“`html

By Aubrey Rose A. Inosante, Reporter

THE PHILIPPINE ECONOMY grew at a marginally quicker rate in the second quarter, propelled by robust agricultural output and an increase in consumption, the statistics agency reported on Thursday.

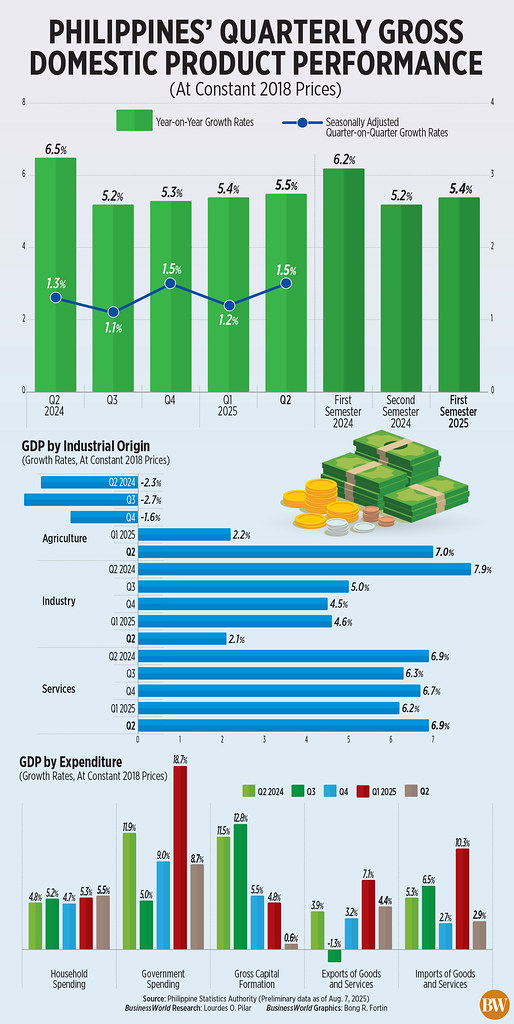

Preliminary figures published by the Philippine Statistics Authority (PSA) indicated that the Philippine gross domestic product (GDP) increased by an annual 5.5% in the April-to-June timeframe, up from 5.4% in the initial quarter.

This also aligned with the 5.5% median expectation in a BusinessWorld survey, and the lower threshold of the government’s 5.5% to 6.5% growth objective for this year.

Nevertheless, this performance was slower than the 6.5% growth observed in the second quarter of 2024.

On a seasonally adjusted quarter-on-quarter basis, the nation’s GDP ascended by 1.5%, an improvement from 1.3% a year prior.

“The Philippine economy demonstrates resilience and stability, even amidst persistent global challenges that introduce uncertainty on multiple fronts,” Department of Economy, Planning, and Development (DEPDev) Secretary Arsenio M. Balisacan remarked during a briefing on Thursday.

“With this performance, we maintain our standing among the fastest-expanding economies in emerging Asia,” he added, noting that the Philippines trails only Vietnam (8%) and is ahead of China (5.2%) and Indonesia (5.1%).

While the Philippines may lag behind India’s anticipated 6.5% growth, Mr. Balisacan mentioned it is still projected to surpass Malaysia’s forecasted 4.3% GDP increase and Thailand’s 2.4%.

For the first half, GDP growth averaged 5.4%, slower than the 6.2% from the previous year.

Mr. Balisacan stated that GDP must rise by 5.6% for the remainder of the year to meet the lower end of the yearly target.

“I believe we can perform better in the second half. (I am) confident that inflation has significantly decreased and the recent cuts in policy rates are starting to have an effect,” he indicated.

Inflation decelerated to a near six-year low of 0.9% in July as utility and food costs continued to decline. For the first seven months of the year, inflation averaged 1.7%, slightly higher than the central bank’s 1.6% prediction for 2025.

The Bangko Sentral ng Pilipinas (BSP) has lowered benchmark interest rates by a total of 125 basis points since it began its easing cycle in August of the previous year.

To achieve the upper end of the target, the DEPDev chief asserted the economy must expand by 7.5% in the July-to-December timeframe.

“Naturally, 7.5% is ambitious, but it’s not unattainable. I believe that if we see ongoing improvement in consumer and domestic investor confidence, (we can expect) increased growth in consumption, investment, and services,” he noted.

PSA data revealed that household final consumption, which represents over 70% of the economy, surged by 5.5% in the April-to-June period. This was quicker than the 4.8% in the second quarter of 2024 but slower than 5.3% in the first quarter. It marked the fastest growth since the 8.1% increase in the first quarter of 2023.

“Our strategic, ongoing, and coordinated initiatives to manage inflation and protect purchasing power are producing results. Significantly, rice prices, a significant concern for households, have been consistently declining in recent months,” Mr. Balisacan remarked.

The election-related prohibition on public works impacted government final consumption spending, which rose by 8.7% in the second quarter compared to 18.7% in the first quarter and 11.9% a year prior.

National Statistician Claire Dennis S. Mapa attributed this slowdown to public construction, which shrank by 8% in the second quarter.

The 45-day election ban on public works commenced on March 28 and concluded with the May 12 elections.

