By Luisa Maria Jacinta C. Jocson, Senior Correspondent

HEADLINE INFLATION probably decreased to a near six-year low in July due to softer costs of food and fuel, analysts noted.

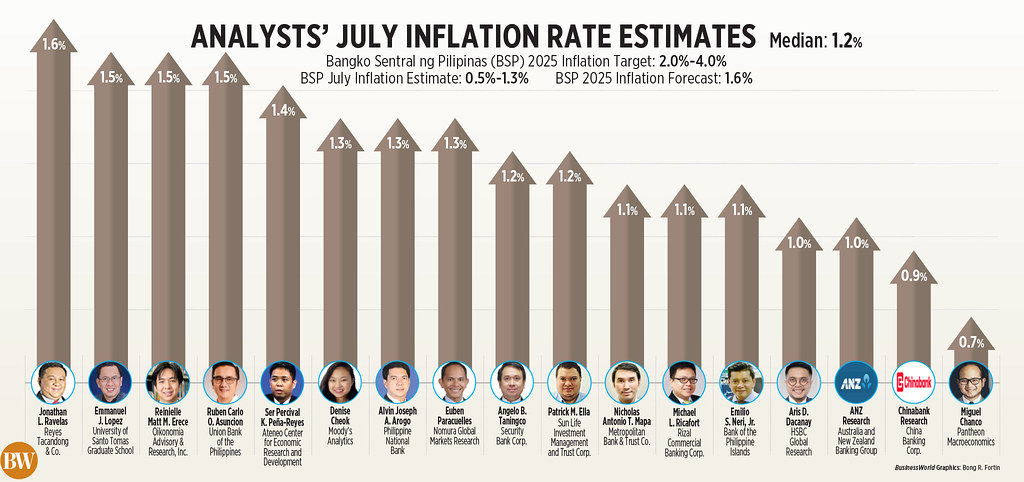

A BusinessWorld survey of 17 analysts produced a median prediction of 1.2% for the July consumer price index, within the central bank’s 0.5%-to-1.3% projection for the month.

The July figure would be slower than the 1.4% in June and 4.4% rate a year earlier.

If confirmed, this would be the slowest inflation in nearly six years or since the 0.6% figure recorded in October 2019.

The Philippine Statistics Authority is set to unveil the July inflation statistics on Tuesday (Aug. 5).

“For July inflation, my prediction is 1.2% and the factors remain soft food prices and restrained nonfood prices, particularly in energy despite some recent pump price changes,” Sun Life Investment Management and Trust Corp. economist Patrick M. Ella stated.

In July, pump price adjustments reflected a net drop of P1.10 per liter for gasoline and P1.10 per liter for kerosene. Conversely, there was a net increase of P1.20 for diesel.

Pantheon Macroeconomics Chief Emerging Asia Economist Miguel Chanco stated that the headline rate might have decelerated in July “owing to what should be a decline in food inflation into negative territory, outright.”

“Food and energy prices are likely to remain subdued, although the effect of lower rice tariffs, which were implemented in late June 2024, will diminish in annual comparisons,” Moody’s Analytics economist Denise Cheok noted.

Nicholas Antonio T. Mapa, chief economist at Metropolitan Bank & Trust Co., mentioned July is likely to mark the fifth consecutive month of below-target inflation this year as rice deflation continues.

Rice inflation has been declining over recent months as the government has implemented numerous strategies to control prices of the staple grain. These include reducing tariffs on rice imports, declaring a food security emergency on the commodity, and lowering the maximum suggested retail price (MSRP) for imported rice.

In June, rice inflation slowed for the sixth consecutive month to a record 14.3%, the largest decline since 1995.

“Furthermore, the high base effect (given that inflation peaked at 4.4% in July 2024) is anticipated to help maintain the year-on-year figure subdued despite the monthly increase,” Bank of the Philippine Islands Lead Economist Emilio S. Neri, Jr. added.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort also highlighted the one-year anniversary of the tariff reduction on rice imports, which were cut to 15% from 35% in July 2024.

“Base effects likely contributed significantly but retail prices, too, remained manageable month on month,” HSBC economist for ASEAN Aris D. Dacanay mentioned.

“Softer costs of rice, fruits, and LPG may have also aided in the deceleration, although these may have been offset by higher expenses for fuel, electricity, and other key food commodities such as vegetables, meat, fish, eggs, and cooking oil,” Chinabank Research remarked.

Analysts also emphasized the upside risks to the inflation figure for the month.

“The increase was primarily fueled by rising oil prices, electricity rates, and select food items such as vegetables, fish, and meat,” Mr. Neri stated.

