PHILIPPINE manufacturing activity persisted in its growth during January, though at the most gradual rate in five months, S&P Global noted on Monday.

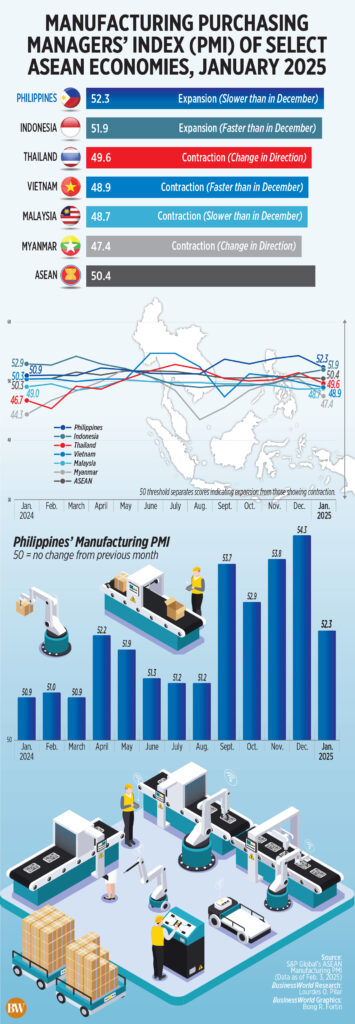

The S&P Global Philippines Manufacturing Purchasing Managers’ Index (PMI) recorded a figure of 52.3 in January, a decline from the 54.3 observed in December 2024. This marks the lowest PMI measure in five months, or since the 51.2 figure reported in August 2024.

According to its report, S&P Global indicated that the PMI figure represented a “notable improvement” in manufacturing conditions within the Philippines.

A PMI value exceeding 50 suggests enhanced operating conditions compared to the previous month, whereas a value below 50 indicates a decline.

“The Filipino manufacturing sector commenced the year with a further and substantial rise in demand. Output increased once again, although at a rate that considerably slowed compared to December,” Maryam Baluch, economist at S&P Global Market Intelligence, stated on Monday.

In January, the Philippines exhibited the fastest PMI value among six Association of Southeast Asian Nations (ASEAN) member countries, surpassing Indonesia at 52.3.

A downturn in manufacturing activity was reported in Thailand (49.6), Vietnam (48.9), Malaysia (48.7), and Myanmar (47.4).

The demand for goods produced in the Philippines saw an improvement in January, though the growth rate experienced a slight reduction compared to the recently observed high in December, according to S&P Global.

“Nonetheless, the rate of growth in new orders remained historically robust, as companies noted that strong client demand and the acquisition of new customers led to increased sales,” it remarked.

S&P highlighted that strong demand trends propelled manufacturing output upward, but January represented the second weakest in the ongoing 10 consecutive months of growth.

This was attributed to competition and elevated raw material costs that limited production.

However, an increase in production needs led manufacturers to boost their purchasing activities in January.

“Companies also concentrated on stock accumulation, resulting in both pre- and post-production inventories increasing at historically robust levels during the latest survey period,” S&P reported.

“Notably, finished goods inventories recorded a new increase after a significant drop in December.”

In January, supply chains continued to face challenges. The shortage of delivery vehicles and port congestion extended average lead times for inputs, S&P noted.

The decline in supplier performance in January was the least severe in five months.

S&P Global indicated that employment levels remained unchanged for the second consecutive month.

The rise in sales encouraged manufacturing firms to expand their workforce, but this was counterbalanced by reports of resignations, it added.

“With respect to pricing, both cost pressures and output charges rose at similar but historically subdued rates,” S&P mentioned, noting that high material and transport expenses increased costs passed on to clients.

Looking ahead to the coming year, manufacturers retained an optimistic perspective, fueled by the anticipation of stronger market demand and the impending election period. Nonetheless, overall sentiment remained below the average trend level.

“If demand trends continue to show improvement as they have, then job growth could be expected in the upcoming months,” Ms. Baluch stated.

Ms. Baluch indicated that the election year is likely to stimulate growth in the manufacturing sector, citing feedback from survey respondents.

“We could expect 2025 to be another year of strong growth for the Philippines manufacturing sector, with industrial production growth projected at 3.9% in 2025, up from 2.4% in 2024,” she stated.

“In fact, the expectation of increased demand has already driven producers to bolster their inventory levels.”

The Philippines is set to conduct its midterm elections on May 12.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort remarked that the slower tempo in factory activities was partly due to “the seasonal drop in demand and production activities following the transition into the new year post-Christmas.”

“Still relatively high prices, interest rates, and a weaker peso against the US dollar since 2022 also partially affected demand and manufacturing activities,” Mr. Ricafort added.

He further stated that increased government expenditure on infrastructure and some election-related spending could benefit manufacturers involved in the supply chains for various infrastructure initiatives.

In an email, Pantheon Macroeconomics Chief Emerging Asia Economist Miguel Chanco stated that the Philippines remains the region’s main outperformer but “encountered a significant speed bump.”

“Overall, the regional index for January was the weakest showing in 11 months; at best, its general slowdown is still stabilizing.”

ASEAN PMI was recorded at 50.4 in January, down from 50.7 in December.

Mr. Chanco suggested the headline figure is likely to decline rather than improve, “as short-term leading indicators continue to show signs of weakening.” — Aubrey Rose A. Inosante