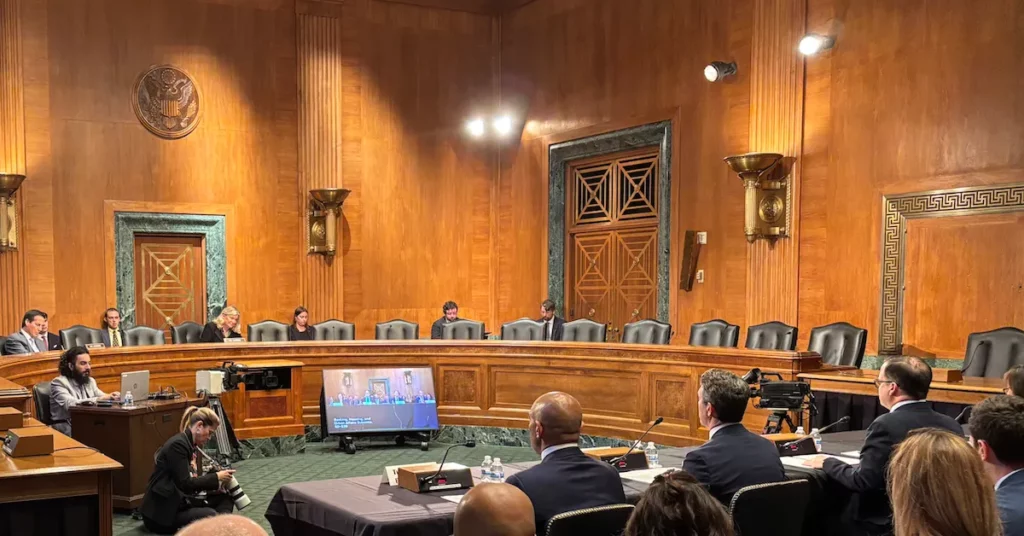

Today, the U.S. Senate Banking Subcommittee on Digital Assets conducted a hearing titled “Exploring Bipartisan Legislative Framework for Digital Assets Market Structure” during which panelists urged Congress to expedite the approval of digital asset legislation.

(Spoiler alert: The term “Bitcoin” didn’t surface at all during the hearing. Nevertheless, Bitcoin would still fall under some of the crypto regulations discussed. Therefore, it’s vital for Bitcoin supporters to grasp the information conveyed.)

The hearing occurred following Senators Cynthia Lummis (R-WY), Thom Tillis (R-NC), Bill Hagerty (R-TN), and Senate Banking Chairman Tim Scott (R-SC) releasing principles for digital asset market structure earlier today. (For the complete list of principles, see here.)

Senator Lummis moderated the session, beginning with some commentary on the previously mentioned principles, while humorously stating that now that the Senate has voted on the GENIUS Act, the U.S. is taking steps to enter the 21st century financially.

Joined by Senators Bill Hagerty (R-TN), Bernie Moreno (R-OH), Angela Alsobrooks (D-MD), and Dave McCormack (R-PA), the panel of witnesses included:

- Sarah Hammer, Executive Director at the University of Pennsylvania Wharton School

- Greg Xethalis, General Counsel at Multicoin Capital and Board Member of the Blockchain Association and the DeFi Education Fund

- Ryan VanGrack, Vice President of Legal at Coinbase

- The Honorable Rostin Behnam, Distinguished Fellow at the Psaros Center for Financial Markets & Policy, Georgetown University, and Former Chairman of the U.S. Commodity Futures Trading Commission (CFTC).

Addressing Illicit Activities in the Crypto Sector

During the initial question round from Senator Lummis, both Behnam and Hammer highlighted the necessity of addressing illicit activities involving digital assets through clear anti-money laundering and anti-terrorist financing regulations, although they did not elaborate on what these might entail.

When Senator Lummis inquired of Hammer which nation the U.S. should observe regarding anti-terrorist financing regulations for crypto, Hammer mentioned Singapore.

Before transitioning from the topic of combating illicit crypto activities, Behnam asserted that the longer Congress delays in passing comprehensive market structure legislation, the greater the opportunity for unscrupulous actors to flourish.

“Malicious actors will find refuge in unregulated areas,” remarked Behnam.

Safeguarding Consumers in the Crypto Space

Senator Hagerty, the primary proponent of the GENIUS Act, which recently passed in the Senate, commended the bipartisan cooperation in the legislative process regarding digital assets, implying that he wishes to see his colleagues maintain this momentum.

Discussing bipartisanship, the sole Democratic senator in attendance at the hearing, Senator Alsobrooks, appeared hopeful about the prospects of crypto but also wary about establishing proper protections for investors.

She questioned Behnam on which aspects of consumer protection were essential for crypto investors.

Behnam identified “bankruptcy protection” as the most critical component of consumer protection.

“Client assets must be entirely segregated so that there’s no ambiguity in the event of bankruptcy regarding the return of assets to clients,” stated Behnam.

Consequences of Inaction on Crypto Legislation in the U.S.

Toward the conclusion of the hearing, Senator Moreno asked the panelists how much time remains for the U.S. to implement crypto regulations and what the consequences of failing to act might be.

Xethalis answered that “we need to move promptly,” before outlining what he considered to be the two most significant potential costs of U.S. inaction.

He asserted that the first cost is that other jurisdictions might introduce stricter regulations for crypto, which could create friction if adopted internationally. He referenced Europe’s implementation of stringent rules for internet commerce decades ago as a relevant precedent.

Xethalis then emphasized that the second cost is economic. He expressed concern that the United States is lagging behind in both 5G development and silicon chip manufacturing, highlighting his desire to avoid a similar fate with crypto.

An Appeal for Bipartisan Collaboration

Senator Lummis concluded the hearing by urging her fellow senators and the panelists to engage in bipartisan dialogue and collaborate across party lines, as she has done with Senator Gillibrand.

She expressed that some Democrats seem hesitant to participate in the legislative process surrounding crypto due to President Trump’s family involvement in the industry, asserting that the significance of crypto transcends the president’s family ties and that Democrats should recognize this.