: Divergent Trajectories in Bitcoin Market Leadership

With over 1 million BTC currently maintained on corporate balance sheets, the impact of these organizations on Bitcoin’s supply-demand dynamics remains substantial. However, the balance of leadership seems to be transitioning. Treasuries such as Strategy and MetaPlanet, while fundamentally optimistic over the long haul, are now positioned at crucial ratio turning points, finding it difficult to outshine spot BTC. Meanwhile, miners are going through one of their most robust periods of relative success in years, an occurrence often indicating that broader market energy may soon follow.

As usual, our objective at Bitcoin Magazine Pro is to pierce through market clutter and deliver data-powered insights across every aspect of the Bitcoin ecosystem, from corporate assets to miner activities, on-chain supply, and macroeconomic liquidity. Thank you all immensely for reading, and I’ll connect with you in the next update!

For a more thorough exploration of this topic, check out our latest YouTube video here: Now Or Never For These Bitcoin Stocks

For additional data, charts, and expert insights into Bitcoin price trends, visit BitcoinMagazinePro.com.

Subscribe to Bitcoin Magazine Pro on YouTube for more specialized market insights and evaluations!

Disclaimer: This article is intended for informational purposes only and should not be seen as financial advice. Always conduct your own research prior to making any investment choices.

Source link

“`