“We anticipate maintaining that momentum in public spending. In the second half of the year, improvements in construction and public project expenditures should be evident as this is where we experienced a slight deceleration, but that was anticipated due to the election ban,” Mr. Balisacan stated.

TARIFF UNCERTAINTY

Uncertainty surrounding US tariffs has begun to impact the Philippine economy, as growth in exports, industry, and investment declined in the second quarter.

Total export growth climbed by 4.4% in the April-to-June interval, improving from 3.9% a year prior but slowing from the 7.1% growth witnessed in the first quarter.

Merchandise exports also increased by 13.6% in the second quarter, spurred by semiconductors, as US companies began front-loading before the higher tariffs came into effect.

The US imposed a 19% tariff on Philippine goods, effective August 7.

“I expect the domestic economy to stabilize somewhat with all this tariff uncertainty, although it remains present, but I believe that this should be the conclusion of that series of announcements. We hope there will be no further disturbances in expectations regarding trade uncertainty,” Mr. Balisacan commented.

Meanwhile, service exports contracted by 4.2% in the second quarter, reversing the 6.3% growth in the preceding quarter and 7.6% a year ago.

“It’s likely reflecting the overall condition of the global economy. Recently, we observed deceleration and uncertainty in the trade sector, including trade and services,” Mr. Balisacan stated.

Conversely, imports of goods and services slowed to 2.9% in the second quarter, down from 5.3% in the same period last year and 10.3% in the first quarter.

Gross capital formation, the investment segment of the economy, increased by 0.6% in the second quarter, a deceleration from the 11.5% growth seen a year prior and 4.8% growth during the first quarter.

“I anticipate a revival of investment in the second quarter. The prohibition on the election is over, so we should proceed, which should be a positive aspect. The domestic investment environment is improving, as indicated by the ongoing decline in interest rates,” Mr. Balisacan remarked.

AGRICULTURE

On the supply front, agricultural output grew by 7% in the second quarter, the fastest rate in nearly 14 years, since the 8.3% recorded in the second quarter of 2011.

Mr. Balisacan attributed the strong recovery in farm production to palay and corn, which increased by 14.2% and 29.8%, respectively.

The services sector, which contributed the most among major industries, expanded by 6.92% in the second quarter, quicker than 6.87% observed the previous year.

The industrial sector grew by 2.1% in the second quarter, slowing from 7.9% a year ago and 4.6% in the first quarter.

“Industry growth eased to 2.1%, influenced by declines in production for coke and refined petroleum products (-12.2%), chemical products (-6.6%), and computer and electronics (-2.5%),” Mr. Balisacan stated.

Food manufacturing advanced by 9.3%, marginally below the 10.8% in the preceding quarter.

The PSA indicated that key contributors to the second-quarter growth included wholesale and retail trade, the repair of motor vehicles and motorcycles (5.8%), and compulsory social security (12.8%)…

“““html

and financial and insurance endeavors (5.6%).

Gross national income registered an annual 8.2% increase in the second quarter, marginally less than the 8.1% growth observed a year prior.

Net primary income surged by 38.8% in the second quarter, surpassing the 25.8% during the same timeframe in 2024.

GROWTH PROSPECTS

Capital Economics Senior Asia Economist Gareth Leather stated in a commentary that they anticipate “steady” growth for the remainder of the year as domestic expenditure will be buoyed by declining inflation and diminished interest rates. They project Philippine GDP growth to average 5.5% for the entire year, aligning with the lower range of the government’s target.

However, the “fragile” external scenario presents threats to the forecast, Mr. Leather noted.

“Trump tariffs and weakened global demand indicate export growth is likely to decelerate further in the upcoming months.”

ANZ Research remarked that external challenges would similarly impact private investment.

“Private investment continues to be hindered by low productivity growth and decelerating global progress… Given the lackluster outlook for external demand, private investment is poised to remain stagnant in the short term. Nonetheless, the robust increase in capital goods imports in June suggests a rise in government capital expenditure, which may help partially counterbalance the frailty in private gross fixed capital formation,” it articulated in a report.

Although inflation has subsided, private consumption will persistently be hindered by subdued wages, ANZ Research added. “Overall, we project growth to taper to 5.1% in 2025.”

“We anticipate private investment spending will be more restrained, as companies turn more cautious due to increasing global trade policy uncertainties and an increasingly difficult operating environment. Similarly, we foresee goods export growth decelerating because of the effect of US tariffs, but recognize rising downside threats particularly stemming from sector-specific tariffs on semiconductors in the forthcoming quarters,” Nomura Global Markets Research commented in a distinct note.

It predicts the economy will expand by 5.3% for the full year. “Our forecast suggests GDP growth will decrease to 5.2% year on year in the second half from 5.4% in the first half, even as we foresee a rebound in public investment expenditures.”

Jonathan L. Ravelas, senior advisor at Reyes Tacandong & Co., mentioned that global trade uncertainty and supply chain risks represent a “red flag” for enduring growth.

“We’re on the right path, but not cruising,” Mr. Ravelas stated. “Stakeholders should intensify efforts towards consumer confidence, unlock private investments, and capitalize on [the agriculture sector’s] momentum.”

“The second half is crucial — it’s time to advance, not hesitate.”

Source link

“`