“`html

Bitcoin is fluctuating around $115K today as the market prepares for the Federal Reserve’s interest rate decision, a moment anticipated to shape the forthcoming weeks. The atmosphere is charged, with bulls readying for a spike if the Fed chooses a 25bps reduction, which numerous analysts perceive as a positive and encouraging signal. However, ambiguity remains elevated, as broader fluctuations continue to affect the market without a definitive direction until the announcement delivers guidance.

At present, Bitcoin remains stable near significant levels, yet pricing behavior indicates hesitation as traders steer clear of aggressive positioning until clarity is established. A minor interest rate reduction could bolster the narrative of a gradual and healthy shift, while a more substantial move could incite risk-off conduct across markets.

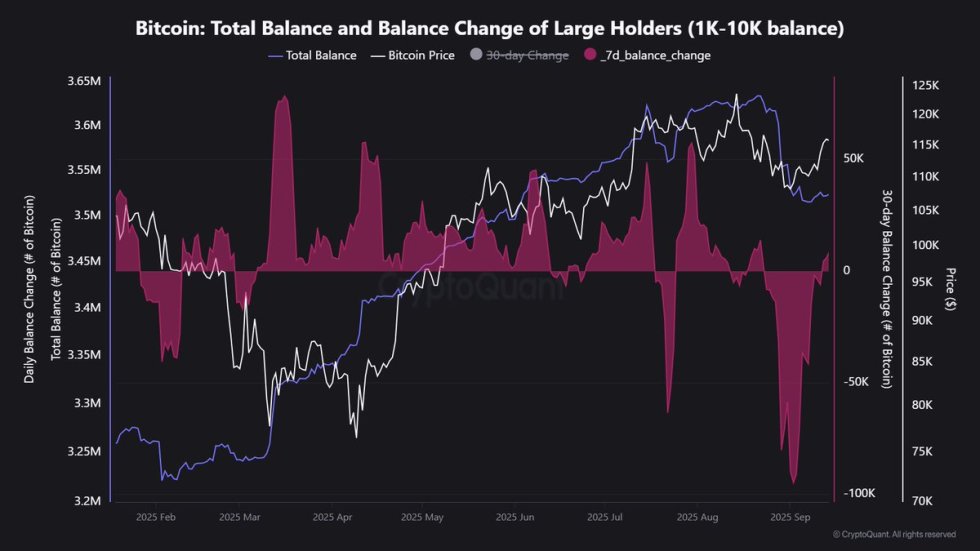

Compounding the cautious sentiment, leading analyst Maartunn has raised alarms regarding onchain activities. According to his analysis, whale holdings have significantly decreased recently, with large entities diminishing exposure ahead of the Fed’s decision. This decline indicates that some institutional and wealthy investors might be adopting a cautious approach, bracing for potential disturbances.

Whale Holdings Indicate Market Transition

Maartunn disclosed compelling data showing that the total Bitcoin possessed by whales fell from 3.628M BTC on August 22 to 3.52M BTC by September 8. This signifies a drop of 108K BTC in merely 17 days, a shift that cannot be dismissed given Bitcoin’s current consolidation around $115K.

This reduction in whale holdings frequently mirrors caution among the market’s largest participants. Whales trimming exposure may suggest profit-taking following Bitcoin’s recent upswing, or preparation for volatility related to macroeconomic unpredictability. With the Federal Reserve’s interest rate decision set for today, this positioning comes off as calculated. Historically, large investors are sensitive to Fed outcomes, as changes in rates directly influence risk appetite and liquidity conditions throughout financial markets.

If the Fed opts for a 25bps decrease, it may provide a bullish backdrop, motivating whales to reaccumulate on dips. On the contrary, a more considerable cut—or any unexpected tone in Powell’s statements—could incite turbulence, affirming the whales’ defensive conduct.

Looking forward, the upcoming weeks may prove pivotal. If whales resume accumulation, it would validate confidence in Bitcoin’s longer-term trajectory. However, if the outflow trend persists, the market could confront deeper corrections before embarking on its next upward movement.

Bitcoin Approaching Resistance At $120K

The 3-day Bitcoin chart illustrates a phase of consolidation just beneath the $120K–$123K resistance zone, with BTC currently trading at $116,493. Following the vigorous rally from the March lows, the price formed a series of higher lows, demonstrating sustained bullish structure. The moving averages offer additional affirmation: the 50-day SMA is significantly above the 100-day and 200-day SMAs, indicating strong medium-term momentum.

Despite this favorable structure, the $120K mark remains the crucial barrier. Each time Bitcoin nears this vicinity, selling pressure manifests, leading to short-term pullbacks. Nevertheless, buyers are defending levels above $114K, averting deeper corrections and sustaining the trend. This indicates accumulation in anticipation of a possible breakout.

If Bitcoin manages to close above $123K, the subsequent upside target lies near $130K–$135K, ranges that could incite another wave of institutional inflows. Conversely, a breach below $110K would undermine the structure, potentially pulling prices towards the $102K–$105K support arena aligned with the 200-day SMA.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is focused on providing extensively researched, precise, and impartial content. We adhere to stringent sourcing standards, and each page goes through thorough review by our team of leading technology professionals and seasoned editors. This process guarantees the reliability, relevance, and value of our content for our readers.

Source link

“`