“`html

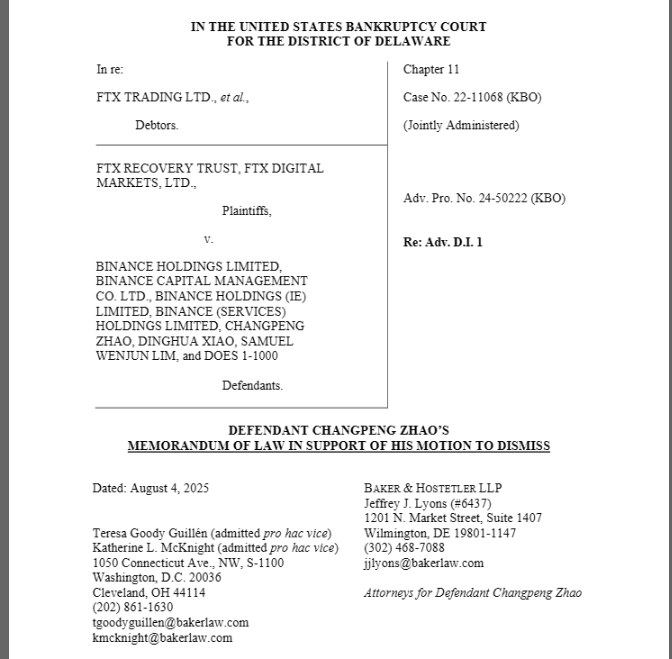

Former Binance chief Changpeng “CZ” Zhao has taken steps to dismiss a $1.76 billion clawback demand from the currently-bankrupt FTX trust. This is a daring initial maneuver. According to reports, he contends that the matter should never have been brought before a Delaware court.

Dispute Over Delaware Authority

As per a news article, Zhao asserts he resides in the United Arab Emirates and does not possess any substantial connections to Delaware. He highlights that the complaint fails to demonstrate that he is “at home” there.

His legal representatives argue that the US Bankruptcy Court for the District of Delaware does not hold authority to adjudicate this dispute. Should the judge concur, FTX may require a different location to refile.

Such jurisdictional regulations are crucial when pursuing a colossal sum like $1.76 billion. FTX claims the funds originated from a share acquisition agreement in 2021.

Binance obtained those shares right as FTX was nearing insolvency. Zhao’s team describes this assertion as flimsy. They argue it lies outside US jurisdiction because the transaction and actions mainly occurred internationally.

Zhao's request to dismiss in the US Bankruptcy Court for the District of Delaware.

Dispute Over Fraud Allegations

According to the request submitted on Monday, Zhao’s side also questions if US fraud statutes can extend beyond the borders of America.

He argues that the applicable regulations do not pertain to someone residing in the UAE. Reports have revealed that he contested what attorneys refer to as “constructive fraud” allegations.

These allegations depend on federal definitions related to securities agreements, according to Zhao’s submission.

FTX initially filed suit against Binance and Zhao back in November 2024. At that moment, a spokesperson for Binance condemned the endeavor as “frivolous.”

They claimed that the trust was attempting to shift responsibility for FTX’s downfall onto Binance and its leader.

Binance had already submitted a comparable request to dismiss in May. That previous document noted that FTX had attributed its issues to “widespread misconduct” by Sam Bankman-Fried.

Evaluating The Earlier Requests

This May request raised many of the same issues that are now at the forefront. It underscored that FTX’s legal team pointed to emails and wire transfers processed through US banks.

Binance countered that such connections are insufficient. They asserted that mere financial communications do not constitute a business “presence” in Delaware.

Sam Bankman-Fried is currently serving a 25-year prison term for fraud and conspiracy. Regardless of the outcome, this battle over jurisdiction and venue will establish the groundwork for a prolonged legal conflict regarding who is responsible for FTX’s losses.

Zhao himself spent four months in custody after admitting guilt regarding US anti-money laundering charges.

The Resistance

In the meantime, attorneys representing the FTX trust are anticipated to resist. They will emphasize that billions of dollars transacted through US accounts. They will argue that those wires and communications affirm jurisdiction under established rules.

The court’s ruling on this procedural matter could take several months.

Featured image from Horacio Villalobos Corbis/Getty Images, chart from TradingView

Editorial Approach for bitcoinist focuses on providing meticulously researched, precise, and impartial content. We adhere to rigorous sourcing guidelines, and each page undergoes careful evaluation by our team of leading technology specialists and experienced editors. This method guarantees the authenticity, relevance, and significance of our material for our audience.

Source link

“`