“`html

Norway’s sovereign wealth fund, overseen by Norges Bank Investment Management (NBIM), has augmented its indirect ownership of Bitcoin to 7,161 BTC, estimated at roughly $862.8 million as of June 30, based on recent analysis from K33.

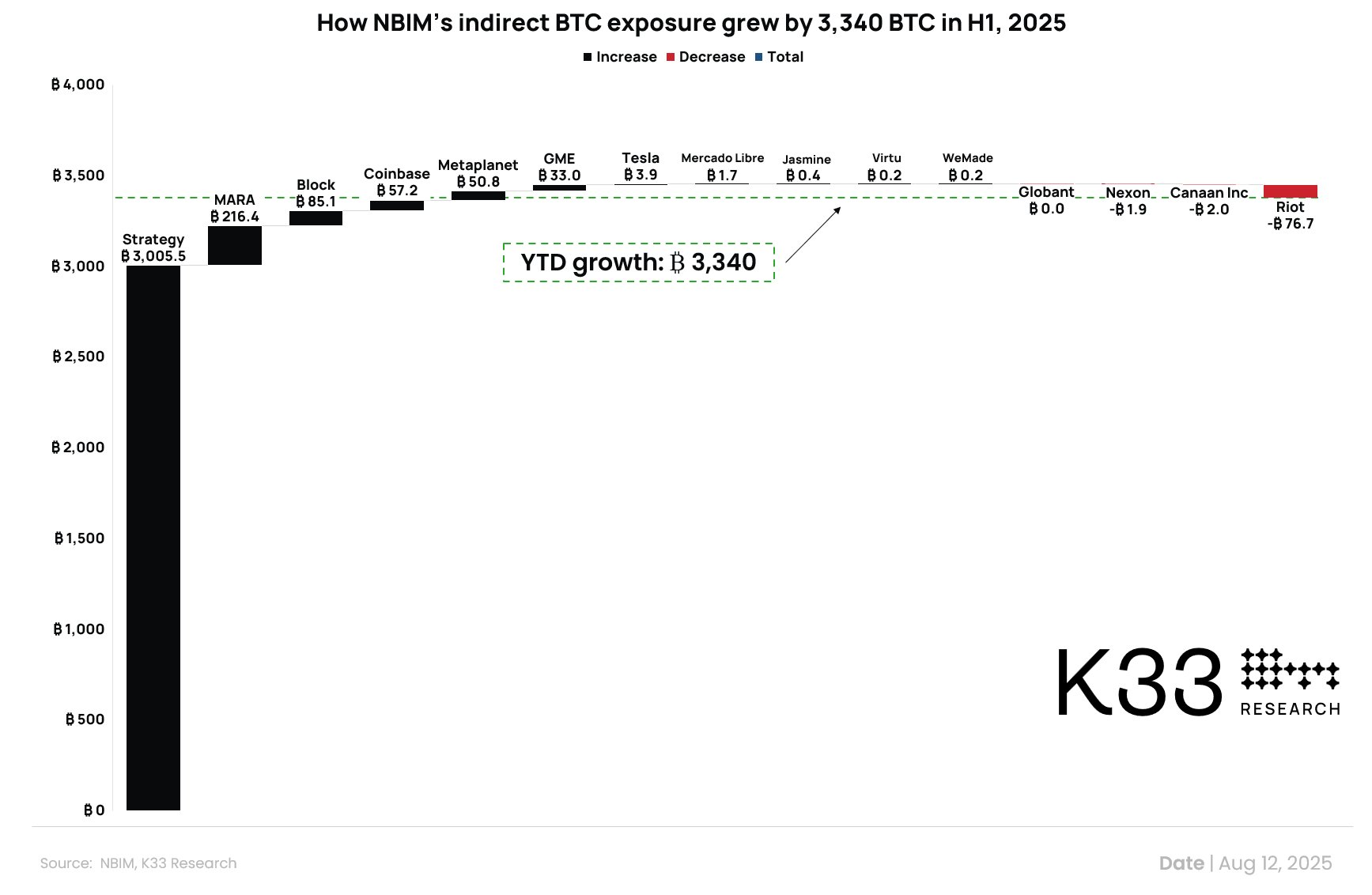

This signifies an 87.7% increase in the previous six months and a 192.7% rise over the last year. The profits are largely attributed to the fund’s stakes in firms possessing considerable Bitcoin reserves, including Strategy, Block, Coinbase, Marathon Digital Holdings (MARA), and Metaplanet.

K33 Head of Research Vetle Lunde elucidated that the estimation is derived from NBIM’s equity in these enterprises, multiplied by the volume of Bitcoin they possess.

While Lunde remarked that the exposure is likely a result of NBIM’s extensive, varied investment approach rather than a focused speculation on Bitcoin, he underscored it as a clear manifestation of how BTC is integrating into traditional financial portfolios, often by default.

Growth Fueled by Strategy Holdings and Corporate BTC Accumulation

The primary source of NBIM’s elevated Bitcoin exposure is its holding in business intelligence and corporate BTC treasury firm Strategy.

NBIM’s stake in the enterprise escalated to 1.05% of its shares, valued at $1.18 billion at the close of June, rising from 0.72% ($514 million) at the conclusion of 2024. Strategy itself expanded its BTC holdings by 145,945 BTC in the initial half of 2025, which contributed 3,340 BTC to NBIM’s indirect exposure during the same timeframe.

Further exposure was derived from stakes in other publicly traded companies with substantial Bitcoin reserves. Enterprises such as Block, Coinbase, MARA, and Metaplanet have either increased or maintained significant BTC balances, further aiding the upward trend.

Lunde noted that per capita, NBIM’s Bitcoin exposure now equals approximately 1,387 Norwegian kroner, or about $138, for each citizen of Norway.

Wider Market Context and Currency Factors

Lunde highlighted that this expanding indirect exposure corresponds with a broader market trend: any investor today with a diversified equity portfolio is likely to possess some exposure to Bitcoin through corporate investments.

He anticipates this trend will strengthen as more firms allocate BTC as part of their treasury strategies. “It is very likely that any index investor or broadly diversified investor currently holds a modest BTC exposure through proxies,” Lunde stated, adding that this phenomenon is likely to accelerate over time.

The report also situated the fund’s Bitcoin exposure within the context of BTC’s recent market performance. In US dollar terms, BTC reached an all-time peak of over $123,000 in July, up 11.9% from its January 20 value.

Nonetheless, gains are less prominent in other currencies, with BTC up only 1.5% against the US dollar index and still lagging behind January highs in euros. According to Lunde, €105,600 represents a significant resistance level for BTC in euro terms, underscoring the impact of currency variations in evaluating Bitcoin’s price dynamics worldwide.

NBIM’s increasing indirect stake in Bitcoin illustrates how exposure to this asset class can broaden naturally within large, varied portfolios. Whether fueled by intentional allocation or as a byproduct of equity investments, this trend mirrors Bitcoin’s deepening role in global financial markets.

Featured image generated with DALL-E, Chart from TradingView

Editorial Process for bitcoinist is focused on delivering rigorously researched, precise, and impartial content. We adhere to stringent sourcing criteria, and each page undergoes careful review by our team of leading technology specialists and seasoned editors. This approach guarantees the integrity, relevance, and quality of our material for our audience.

Source link

“`