Statistics indicate that Bitcoin sentiment on social platforms might be starting to reach a boiling point, suggesting a potential risk to the price surge.

Bitcoin Social Media Sentiment Is Currently Remarkably Positive

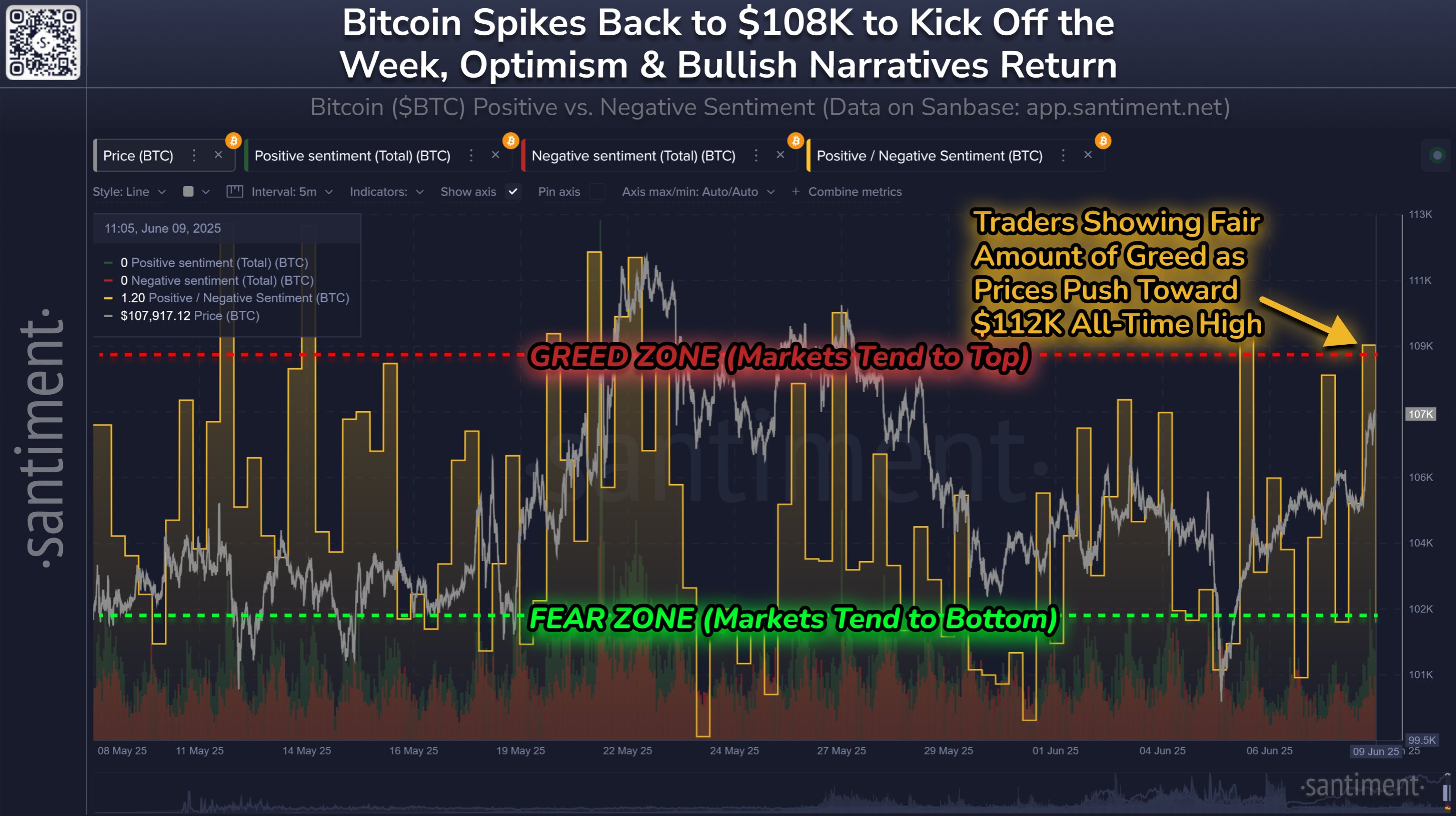

In a recent update on X, the analytics firm Santiment analyzed how feelings regarding Bitcoin have evolved on major social media networks following the recent recovery rally.

The significant measure here is the “Positive/Negative Sentiment,” which contrast the levels of affirmative sentiment with negative sentiment concerning a specific cryptocurrency on social media.

The metric operates by filtering posts/messages/threads that mention the asset and processing them through a machine-learning model that distinguishes between positive and negative remarks. The indicator tallies both categories of posts and calculates their ratio to deliver a net overview of social media sentiment.

Now, here is the chart shared by Santiment that illustrates the trend in the Positive/Negative Sentiment for Bitcoin over the past month:

The value of the metric seems to have surged in recent days | Source: Santiment on X

As shown in the graph above, the Bitcoin Positive/Negative Sentiment has witnessed a spike beyond the 1.0 line, indicating a surge of positive remarks regarding the asset on social media platforms. This shift towards a significant favorable sentiment coincides with a price recovery of the cryptocurrency.

This isn’t an exceptionally uncommon trend, as enthusiasm generally increases among traders during bullish price movements. In light of the latest surge, particularly, a rise in sentiment isn’t unexpected, given it has nearly pushed the price to the all-time high (ATH).

While some buzz is predictable, an overabundance can pose cautionary signs. The rationale for this is that Bitcoin and other cryptocurrencies have a historical tendency to move opposite to the prevailing public sentiment.

This implies that a wave of greed in the market can signal a peak for the asset’s value. Conversely, a decline in sentiment could indicate a bullish reversal.

From the chart, it’s evident that the Positive/Negative Sentiment dropped to a comparatively low level a few days ago when Bitcoin experienced a dip towards $100,000. This anxiety among social media users may have aided the coin in reaching a floor.

Following the recent surge in the indicator, the dynamics have shifted, with Fear Of Missing Out (FOMO) likely emerging among investors. It remains to be seen whether this overenthusiasm will impede the price rally or not.

BTC Price

Bitcoin briefly surpassed $110,000 during the past 24 hours, but the asset has since experienced a slight retraction, currently resting at $109,500.

The trend in the BTC price over the past five days | Source: BTCUSDT on TradingView

Featured image from iStock.com, Santiment.net, chart from TradingView.com

Editorial Process for bitcoinist is focused on delivering well-researched, precise, and impartial content. We adhere to strict sourcing criteria, and each page is thoroughly reviewed by our team of leading technology experts and experienced editors. This method guarantees the integrity, relevance, and value of our material for our readers.