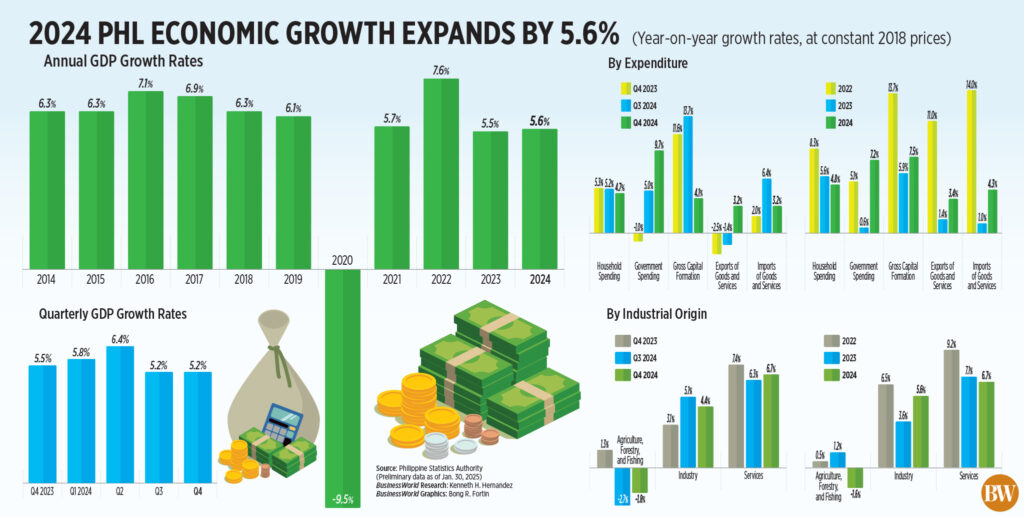

THE PHILIPPINE ECONOMY grew by a disappointing 5.2% in the last quarter, resulting in annual growth falling short of the government’s target, impacted by weak consumer spending and diminished agricultural output.

According to data from the Philippine Statistics Authority (PSA), the gross domestic product (GDP) increased by 5.2% in the period from October to December, a deceleration compared to the 5.5% figure from the same quarter in 2023 and below the 5.8% median expectation from a BusinessWorld poll.

This remained consistent with the 5.2% growth from the third quarter, marking the slowest GDP performance since a 4.3% increase in the second quarter of 2023.

Annual growth registered at 5.6%, below the adjusted target of 6-6.5%, and the 5.7% median forecast in a BusinessWorld survey. The GDP increase for 2024 was slightly above 5.5% from 2023.

“In 2024, we encountered several challenges like severe weather patterns, geopolitical tensions, and muted global demand, mirrored by the obstacles we faced in 2023,” said Rosemarie G. Edillon, Undersecretary for Policy and Planning Group of the National Economic and Development Authority (NEDA). “This indicates that such conditions could become the new norm.”

On a seasonally adjusted quarterly basis, GDP recorded a rise of 1.8% in the fourth quarter, up from 1.5% in the preceding quarter.

Among countries in Asia that have released their statistics, Ms. Edillon noted that the Philippines experienced the third-fastest GDP growth in the fourth quarter, trailing Vietnam (7.5%) and China (5.4%), while surpassing Malaysia (4.8%).

“Although this is below our target, we still rank as one of the fastest-growing economies globally and within the region. This is despite external and domestic challenges, such as severe weather conditions, geopolitical unrest, and lowered global demand,” stated Finance Secretary Ralph G. Recto in a separate declaration.

Ms. Edillon linked the reduced growth rate to the effects of multiple typhoons on the agricultural sector in the latter months of 2024.

The agriculture, forestry, and fishing (AFF) sector contracted by 1.8% from October to December, an improvement from the 2.7% decline a year prior.

In 2024, agriculture faced a decrease of 1.6%, marking a reversal from the 1.2% growth seen in 2023.

“The agricultural sector has endured notable setbacks due to typhoons, droughts, and various climate-related challenges,” said Ms. Edillon.

Additional data from the PSA indicated that agricultural output fell by an unprecedented 2.2% to P1.73 trillion in 2024, adversely affected by El Niño followed by La Niña. The downturn in farm production last year was the worst seen in nearly three decades (26 years) since a 7% decline in 1998.

“The AFF sector, contributing around 8% to GDP and providing jobs for nearly one-quarter of the labor force, faced disruptions in crop production, livestock, and fisheries, exacerbating its vulnerabilities,” Ms. Edillon noted.

In contrast, the industrial sector grew by 4.4% in the fourth quarter, a slowdown from the 5.1% a year earlier. For 2024, the industry recorded a 5.6% expansion, up from 3.6% in 2023.

The primary drivers of industrial growth were construction and manufacturing. Construction growth decreased to 7.8% in the fourth quarter from 9% in the same period the previous year, resulting in a full-year growth rate of 10.3%.

