By Aubrey Rose A. Inosante, Reporter

PHILIPPINE MANUFACTURING activity in February increased at its slowest rate in 11 months due to diminished growth in orders and production, data from S&P Global revealed.

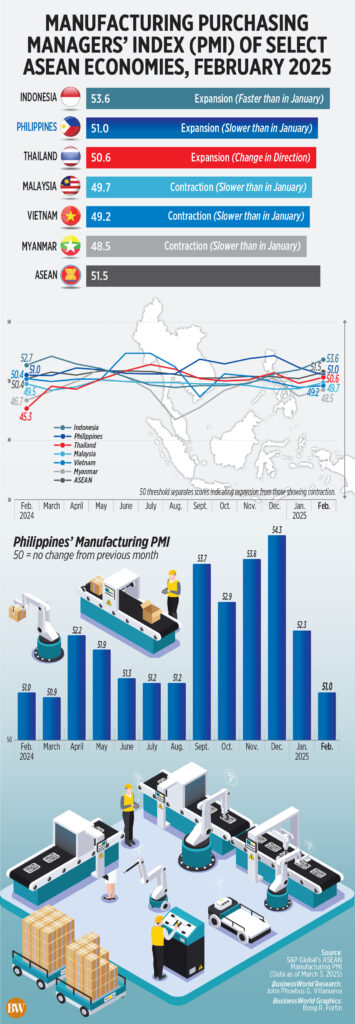

The S&P Global Philippines Manufacturing Purchasing Managers’ Index (PMI) was recorded at 51 in February, down from 52.3 in January.

This marked the lowest PMI figure in 11 months, since the 50.9 reading in March 2024. February also indicated the second consecutive month of reduced growth.

A PMI measurement above 50 signifies improved operating conditions compared to the prior month, while a measurement below 50 indicates a decline.

“The strong growth seen from the end of last year into the start of this year diminished in February, as the latest survey data revealed slower expansions in output and new orders,” stated Maryam Baluch, economist at S&P Global Market Intelligence, in a statement on Monday.

The Philippines recorded the second-fastest PMI measurement among six member countries of the Association of Southeast Asian Nations (ASEAN), following Indonesia (53.6) and preceding Thailand (50.6).

Malaysia (49.7), Vietnam (49.2), and Myanmar (48.5) all experienced a contraction in production activity during February.

According to its report, S&P Global mentioned that the manufacturing conditions in the Philippines continued to improve in February, although this was the “least significant improvement in nearly a year.”

“However, the underlying data presented a mixed scenario, with the sector showing a slight cooldown as growth in new orders and output slowed on a monthly basis, resulting in a more subdued increase in purchasing activity,” it added.

S&P Global highlighted that new orders growth decelerated in February after a substantial rise observed in the fourth quarter of 2024. New factory orders increased at the slowest rate in seven months, while growth in new export orders was minimal.

Production growth also slowed in February, with output growth reaching its weakest level since July 2024.

As demand eased, manufacturers adjusted their purchasing activities. February witnessed the slowest expansion in the past 15 months.

S&P Global noted that manufacturing companies reported a renewed rise in backlogs for the first time in five months.

“While the rate of backlog accumulation was modest, it was the most significant seen in nearly two years. As a result, companies tapped into their inventories to meet order demands and consequently reduced their input stock levels, marking the first decline in three months,” it explained.

Ms. Baluch remarked that employment levels increased for the first time in three months, “with companies striving to meet sustained demand improvements.”

S&P Global noted that price pressures further lessened in February.

“While material shortages and logistics costs continued to elevate input prices, the rate of increase was the slowest in the ongoing nine-month sequence of inflation,” it noted.

Prices for goods produced in the Philippines slightly increased at the softest rate in 10 months, it added.

“Inflationary pressures have eased, indicating that the central bank may continue with a loosening of its monetary policy. This could potentially enhance somewhat weakened business confidence and encourage further growth in new orders,” Ms. Baluch stated.

The Bangko Sentral ng Pilipinas (BSP) maintained the benchmark rate unchanged at 5.75% during its meeting on February 13. BSP Governor Eli M. Remolona, Jr. has indicated that the central bank is still in its easing phase and suggested the possibility of up to 50 basis points of reductions this year.

The Monetary Board’s next meeting to set rates is scheduled for April 3.

S&P mentioned that manufacturers retained a positive outlook for production in the upcoming year, although the level of confidence dipped to a 10-month low.

In an email, Pantheon Macroeconomics Chief Emerging Asia Economist Miguel Chanco reported that the Philippines was the only nation in ASEAN that “experienced a decline in momentum” in February.

“[The Philippines’] PMI decreased for the second consecutive month to an 11-month low of 51.0, a significant drop from a recent high of 54.3 in December,” he stated.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort pointed out that the PMI figure reflects the downturn in demand following the holiday season.

“Moreover, uncertainties regarding Trump’s increased US import tariffs and other protectionist strategies since his inauguration also weigh on global investments and international trade, including those in the Philippines,” he added.

“Nonetheless, a counteracting positive factor could be election-related expenditures, the May 12, 2025 midterm elections, which may drive increased government spending on various initiatives, particularly infrastructure and other programs before the election ban,” Mr. Ricafort remarked.