“`html

Bitcoin is stabilizing around the $115,000 mark as markets prepare for tomorrow’s eagerly awaited Federal Reserve assembly. Following weeks of unpredictability, the market has transitioned into a careful holding phase, with traders and institutions collectively seeking clarity on the Fed’s forthcoming actions. The determination to lower interest rates will influence the sentiment surrounding risk assets, yet investors are also closely monitoring whether quantitative easing strategies will re-enter the dialogue. Both scenarios could profoundly alter the macroeconomic landscape and dictate Bitcoin’s subsequent movement.

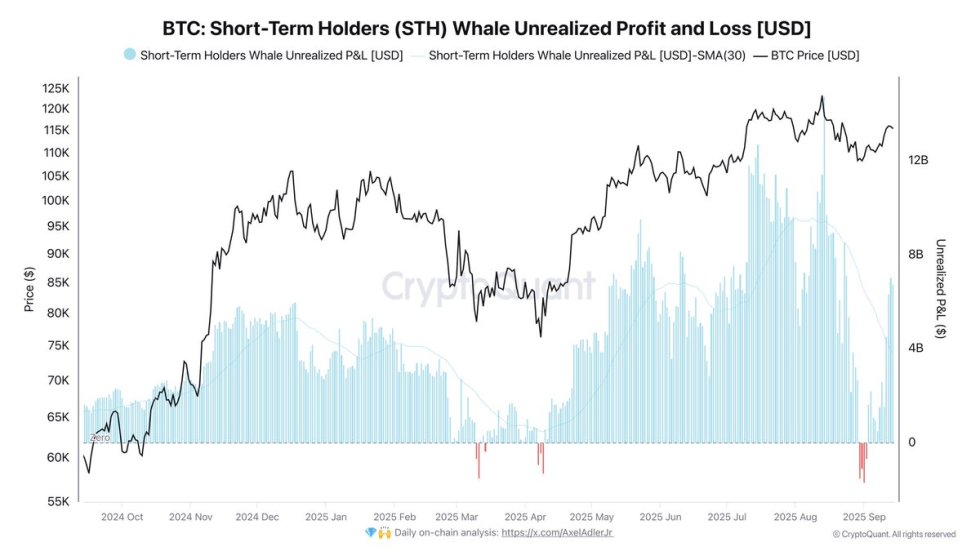

Leading analyst Darkfost emphasized a significant on-chain occurrence that enriches the understanding of the ongoing consolidation. Based on his findings, Short-Term Holder (STH) whales, who experienced pressure during the slight pullback in early September, have now returned to unrealized gains. That pullback briefly forced STH whales into loss territory, challenging their confidence. However, historical data reveals that comparable declines have been fleeting and strongly defended, frequently clearing the path for Bitcoin to continue its ascent.

The intersection of macroeconomic decisions and enhancing onchain health prepares the ground for a decisive week. With the $115K interval serving as a pivot, the Fed’s declaration could act as the spark that decides Bitcoin’s breakout trajectory.

Short-Term Holders Safeguard Crucial Levels

According to Darkfost, the slight pullback at the beginning of September exerted substantial pressure on Short-Term Holders (STH) as it directly confronted their unrealized profit region. This vital zone, oscillating around $108,000–$109,000, has become a key battleground for bulls and bears. At present, STH whales continue to successfully defend this area, preventing losses from escalating and ensuring stability in the broader market structure.

Past instances support this fortitude. Prior corrections of similar characteristics, which momentarily forced STH whales into unrealized losses, have been short and well-defended. In each instance, Bitcoin stabilized and subsequently resumed its bullish trajectory shortly thereafter. This pattern indicates that the ongoing defense could again serve as a launching pad, bolstering confidence among traders who regard the $108K–$109K area as a structural line of defense.

Nonetheless, the larger context cannot be overlooked. This week is positioning itself to be crucial for Bitcoin and risk assets, with the Federal Reserve poised to unveil its interest rate decision tomorrow. While technical and on-chain indicators imply underlying strength, macroeconomic influences could introduce rapid volatility. Darkfost observes that tomorrow’s decision will offer much-needed clarity, potentially establishing the groundwork for whether Bitcoin extends its rally or enters a deeper consolidation stage.

Bitcoin Stabilizes Around Significant Level

Bitcoin (BTC) is maintaining its position near $115,482, exhibiting resilience as the market prepares for tomorrow’s Federal Reserve decision. On the daily chart, BTC is consolidating near a pivotal level after rebounding from its early-September lows. The price hovers just above the 50-day moving average ($114,355), which now serves as immediate support, while the 100-day average ($112,782) provides an extra safety cushion. The 200-day average at $102,810 remains significantly lower, reinforcing the broader bullish framework despite short-term ambiguity.

Resistance lies in the $116,000–$117,000 region, where BTC has encountered multiple rejections in the past weeks. A breakthrough above this threshold would likely facilitate a retest of the $123,217 resistance, a barrier that capped the last significant rally. Conversely, failing to uphold the 50-day moving average might lead to a decline toward $113,000 or even $112,000.

BTC is consolidating within a narrowing range, awaiting macroeconomic insights. If the Fed announces the expected rate cut without jolting the market, Bitcoin could build momentum for another upward movement. Until then, sideways movements and heightened volatility remain the anticipated scenario.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is focused on delivering thoroughly analyzed, precise, and impartial content. We adhere to rigorous sourcing standards, and every page undergoes rigorous evaluation by our team of esteemed technology authorities and experienced editors. This approach guarantees the integrity, relevance, and value of our content for our audience.

Source link

“`