The emergence of BitVM smart contracts has heralded a remarkable achievement in the journey toward scalability and programmability of Bitcoin. Based on the original BitVM framework, Bitlayer’s Finality Bridge unveils the initial iteration of the protocol live on testnet, serving as a promising foundation for actualizing the aspirations of the Bitcoin Renaissance or “Season 2”.

Unlike previous BTC bridges that frequently depended on centralized bodies or dubious trust assumptions, the Finality Bridge utilizes a synergy of BitVM smart contracts, fraud proofs, and zero-knowledge proofs. This amalgamation not only boosts security but also considerably diminishes the necessity for reliance on intermediaries. While we haven’t reached the trustless level provided by Lightning, this is vastly superior to current sidechain models claiming to be Bitcoin Layers 2s (alongside significantly expanding the design possibilities for Bitcoin applications).

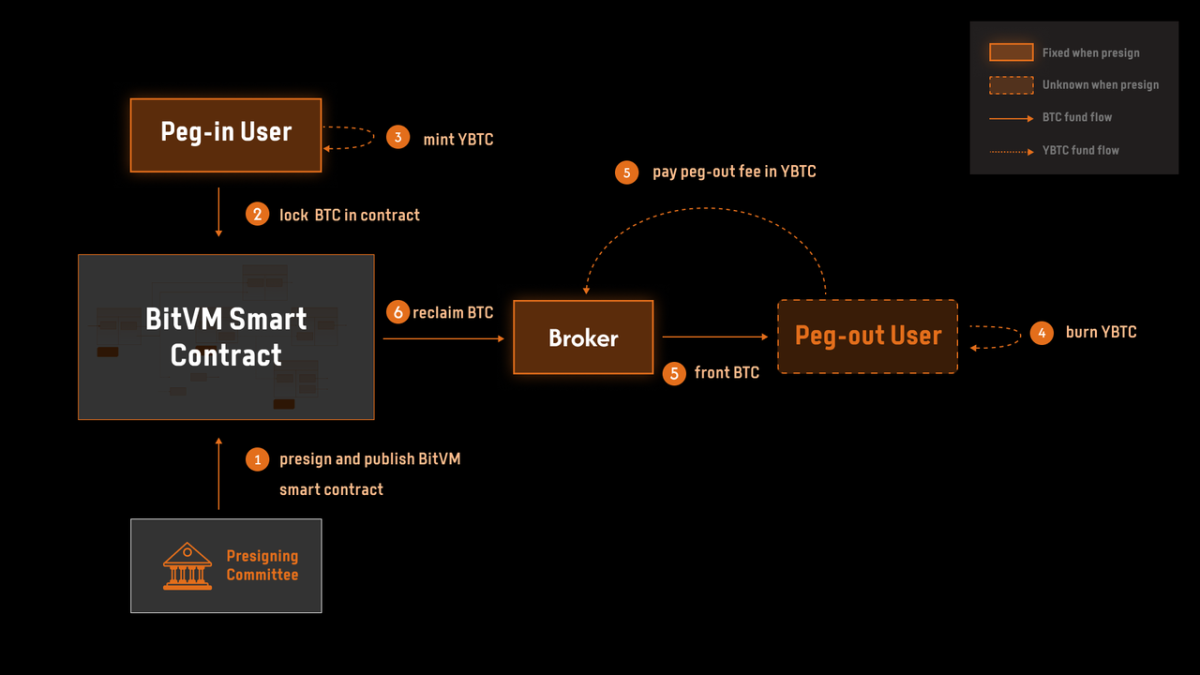

The system adheres to a principle where funds are securely held in addresses controlled by a BitVM smart contract, based on the assumption that at least one participant within the system will act with integrity. This arrangement inherently lowers the trust demands but must introduce additional complexities that Bitlayer intends to address in this version of the bridge.

The Mechanics of Trust

In practical terms, when Bitcoin is secured within the BitVM smart contract via the Finality Bridge, users receive YBTC – a token that maintains a strict 1:1 ratio with Bitcoin. This ratio isn’t merely a promise but is enforced by the underlying smart contract logic, ensuring that each YBTC corresponds to a genuine, secured Bitcoin on the main blockchain (no deceptive “restacked” BTC statistics). This system allows individuals to engage in DeFi activities such as lending, borrowing, and yield farming within the Bitlayer framework without sacrificing the security and settlement guarantees that Bitcoin offers.

While some members of the community may view these activities as contentious, this architecture permits users to obtain assurances that they could not previously attain with conventional sidechain models, with the added advantage that there is no need to “alter” Bitcoin to make this possible (although covenants would render this bridge design completely “trust-minimized,” effectively classifying it as a “True” Bitcoin Layer 2). For further insights into the varying degrees of risks tied to sidechain designs, check out Bitcoin Layers’ evaluation of Bitlayer here.

Nevertheless, until such progress comes to fruition, the Bitlayer Finality Bridge stands as the best realization of the BitVM 2 model. It reflects what is achievable following the dev “brain drain” from centralized chains back to Bitcoin. Despite the hurdles that BitVM chains will encounter, I remain highly optimistic about the potential of Bitcoin to fulfill its role as the Ultimate Settlement Chain for all economic endeavors.

This article is a Take. The views expressed are solely those of the author and do not necessarily mirror the perspectives of BTC Inc or Bitcoin Magazine.

Guillaume’s articles may particularly address subjects or companies that are part of his firm’s investment portfolio (UTXO Management). The opinions expressed are exclusively his own and do not reflect the views of his employer or its affiliates. He’s not receiving any financial compensation for these Takes. Readers should not interpret this content as financial guidance or an endorsement of any specific company or investment. Always conduct your own research prior to making financial decisions.