Wouldn’t it be fantastic if we had a singular, all-comprehensive metric to direct our Bitcoin investment choices? That’s exactly what has been developed: the Bitcoin Everything Indicator. Recently included in Bitcoin Magazine Pro, this indicator seeks to consolidate numerous metrics into one unified framework, thus simplifying Bitcoin analysis and investment decision-making processes.

For a more detailed exploration of this subject, check out a recent YouTube video here: The Official Bitcoin EVERYTHING Indicator

Reasons for a Unified Indicator

Investors and analysts generally depend on various metrics, including on-chain data, technical analysis, and derivative charts. However, concentrating excessively on one element can result in a fragmented understanding of Bitcoin’s price fluctuations. The Bitcoin Everything Indicator endeavors to address this issue by merging essential components into one coherent metric.

The Key Elements of the Bitcoin Everything Indicator

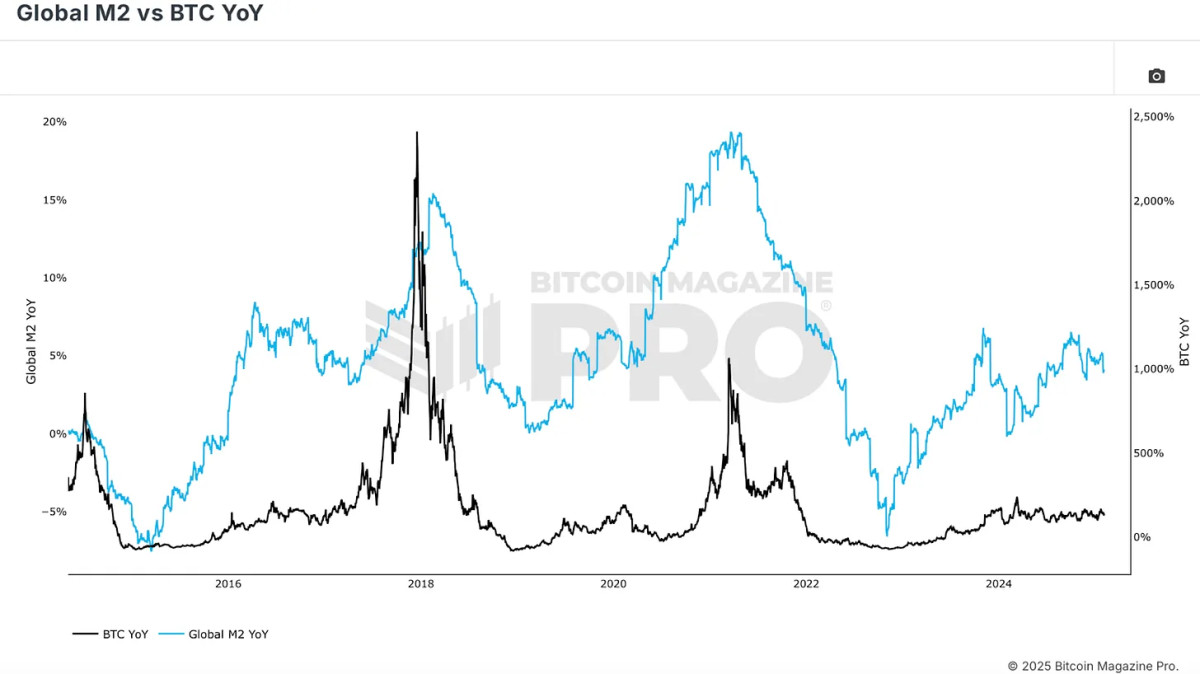

Bitcoin’s price activity is significantly affected by global liquidity trends, rendering macroeconomic factors a crucial element of this indicator. The relationship between Bitcoin and broader financial markets, particularly concerning Global M2 money supply, is evident. As liquidity increases, Bitcoin usually appreciates in value.

Fundamental aspects such as Bitcoin’s halving cycles and miner efficiency are vital in evaluating its valuation. While halvings reduce the new Bitcoin supply, their effect on price appreciation has lessened as over 94% of Bitcoin’s total supply is already on the market. Nevertheless, miner profitability is of utmost importance. The Puell Multiple, assessing miner earnings in relation to historical averages, offers insights into market cycles. Traditionally, when miner profitability is robust, Bitcoin tends to be in a strong position.

On-chain indicators are essential for evaluating Bitcoin’s supply and demand dynamics. The MVRV Z-Score, for instance, contrasts Bitcoin’s market cap with its realized cap (average purchase price of all coins). This metric highlights accumulation and distribution zones, indicating when Bitcoin is overvalued or undervalued.

Another significant on-chain metric is the Spent Output Profit Ratio (SOPR), which analyzes the profitability of coins being utilized. When Bitcoin holders realize significant profits, it often indicates a market peak, while considerable losses typically suggest a market bottom.

The Bitcoin Crosby Ratio serves as a technical measure that evaluates Bitcoin’s overextended or undervalued conditions solely based on price movement. This ensures that market sentiment and momentum are also factored into the Bitcoin Everything Indicator.

The utilization of the network can provide essential insights about Bitcoin’s stability. The Active Address Sentiment Indicator gauges the percentage change in active addresses over a span of 28 days. An increase in active addresses usually supports a bullish trend, while stagnation or decline may indicate price weakness.

Functionality of the Bitcoin Everything Indicator

By merging these diverse metrics, the Bitcoin Everything Indicator guarantees that no single aspect is given excessive emphasis. Unlike models that are overly reliant on specific signals, such as the MVRV Z-Score or the Pi Cycle Top, this indicator equally distributes influence across various categories. This approach prevents overfitting and allows the model to adjust to evolving market dynamics.

Historical Performance Compared to Buy-and-Hold Strategy

One of the most notable observations is that the Bitcoin Everything Indicator has outperformed a basic buy-and-hold strategy since Bitcoin was priced below $6. By employing a strategy of accumulating Bitcoin during oversold situations and gradually selling during overbought conditions, investors utilizing this approach would have markedly improved their portfolio’s performance while experiencing reduced drawdowns.

For example, this model exhibits a 20% drawdown as opposed to the typical 60-90% declines observed in Bitcoin’s history. This indicates that a balanced, data-driven approach can assist investors in making better-informed choices with less risk of loss.

Final Thoughts

The Bitcoin Everything Indicator streamlines investing by combining the most significant elements impacting Bitcoin’s price action into a single metric. It has historically outperformed buy-and-hold tactics while minimizing risk, establishing itself as a valuable resource for both retail and institutional investors.

For more thorough Bitcoin analysis and to gain access to advanced features such as live charts, tailored indicator notifications, and detailed industry reports, explore Bitcoin Magazine Pro.

Disclaimer: This article serves informational purposes only and should not be construed as financial guidance. Always conduct your own research prior to making any investment decisions.