NET INFLOWS of foreign direct investment (FDI) into the Philippines decreased in November, preliminary figures from the central bank revealed.

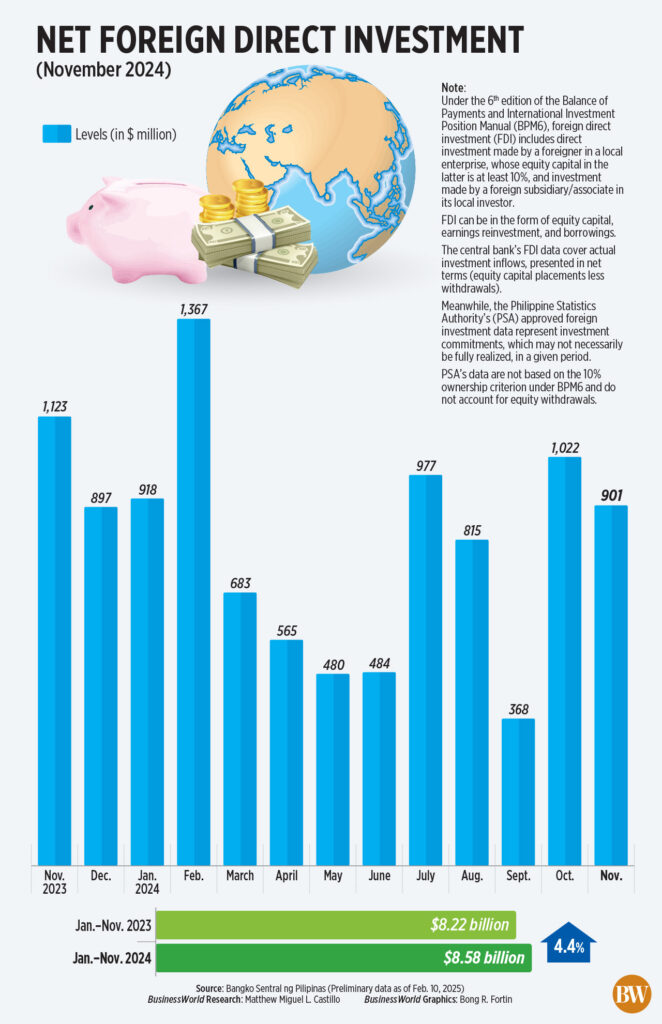

FDI net inflows declined by 19.8% to $901 million in November compared to $1.12 billion in the same month last year, according to the Bangko Sentral ng Pilipinas (BSP) on Monday.

On a month-to-month basis, inflows decreased by 11.8% from $1.02 billion in October.

This marked the lowest FDI net inflow in two months, following the $368 million recorded in September.

Net investments in debt instruments fell by 17.9% to $791 million in November from $964 million in the same month last year.

These primarily comprised intercompany lending or borrowing between foreign direct investors and their subsidiaries or affiliates in the Philippines, according to the central bank.

“The remaining share of net investments in debt instruments consists of investments made by nonresident subsidiaries or associates in their resident direct investors, known as reverse investment,” it noted.

In contrast, net investments in equity capital, excluding the reinvestment of earnings, plummeted by 58.9% to $35 million in November from $85 million a year earlier.

Equity capital placements decreased by 37.8% year on year to $71 million. Conversely, withdrawals increased by 24.3% to $36 million.

By origin, the majority of equity capital placements were sourced from Japan (49%), followed by the United States (24%) and Singapore (17%).

These investments were primarily directed towards manufacturing (49%), real estate (25%), financial and insurance (9%), and administrative and support services (5%).

Central bank data indicated that investments in equity and investment fund shares dropped by 31.2% to $110 million in November from $159 million in the same month last year.

“Reinvestment of earnings by nonresidents remained relatively stable at $74 million,” it added.

11-MONTH PERIOD

During the January-November period, FDI net inflows grew by 4.4% to $8.58 billion from $8.22 billion in the same period last year.

This represented 95.3% of the BSP’s overall forecast of $9 billion in FDI net inflows for 2024.

Investments in equity and investment fund shares surged by 16.4% year on year to $2.6 billion from $2.2 billion in the comparable period last year.

Net foreign investments in equity capital rose by 37.7% to $1.49 billion in the first 11 months from $1.08 billion in the same period last year.

Placements increased by 23% to $1.98 billion, while withdrawals fell by 7.1% to $493 million.

These placements were predominantly from Japan (39%) and the United Kingdom (39%), followed by the United States (10%) and Singapore (5%).

Investments were primarily allocated to manufacturing (72%), real estate (12%), and wholesale and retail trade (4%).

Meanwhile, net investments in debt instruments slightly decreased by 0.1% to $5.98 billion. Reinvestment of earnings also dropped by 3.6% to $1.1 billion.

Michael L. Ricafort, Chief Economist at Rizal Commercial Banking Corp., stated that the drop in FDI inflows might be due to uncertainties surrounding US President Donald J. Trump’s protectionist policies.

“President Trump, who won the US elections on Nov. 5, promotes more investments and jobs within the US rather than abroad, which could diminish foreign investments globally,” he said.

Reinielle Matt Erece, an economist at Oikonomia Advisory & Research, Inc., mentioned that foreign investors were cautious in making decisions in November following Mr. Trump’s election win.

“His proposed protectionist measures led investors to hold capital and reassess their investments as there are rising inflation expectations, higher interest rates, and the potential for trade wars as consequences of these economic strategies,” he added.

Mr. Ricafort noted that foreign investors were in a “wait-and-see” state as the Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy (CREATE MORE) Act was enacted in November.

“But this legislation may prompt foreign investors to make more definitive decisions about whether to establish operations in the country in the future,” he elaborated.

CREATE MORE enhances fiscal incentives and reduces corporate income tax for specific foreign enterprises.

“The sequence of storms and floods caused some economic disturbances in certain regions of the country and partially affected some FDIs into the nation,” Mr. Ricafort added.

The Philippines encountered numerous typhoons in the fourth quarter, resulting in billions in damages to infrastructure and agriculture.

“Nonetheless, a net FDI close to $1 billion remains substantial and among the pre-pandemic levels that could generate more jobs and business opportunities while contributing to further economic growth and development,” Mr. Ricafort stated.

Moreover, continued monetary policy easing would likely reduce financing costs and attract additional investments, he remarked.

In 2024, the BSP cut interest rates by a total of 75 basis points (bps), implementing three consecutive 25-bp cuts in August, October, and December.

A BusinessWorld poll conducted last week indicated that 19 out of 20 analysts expect the Monetary Board to decrease rates by another 25 bps during its first meeting of the year on Feb. 13.

The central bank anticipates concluding 2025 with a $10-billion net FDI inflow.

The BSP emphasized that its FDI figures differ from those of other government sources, as they reflect actual investment flows.

“In contrast, the approved foreign investment figures published by the Philippine Statistics Authority, sourced from Investment Promotion Agencies, represent investment commitments that may not necessarily be fully realized within a given timeframe.” — Luisa Maria Jacinta C. Jocson