In the current vibrant economic environment, experienced investors are reassessing their holdings and contemplating the viability of Bitcoin as an alternative to conventional assets such as real estate. With its limited availability and revolutionary growth prospects, Bitcoin makes a persuasive argument for innovative investment approaches.

Real Estate: The Mirage of Security

For a long time, real estate has been seen as a refuge for safeguarding wealth. Nonetheless, the housing market is susceptible to systemic threats including rises in interest rates, governmental interference, and economic recessions. Furthermore, investments in property typically involve considerable upkeep costs, taxes, and liquidity challenges.

In contrast, Bitcoin provides unmatched portability, protection against confiscation, and resilience to regional economic or geopolitical disturbances. Unlike real estate, Bitcoin incurs no maintenance expenses or physical limitations.

The Ascendancy of Bitcoin as a Store of Wealth

With its capped supply of 21 million coins, Bitcoin is positioned as “digital gold” for the current century. Throughout the last ten years, Bitcoin has consistently outshone other asset types, yielding remarkable returns despite fluctuations.

In comparison, the rise in real estate values is frequently linked to inflation and government monetary strategies, which can erode its actual worth over time. Conversely, Bitcoin functions on a deflationary framework, guaranteeing scarcity and maintaining purchasing power.

Liquidity and Accessibility

Investing in real estate often necessitates prolonged transactions, hefty fees, and substantial regulatory obstacles. Offloading a property can take significant time, tying down capital and impeding flexibility. Bitcoin, however, provides immediate liquidity and can be exchanged around the clock on worldwide platforms. This ease of access allows investors to transfer their wealth effortlessly across borders.

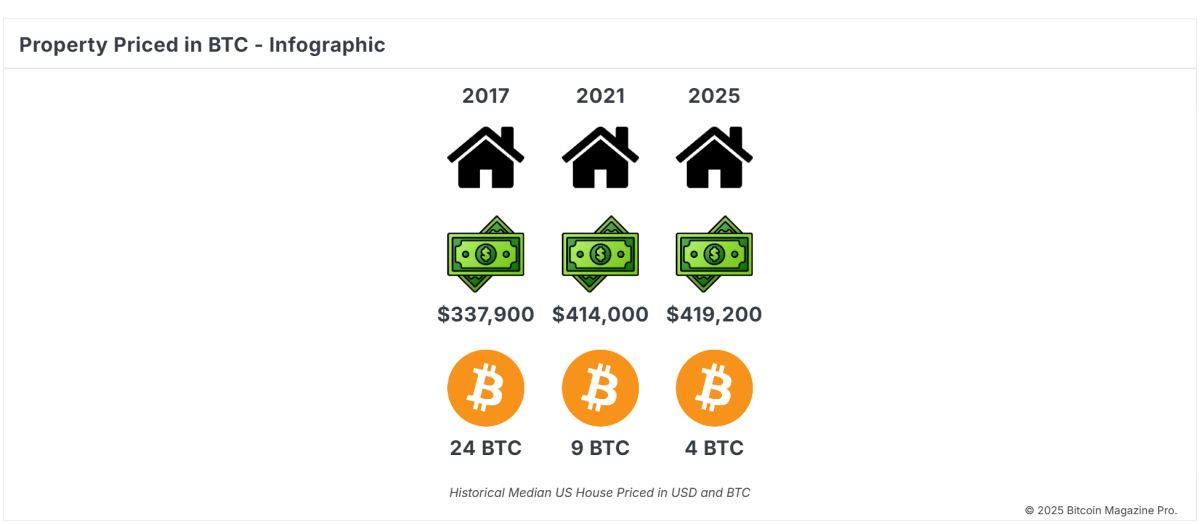

The statistics highlight Bitcoin’s capacity to preserve and enhance wealth more efficiently than conventional property investments.

Protection Against Inflation

Real estate values typically reflect inflationary patterns but struggle to exceed them significantly. Bitcoin, designed as a safeguard against fiat currency depreciation, has shown its robustness during inflationary phases. As central banks persist in creating money at unparalleled rates, Bitcoin’s finite availability ensures its value remains shielded from currency debasement.

Adaptability for Contemporary Investors

Modern investors value adaptability and global reach. Real estate is a localized, illiquid asset that restricts mobility. In contrast, Bitcoin transcends borders and facilitates decentralized ownership independent of traditional financial frameworks. This attribute is particularly appealing to younger, technology-oriented investors who prioritize freedom and control.

A Visionary Path Forward

Bitcoin represents more than merely a speculative asset; it signifies a financial revolution. By embracing Bitcoin, astute investors align themselves with the forefront of this transformative shift. As Bitcoin adoption increases, its value proposition becomes ever more evident: a solid, deflationary asset crafted for the contemporary economy.

Conclusion

Although real estate has traditionally been a foundational element of investment portfolios, Bitcoin provides a transformative substitute that meets the expectations of a rapidly changing global economy. For those aiming to protect wealth, guard against inflation, and leverage groundbreaking technology, Bitcoin is the preferred asset. The inquiry is no longer “Why Bitcoin?” but rather “Why not Bitcoin?”

If you’re seeking further detailed analysis and real-time data, consider exploring Bitcoin Magazine Pro for valuable perspectives on the Bitcoin market.

Disclaimer: This article serves informational purposes only and should not be interpreted as financial advice. Always conduct your own research before making any investment choices.