“`html

Despite the scorching start to the month, the historically optimistic “Uptober” period has not precisely met the predictions for the Bitcoin value. Following the market-wide decline on October 10, the leading cryptocurrency has struggled to initiate a definite recovery towards its previous peaks.

In actuality, the Bitcoin price movement continues to face ongoing bearish pressure, declining to a new low of approximately $103,000 on Friday, October 18. As uncertainty reigns in the market, investors are left contemplating whether the bull rally has concluded or if the sluggish movement is merely a temporary setback.

A recent forecast suggests that the current technical status of the BTC price might provide clues regarding its forthcoming direction.

BTC Faces Risk of More Significant Correction If It Breaks $99,900 Support

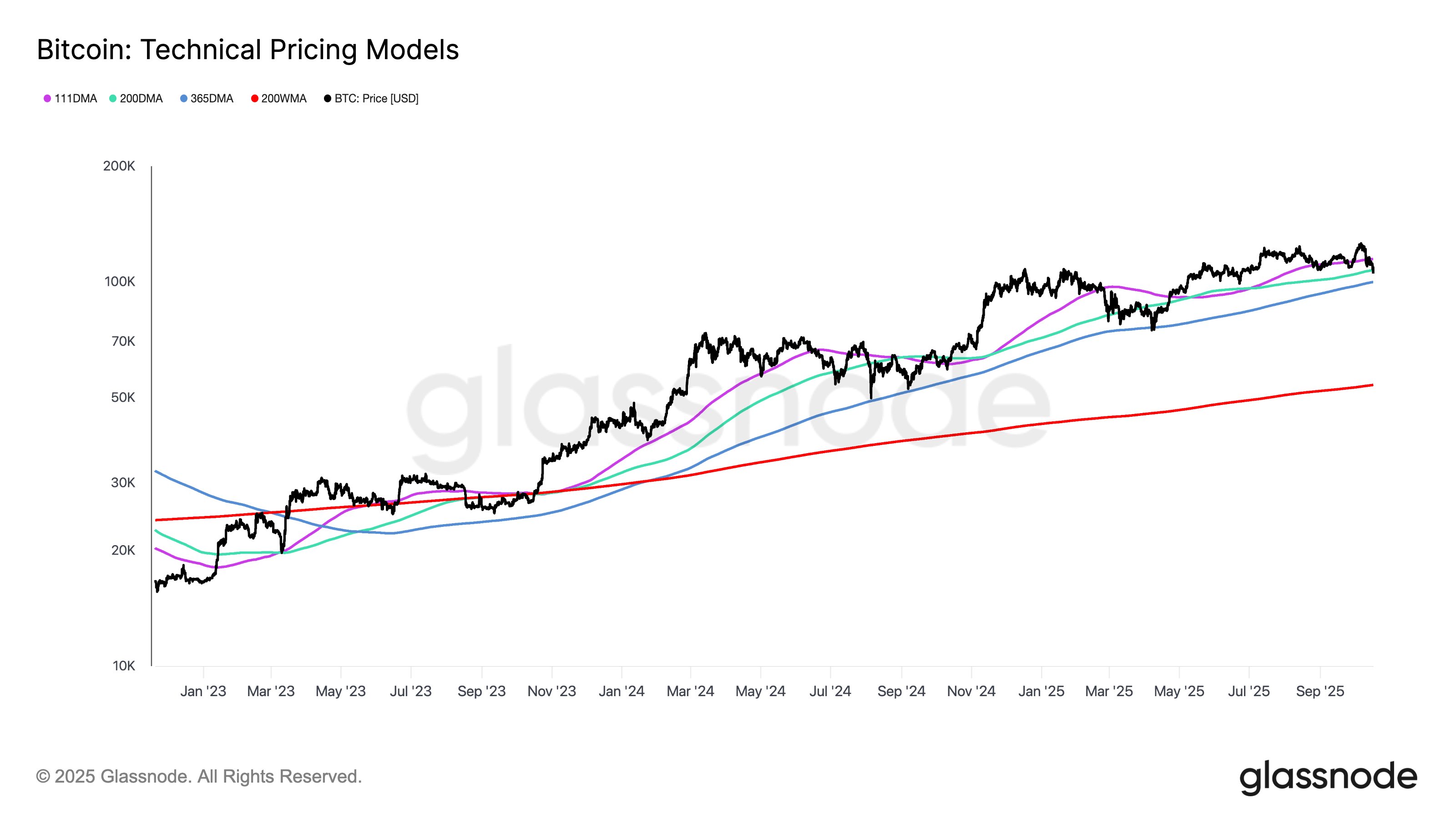

In a post dated October 17 on the social media site X, Glassnode submitted an intriguing assessment of the existing Bitcoin price configuration. The renowned crypto analytics organization disclosed that the flagship cryptocurrency is currently situated between two significant support areas.

This evaluation relies on the Glassnode Technical Pricing Model, a chart featuring several technical indicators, including the Pi Cycle indicator, the Mayer Multiple, the Yearly Moving Average (MA), and the 200-Week Moving Average.

As per Glassnode, the Bitcoin price is presently trapped between the Mayer Multiple ($107,400) and the Yearly MA ($99,900).

Source: @glassnode on X

The Mayer Multiple (200-Day Simple Moving Average) is a well-known technical indicator frequently associated with the pivot point between a bull and bear market. Meanwhile, the 365 Day SMA provides a long-term benchmark for high-timeframe market momentum.

Following the latest decline, the Bitcoin price fell below the 200-day Moving Average, indicating a potential transition from a bullish market state to a bearish one. While BTC remains above the 365-day MA, the leading cryptocurrency must maintain its position above this threshold to stabilize the current trend.

Ultimately, investors may want to monitor the BTC price, as a drop below the $99,900 mark could signal significantly greater challenges for the world’s largest cryptocurrency. It’s essential to note that a resurgence above the Mayer Multiple could be crucial for Bitcoin’s advancement, though it faces price resistance near the 111-day moving average (currently at $114,700).

Bitcoin Price Overview

At the time of this writing, Bitcoin is priced at approximately $106,427, indicating nearly a 2% drop in value over the past 24 hours.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Editorial Approach for bitcoinist prioritizes delivering thoroughly researched, accurate, and impartial content. We adhere to stringent sourcing standards, and every page undergoes careful review by our team of expert technology analysts and experienced editors. This procedure ensures the integrity, relevance, and value of our material for our audience.

Source link

“`