Today, Gemini Space Station, Inc. revealed that it has privately submitted a draft registration statement to the US Securities and Exchange Commission for a proposed initial public offering (IPO) of its Class A common stock. Information regarding the share quantity and price range remains undisclosed. The IPO will move forward following the SEC’s examination and is contingent on market conditions.

“Any proposals, requests, or invitations to purchase, or any sales of securities will be executed in compliance with the registration mandates of the Securities Act of 1933, as amended,” stated the press announcement. “This information is being disseminated in accordance with Rule 135 under the Securities Act.”

Gemini’s action occurs amid an escalating level of activity in both the public markets and the digital asset arena. Just yesterday, Trump Media and Technology Group Corp. (Nasdaq, NYSE Texas: DJT) also submitted a Form S-1 to the SEC for its forthcoming Truth Social Bitcoin ETF.

“Truth Social Bitcoin ETF, B.T. is a Nevada business trust that issues beneficial interests in its net assets,” outlined the Form S-1. “The Trust’s assets consist mainly of bitcoin held by a custodian on behalf of the Trust. The Trust aims to generally mirror the performance of bitcoin’s price.”

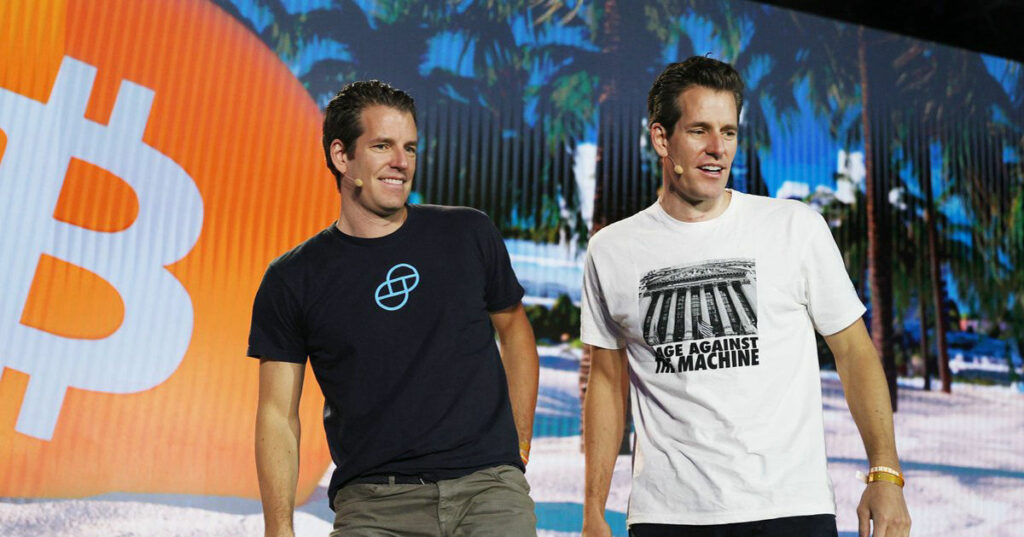

Interest surrounding Bitcoin and wider crypto policy was also apparent last week at the 2025 Bitcoin Conference in Las Vegas. There, Gemini founders Cameron and Tyler Winklevoss participated alongside White House A.I. & Crypto Czar David Sacks to deliberate on how the government should navigate Bitcoin and recent changes in federal policy.

“Orange is the new gold,” stated Cameron. “Hence, Bitcoin is Gold 2.0, and that has held true since day one. So, at $100,000 per Bitcoin, that’s thrilling, but if you take 21 million and calculate the surface market price of gold, it should realistically be a million dollars a coin—easily,”

They discussed some of the recent policy shifts that have benefited crypto, such as reversing the IRS digital asset broker rule and SAB 121, which had restricted banks from holding Bitcoin. The Department of Justice has also ceased its regulation by prosecution tactic, alleviating stress on digital asset companies.

“It’s hard to envision any President. Any other President being able to achieve any portion of this or accomplish that, and we have just over 100 days,” noted Tyler. “So, it’s pretty remarkable that we still have plenty of time remaining.” He concluded the panel, exclaiming, “To the Moon!”