“`html

By Katherine K. Chan

THE BANGKO SENTRAL ng Pilipinas (BSP) is expected to maintain interest rates this week as inflation uncertainties persist, as indicated by most experts surveyed by BusinessWorld.

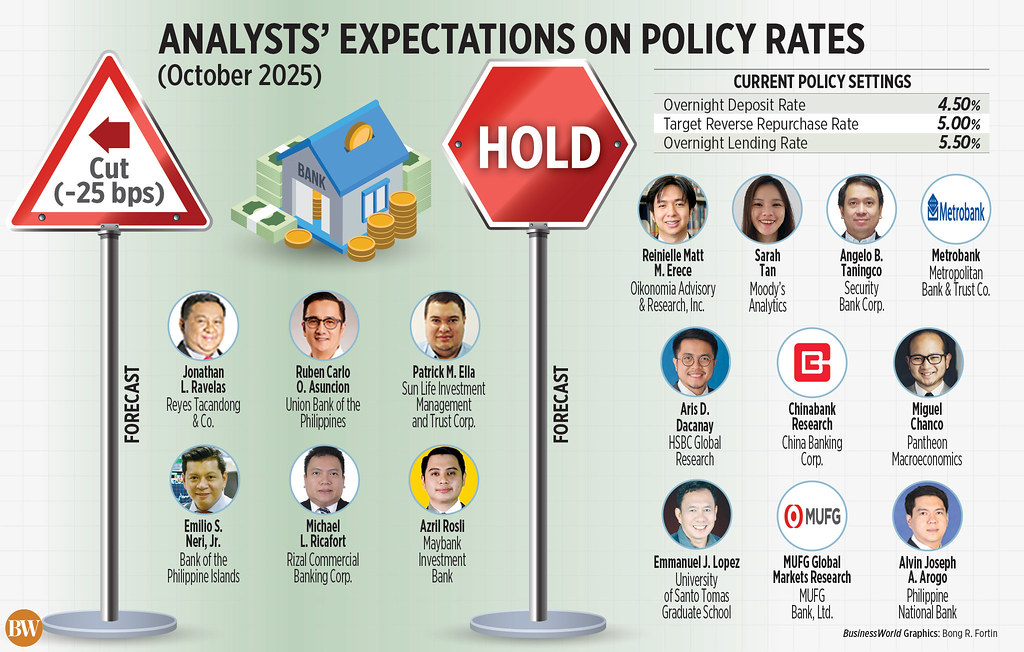

A BusinessWorld survey conducted last week revealed that 10 out of 16 experts foresee the Monetary Board to refrain from monetary easing in its meeting on Oct. 9, retaining the benchmark rate at 5%.

Conversely, six analysts predict a reduction of 25 basis points (bp), referring to lower-than-target inflation and the necessity to bolster economic growth. If this occurs, the benchmark rate would adjust to 4.75%.

Thus far, the central bank has decreased borrowing expenses by 150 bps in total since the onset of its easing cycle in August of the previous year.

Security Bank Chief Economist Angelo B. Taningco stated that rising inflation risks are likely to influence the Monetary Board to keep rates unchanged on Thursday.

“I anticipate the Monetary Board to halt rate cuts mainly because of the inflation acceleration and potential inflation risks from a possible extension of the rice import ban and an increase in rice tariffs,” he expressed in an email.

Inflation statistics for September will be released on Oct. 7. A BusinessWorld survey of 12 analysts yielded a median forecast of 1.9% for September inflation, which is quicker than the 1.5% in August, reflecting the effect of recent typhoons on food prices, along with heightened fuel prices and electricity costs. This falls within the BSP’s 1.5-2.3% estimate for the month.

The 60-day ban on imports of regular milled and well-milled rice commenced on Sept. 1. Nonetheless, the import suspension is anticipated to be prolonged by an additional 30 days.

Moody’s Analytics economist Sarah Tan noted that a pause would permit the BSP to assess how its prior rate reductions have influenced the economy, especially regarding domestic demand and lending activities.

