“`html

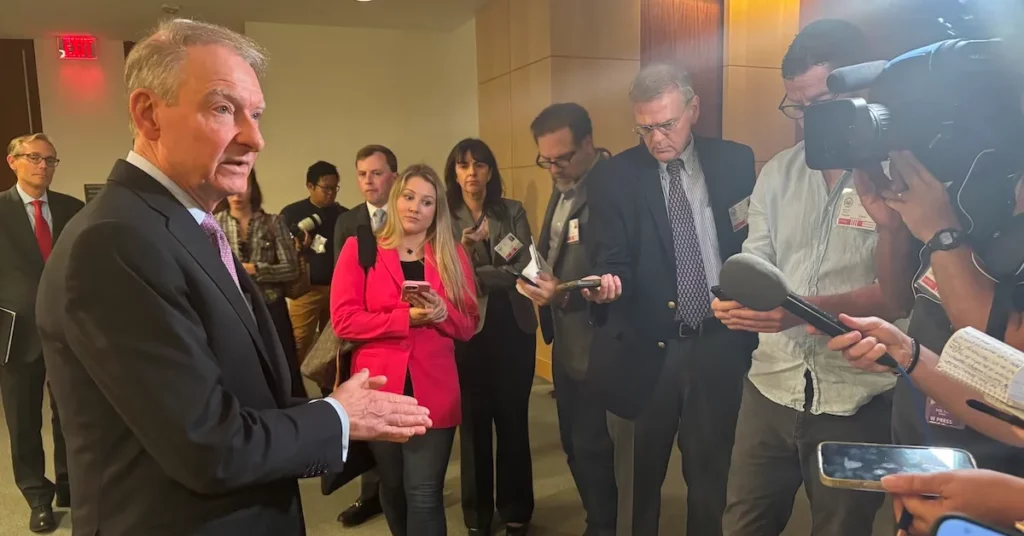

Today, following a media scrum after his introductory comments at the SEC-CFTC Roundtable on Regulatory Harmonization Initiatives, U.S. Securities and Exchange Commission (SEC) chairman Paul Atkins conveyed his enthusiasm regarding the integration of tokenized securities on-chain, although he didn’t provide any specifics on the platforms or protocols these assets may utilize.

The latter could be particularly crucial for Bitcoin advocates, as the wallets used to trade tokenized securities on-chain will likely necessitate identification details, and such a regulation could extend to bitcoin wallets.

Thus, I inquired of the chairman how he envisions the transition of securities onto the blockchain: Would it resemble restricted platforms like Fidelity and Charles Schwab utilizing blockchain for transaction settlements or would it appear akin to tokenized stocks being exchanged on decentralized markets?

He did not address my inquiries directly.

Instead, he initially elaborated on how blockchain-based securities trading can expedite settlement durations.

“The positive aspect of tokens [is that] you can facilitate payment and transfer of the actual asset simultaneously — it’s T zero, essentially instant clearance,” Chairman Atkins remarked to me.

He concluded this remark with some somewhat troubling terminology.

“So, perhaps we’ll need to create a sort of speed bump to ensure that we don’t make mistakes or wire funds to incorrect locations,” the chairman added. “We will be realistically working over the next year or two to establish effective guardrails around the system.”

Terms like “speed bump” and “guardrails” raised warning signals, as these imply some manner of oversight, and where there is oversight, there’s frequently KYC.

If tokenized securities ultimately trade within the confined environments of traditional brokerages, then the concern regarding KYC diminishes, as these platforms already conduct KYC on their clientele.

The dilemma intensifies if tokenized securities can be exchanged via protocols like Uniswap using wallets such as MetaMask and Trust Wallet, which would then likely need to enforce KYC for their users.

If this occurs, it raises the following inquiries: Will this compel all crypto wallets to implement KYC for their users? Will this regulation eventually extend to bitcoin-exclusive wallets?

From my conversation with the chairman, I gathered that he doesn’t presently have the solutions to these inquiries. That is, he wasn’t being elusive but genuinely didn’t appear to have a clear understanding of the broader context surrounding tokenized securities at this moment, as he awaits Congressional action.

A great deal regarding crypto market regulation is at stake as the Senate discusses and modifies the CLARITY Act (CLARITY), the digital asset market structure legislation. The chairman mentioned that he’s monitoring CLARITY as it progresses through the legislative channels.

“There’s the market structure act that passed the House and is currently [being discussed] in the Senate,” he stated. “We’ll observe what transpires.”

Bitcoin Magazine will follow up with Chairman Atkins on this matter if and when CLARITY is enacted.

In the meantime, if you wish to safeguard your right to utilize your bitcoin wallet privately and without permission, make sure to reach out to your elected representatives as part of the Satoshi Needs You campaign.

Source link

“`