“`html

THE NATIONAL Government’s (NG) total liabilities reached a new peak of P16.92 trillion at the conclusion of May as fresh domestic debt issuances were somewhat countered by the appreciating peso, the Bureau of the Treasury (BTr) reported on Thursday.

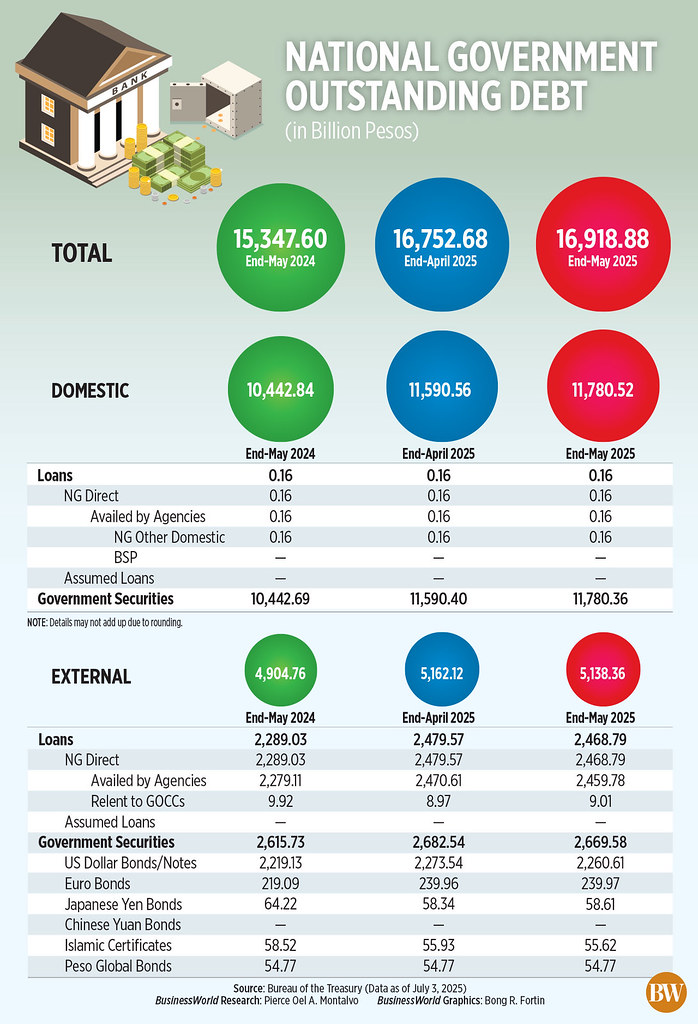

The most recent figures from the BTr indicated that the total debt rose by 0.99% or P166.2 billion to P16.92 trillion from P16.75 trillion at the end of April.

On a year-over-year basis, total liabilities surged by 10.24% from P15.35 trillion as of the end of May 2024.

The BTr noted that the “slight increase” in total obligations is largely attributed to the net issuances of fresh domestic securities, “which reflect ongoing investor faith in the Philippine economy.”

“This was partially balanced by the valuation impacts of a stronger peso, contributing to the reduction in the value of external liabilities,” it elaborated.

The BTr data adopted a foreign exchange rate of P55.615 per dollar at the end of May, strengthening from P55.933 per dollar at the end of April and P58.524 at the end of May 2024.

In May, the majority, or 69.6%, of the debt portfolio was obtained from domestic sources, while external obligations comprised the remainder.

“This illustrates the government’s strong preference for domestically sourced financing, which aids in mitigating foreign exchange risks and bolstering the local capital market,” the BTr stated.

Domestic liabilities, primarily consisting of government securities, increased by 1.64% to P11.78 trillion as of the end of May, up from P11.59 trillion at the end of April.

“This growth was primarily due to net issuances amounting to P190.87 billion, although it was slightly moderated by the P0.91 billion downward valuation effect of a stronger peso against the US dollar,” it explained.

Year over year, domestic borrowings rose by 12.81% from P10.44 trillion at the end of May 2024.

Conversely, external debt fell by 0.46% to P5.14 trillion at the end of May from P5.16 trillion in the previous month.

The decline was due to P3.55 billion in net repayments and the strengthening of the peso, which reduced the peso value of foreign liabilities by P29.35 billion.

“These were partially countered by a P9.14 billion revaluation resulting from fluctuations in other currencies against the US dollar,” the BTr noted.

On an annual basis, foreign liabilities increased by 4.6% from P4.9 trillion at the end of May 2024.

External debt instruments comprised P2.26 trillion in US dollar bonds, P239.97 billion in euro bonds, P58.61 billion in Japanese yen bonds, P55.62 billion in Islamic certificates, and P54.77 billion in peso global bonds.

Meanwhile, NG-guaranteed liabilities edged up by 1.79% to P343.58 billion as of the end of May from the end-April figure of P337.54 billion.

The BTr attributed the rise to the P6.53 billion net availments of domestic guarantees and the P0.53 billion third-currency revaluation.

“These were partially offset by the P0.51 billion net repayment of external guarantees and an additional P0.51 billion decrease from the stronger peso,” it added.

On a year-over-year basis, guaranteed debt decreased by 0.89% from P350.2 billion.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort expressed expectations that debt levels will reach new highs in the forthcoming months.

“In the upcoming months, the outstanding National Government debt could achieve unprecedented highs amid new borrowings by the National Government early in the year and the necessity to hedge both domestic and foreign borrowings in light of the Trump factor,” he remarked.

The Treasury indicated that the debt “remains manageable,” stressing the government’s dedication to a prudent debt management strategy.

Outstanding debt as a percentage of gross domestic product stood at 62% at the conclusion of the first quarter.

The NG’s outstanding liabilities are anticipated to reach P17.35 trillion by the end of 2025. — Aubrey Rose A. Inosante

Source link

“`