THE NATIONAL Government’s (NG) total indebtedness reached a new peak of P16.31 trillion at the conclusion of January as it intensified borrowings, according to the Bureau of the Treasury (BTr) reported on Tuesday.

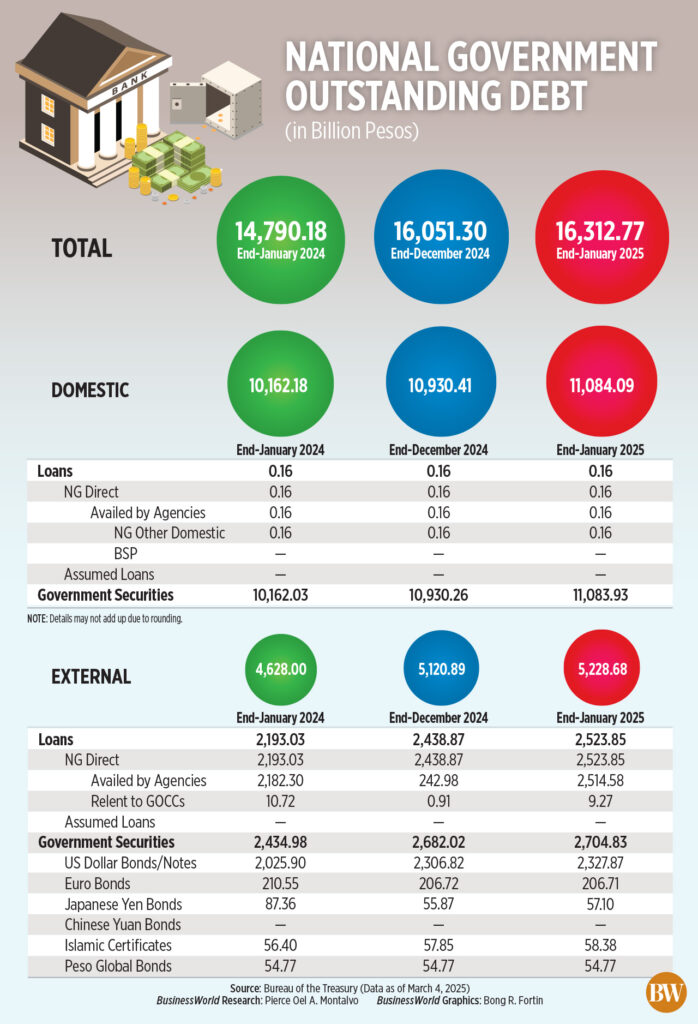

Initial figures from the BTr indicated that total debt surged by 1.63% or P261.47 billion, climbing to P16.31 trillion from P16.05 trillion at the end of 2024.

“The month-over-month increase in the debt stock was attributed to the net accumulation of both domestic and international debt, alongside the repercussions of peso depreciation against the US dollar from P57.847 at the end of 2024 to P58.375 by the close of January 2025,” stated the Treasury in a declaration.

The debt stock witnessed a 10.29% rise from P14.79 trillion at the end of January 2024.

“This level remains manageable and aligns with the government’s objective to foster economic development while maintaining fiscal sustainability,” the BTr stated.

NG debt represents the entire amount owed by the Philippine government to lenders including international financial institutions, partner nations, banks, global bondholders, and other investors.

BTr statistics showed that a substantial portion, or 67.9%, of the total outstanding debt was sourced domestically, while 32.1% came from foreign creditors.

Domestic debt rose by 1.41% or P153.68 billion to P11.08 trillion as of January from P10.93 trillion in December. Year on year, it increased by 9.07% from P10.16 trillion recorded at the end of January 2024.

“This was primarily due to the net issuance of government securities amounting to P152.17 billion, as gross issuances of P270.01 billion surpassed repayments of P117.84 billion to partly fund the anticipated deficit for the quarter,” the BTr noted.

The valuation effect of the peso depreciation against the US dollar raised domestic debt by P1.51 billion in January.

Meanwhile, external debt increased by 2.1% to P5.23 trillion as of the end of January from P5.12 trillion at the close of 2024.

Year on year, external debt escalated by 12.98% from P4.63 trillion.

“This was fueled by net availment of foreign loans totaling P59.3 billion, in addition to the upward revaluation caused by negative US and third currency fluctuations amounting to P46.74 billion and P1.75 billion, respectively,” the Treasury remarked.

External debt comprised P2.7 trillion in global bonds and P2.52 trillion in loans, the BTr reported.

NG-guaranteed liabilities fell by 0.11% to P346.27 billion as of the end of January from the December-end figure of P346.66 billion.

Year on year, guaranteed liabilities decreased by 0.69% from P348.66 billion.

As of the end of January, the net repayment of domestic guarantees was recorded at P1.55 billion, while external guarantees amounted to P250 million.

“The redemption of matured guarantees more than compensated for the currency valuation modifications on US dollar and third-currency denominated guarantees totaling P0.83 billion and P0.58 billion, respectively,” stated the BTr.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort indicated that the rise in outstanding debt mirrored the persistent budget deficit in recent months that “essentially necessitated additional borrowings” by the government.

The NG recorded a budget deficit of P1.506 trillion in 2024, a minor reduction of 0.38% year on year. However, it exceeded the P1.48-trillion deficit limit set by the Development Budget Coordination Committee (DBCC) by 1.48%.

Mr. Ricafort also mentioned that the depreciated peso against the US dollar in January heightened the peso value of external debt.

He anticipates the NG debt to reach new heights as the government intensified borrowings in the early months of 2025.

“(There is also) a necessity to hedge both domestic and international borrowings of the National Government given the Trump factor that induced instability in global financial markets,” he affirmed.

Oikonomia Advisory and Research, Inc. economist Reinielle Matt M. Erece projected a further rise in debt levels.

“I anticipate debt to increase this year driven by both expansionary fiscal policies aimed at promoting growth and an election year, which typically leads to greater government expenditure. Financing this spending proves challenging within a constrained fiscal environment and borrowing might be required,” he stated.

Mr. Erece mentioned that the debt remains manageable “as long as the government enhances its revenue generation and curtails corruption.”

At the end of December, the nation’s debt as a share of gross domestic product (GDP) inched up to 60.7% from 60.1% a year prior. This marginally exceeds the 60% threshold deemed manageable by multilateral lenders for developing nations.

The Philippines’ debt-to-GDP ratio of 60.7% positions it “competitively” relative to its Southeast Asian counterparts, as stated by the BTr. It surpasses Thailand’s 56.6% and Indonesia’s 36.8%, yet remains lower than Malaysia’s 64.6% and Singapore’s 173.1%.

The government aims to reduce the debt-to-GDP ratio to 60.4% this year, 60.2% in 2026, and 56.3% by 2028.

The National Government intends to borrow P2.55 trillion this year — P2.04 trillion from domestic markets and P507.41 billion from overseas sources. — Aubrey Rose A. Inosante