Manila Electric Co. (Meralco) raised rates by P0.4883 per kilowatt-hour (kWh) in July, bringing the overall rate for an average household to P12.6435 per kWh from P12.1552 per kWh a month earlier.

“Upward price pressures were observed in electricity rates and diesel, but we don’t believe these were sufficient to counter the deflationary pressures from rice and gas,” Mr. Dacanay remarked.

BAD WEATHER

Meanwhile, several analysts anticipate July inflation to quicken from the previous month as adverse weather hampered economic activity in crucial regions.

“The rise is attributed to delayed effects of food and transport expenses, weather-induced supply interruptions from early monsoon and typhoon activity, and seasonal demand associated with school openings and midyear bonuses,” Ruben Carlo O. Asuncion, chief economist at Union Bank of the Philippines, stated.

The most recent data from the Department of Agriculture indicated damages to the agricultural sector from three consecutive tropical storms and the southwest monsoon have escalated to P3 billion.

“The recent spate of typhoons and bad weather may have impacted domestic supply chains especially for food, potentially leading to price surges,” Oikonomia Advisory & Research, Inc. economist Reinielle Matt M. Erece added.

Mr. Asuncion also pointed out that exchange rate fluctuations influenced import prices.

The peso depreciated to P58.32 against the dollar at the end of July from its finish of P56.33 at the end of June. The peso’s close at the end of July represented its weakest in nearly six months or since its P58.34 close on Feb. 4.

FURTHER EASING?

With inflation still beneath the 2-4% target, analysts indicated that the Bangko Sentral ng Pilipinas (BSP) has ample room to persist in its rate-cutting cycle.

“Inflation remains below target and is projected to stay within target over the policy horizon, providing BSP ample latitude to reduce rates and support moderating growth momentum,” Mr. Mapa mentioned.

Chinabank Research expects the central bank to implement another 25-bp cut at its meeting later this month.

“With inflation potentially dropping to its lowest since October 2019 — and average inflation expected to remain under target this year — we believe the BSP has the capacity to continue easing monetary policy with a 25-bp rate cut at its August meeting,” it stated.

The Monetary Board’s next assembly occurs on Aug. 28.

“We’re currently anticipating a 25-bp rate cut from the BSP this month, as the opportunity for easing could possibly shrink starting in the fourth quarter, with headline inflation projected to rebound toward the 3% level, and potentially even higher in 2026,” Mr. Neri remarked.

BSP Governor Eli M. Remolona, Jr. stated that a rate cut remains a possibility at their policy review later this month.

“The BSP might proceed with its policy easing with another 25-bp cut in their subsequent meeting. This is as inflation continues to be below the 2% target and gross domestic product (GDP) growth is still expected to be below the desirable 6% growth or above,” Mr. Erece stated.

Chinabank noted that a weaker-than-anticipated second-quarter GDP figure could further solidify the rationale for a cut.

Meanwhile, Security Bank Corp. Vice-President and Research Division Head Angelo B. Taningco mentioned that there exists a possibility that the BSP could maintain rates this month.

“We still foresee further monetary easing but may not be immediate for this month of August as the recent and anticipated peso depreciation could influence it,” he remarked.

The central bank could also adopt a cautious stance going forward, analysts remarked.

“Subsequent actions following a potential August cut are expected to be more measured, with our in-house perspective anticipating further reductions in the fourth quarter as less likely,” Mr. Neri noted.

He pointed out inflation risks, a prolonged hawkish stance from the Federal Reserve, and significant current account deficits, which could limit the BSP’s flexibility in adjusting monetary policy.

“A pause in the fourth quarter may be warranted to assist in managing pressure on the local currency,” Mr. Neri added.

Mr. Ella noted that a rate cut in the fourth quarter is feasible “if growth will surprise on the downside due to trailing impact of global tariffs.”

“The BSP will be diligently monitoring potential inflationary pressures arising from geopolitical tensions and tariff-related supply chain disruptions,” Ms. Cheok remarked.

Mr. Chanco anticipates the Monetary Board to execute at least two cuts before the year concludes.

Mr. Remolona earlier asserted he is sticking to his prediction of two more rate cuts this year. Following August, the Monetary Board has two remaining meetings slated for October and December.

“Moving ahead, inflation will likely begin its gradual rise as the favorable base effects from lower rice prices dissipate,” Mr. Dacanay said.

“Nonetheless, with inflation remaining within the lower-end range of the BSP target band, there is room for the BSP to sustain its easing cycle and potentially deepen the cycle further in the remaining five months of the year.”