“The central bank will also consider the balance between fostering growth and ensuring inflation expectations remain anchored. Global oil price fluctuations, the effects of recent typhoons on food supply, and the Fed’s policy position are also significant factors,” Ms. Tan added in an email.

Philippine National Bank economist Alvin Joseph A. Arogo indicated that a pause would ease the depreciation pressure on the Philippine peso since the BSP has relaxed rates more than the US Federal Reserve this year.

The local currency closed at P58.196 per dollar on Sept. 30, declining by P1.066 or 1.83% from its P57.13 rate on Aug. 29.

“A pause from the BSP will also support the peso given the current USD/PHP levels, which remain above the 58-level despite a generally weak dollar,” remarked Metropolitan Bank & Trust Co. (Metrobank) in a separate statement.

Metrobank suggested that the BSP might hold off on making policy changes until the third-quarter gross domestic product (GDP) data is released on Nov. 7.

“We forecast household spending and investment to remain lukewarm while the delayed impacts of the BSP’s previous RRP (reverse repurchase rate) reductions start to significantly take effect. We believe this will drive the BSP to enact another reduction to the RRP during its final meeting of 2025 in December,” it mentioned.

In the first half of the year, the economy grew by 5.4%, slower than the 6.2% growth exhibited last year. This was slightly below the government’s target range of 5.5-6.5% for this year.

“With the central bank describing the current policy rate as the ‘Goldilocks rate,’ policymakers may require stronger justification for an immediate change to monetary policy,” Chinabank Research commented in a note.

RATE CUT

On the contrary, some analysts anticipate a 25-bp rate reduction in this week’s meeting as inflation remains under the BSP’s 2-4% target and the rate of economic growth continues to be a concern.

Previously, BSP Governor Eli M. Remolona, Jr. mentioned they are open to implementing a cut this month if the nation’s economic performance further declines.

Union Bank of the Philippines Chief Economist Ruben Carlo O. Asuncion expressed they expect a 25-bp cut on Thursday “to address downside risks to growth.”

“While inflation remains mild and below target, the BSP is likely to focus on bolstering economic momentum amidst subdued fiscal expenditure, persistent external challenges, and recent weather-related disruptions that may impede activity,” Mr. Asuncion stated.

Azril Rosli, an economist at Maybank Investment Banking Group, noted in an email that slumping investment expenditure and uncertainty stemming from US tariffs will also influence the growth outlook.

Meanwhile, Michael L. Ricafort, chief economist at Rizal Commercial Banking Corp., mentioned in a Viber message that the BSP could synchronize its rate cuts with the Fed’s 25-bp reductions during the October and December meetings.

“These Fed rate reductions could be mirrored locally by the BSP so that a healthy interest differential would ultimately be preserved to assist in supporting/stabilizing the peso exchange rate, import costs, and overall inflation,” he remarked.

The Monetary Board’s last meeting of the year is scheduled for Dec. 11.

Miguel Chanco, chief emerging Asia economist at Pantheon Macroeconomics, indicated that the BSP might implement another rate cut in December as GDP growth in the third quarter is likely to have deteriorated.

“We still anticipate another 25-bp cut in December, as we expect the Q3 GDP report due in November to be sufficiently weak to persuade the Board to ease policy at least one last time,” he stated in an email.

In a note, Bank of the Philippine Islands Lead Economist Emilio S. Neri, Jr. proposed that the probability of the BSP cutting rates in December increases if third-quarter GDP confirms “potential demand softness.”

“With rates already approaching neutrality and inflation projected to converge to 3% by 2026-2027, we believe the potential for further easing after this point is constrained,” Mr. Neri expressed.

“Nevertheless, the BSP could still implement up to two additional cuts if the economy continues to function below capacity. They may also decide to coordinate their actions with the Federal Reserve’s decisions, especially if markets anticipate aggressive reductions after Powell’s term concludes in May 2026.”

Source link

“`