“Manufacturing managed only a 3.1% growth. This performance has been constrained by subdued global demand due to geopolitical tensions and the sluggish recovery of advanced economies,” Ms. Edillon observed.

“Certain sectors like semiconductors need to adjust their product offerings to align with evolving demand.”

The services sector, responsible for 62% of total GDP, grew by 6.7% in the October-to-December period, a decrease from 7.4% in the same quarter of 2023. For the entire year, services growth maintained at 6.7%.

DISAPPOINTING CONSUMPTION

In the meantime, household final consumption expenditure, which constitutes over 70% of the economy, increased by 4.7% in the fourth quarter, down from 5.2% in the previous quarter and 5.3% in the same quarter in 2023.

For the entire year, household consumption climbed by 4.8%, down from 5.6% in 2023. Private consumption represents approximately three-fourths of the economy.

Ms. Edillon remarked that household consumption was impacted by the series of typhoons that struck the country in the fourth quarter.

“This has dampened the growth momentum… Although we did observe an uptick in spending on travel, transportation, and recreation and culture, it was insufficient to offset the slowing in other expenditure categories,” she stated.

Ms. Edillon also pointed out that high food prices, particularly for vegetables, negatively influenced consumption in the fourth quarter.

“We’re optimistic that this situation is temporary… We hope for a stabilization soon,” she added.

Miguel Chanco, chief emerging Asia economist at Pantheon Macroeconomics, noted that the latest GDP figures indicate a renewed decline in household consumption.

“The 4.7% increase in consumption in the fourth quarter signifies a return to the low levels experienced over the past decade, excluding the anomalies of the COVID-19 years. The full-year figure of 4.8% marks the slowest growth since 2010,” Mr. Chanco stated in a report.

“We wish to emphasize that private consumption is likely to remain low, despite a normalization of inflation and declining interest rates, as household financial positions remain weak, burdened by low savings and high debt levels,” he added.

GOVERNMENT EXPENDITURE

PSA statistics also revealed that government final consumption expenditure (GFCE) rose by an annual 9.7% in the fourth quarter, rebounding from a 1% decline in the same period in 2023.

In 2024, government spending rose by 7.2%, faster than the 0.6% observed in 2023.

“We are quite pleased with the performance of GFCE… That particular growth rate is commendable and indeed supportive of the overall economy,” Ms. Edillon remarked.

In a separate conversation, Ms. Edillon disclosed that seven infrastructure flagship projects (IFPs) were completed last year, and 13 additional projects are set to be completed this year.

Gross capital formation, the investment segment of the economy, increased by 4.1% in the fourth quarter, significantly slowing from 11.6% in the same quarter of 2023.

For the full year, gross capital formation grew by 7.5%, quicker than the 5.9% increase observed a year ago.

Ms. Edillon stated that overall, investments remain strong due to the substantial backlog of infrastructure projects that will “sustain us until these significant investments come in.”

“Regarding foreign investments, geopolitical tensions continue to pose challenges. However, we are hopeful these issues are temporary,” she remarked.

Meanwhile, goods and services exports increased by 3.2% in the fourth quarter, recovering from a 2.5% contraction in the same period a year earlier, largely supported by a 13.5% rise in service exports. However, goods exports declined by 4.6%.

In 2024, exports of goods and services grew by 3.4%, surpassing the 1.4% increase from the prior year.

Imports rose by 3.2% in the fourth quarter, faster than the 2% growth recorded in the previous year.

For the full year, imports expanded by 4.3%, quicker than the 1% growth in 2023.

PROSPECTS

Looking forward, Ms. Edillon from NEDA expressed confidence in achieving at least the lower range of the 6-8% target for 2025, as government agencies have been instructed to “focus on continuity and maximum impact.”

“As we approach 2025, we aim to regain our growth momentum through strategic investments and initiatives to bolster resilience and establish a foundation for long-term, inclusive growth,” she added.

Mr. Recto indicated that the government remains positive about the economic forecast for this year.

“A lower inflation rate provides us with more leeway to reduce interest rates, which will further stimulate consumption,” he added.

Gareth Leather, Senior Asia Economist at Capital Economics, predicted that the Philippine economy would grow by 6% this year.

“Strong and consistent growth supports our belief that the rate easing cycle will proceed gradually in the coming months,” Mr. Leather stated in a report.

The Bangko Sentral ng Pilipinas commenced its rate-cutting cycle in August of last year, implementing a total reduction of 75 basis points.

“A major uncertainty for the upcoming year lies in whether, and to what degree, Donald Trump will enact his threats to impose tariffs and restrict immigration. The Philippines is less vulnerable to tariffs compared to other regions. However, Trump’s deportation policies could impact remittance flows from the US to the Philippines, which account for approximately 3.5% of the nation’s GDP,” Mr. Leather remarked. — A.R.A. Inosante