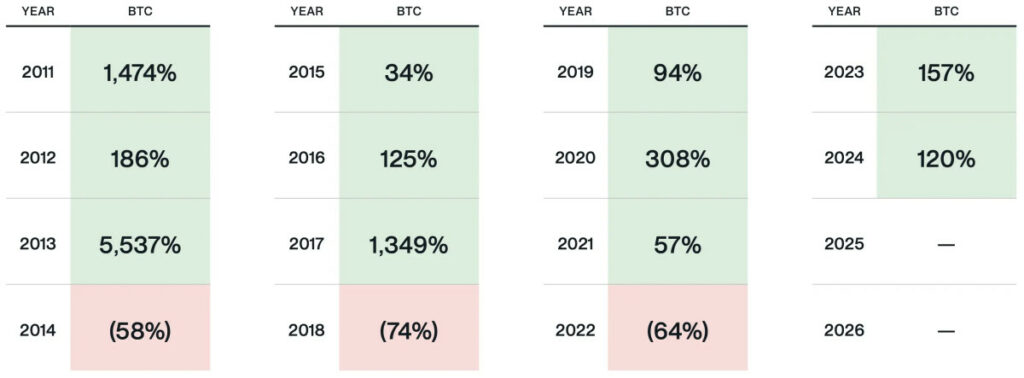

The Bitcoin sector has been historically characterized by its seemingly unwavering four-year cycle, a trend of three years of escalating prices followed by a steep downturn. Nonetheless, a monumental change in policy from Washington, spearheaded by former President Donald Trump, could potentially disrupt this cycle and herald a new age of extended growth for the cryptocurrency sector.

Matt Hougan, Chief Investment Officer at Bitwise Asset Management, recently raised a thought-provoking inquiry: Can Trump’s Executive Order disrupt crypto’s four-year cycle? His response, while intricate, tends to favor an emphatic yes.

A Recap of the Four-Year Cycle

Hougan articulates his personal opinion that the four-year Bitcoin market cycle does not stem from Bitcoin’s halving occurrences. He remarks, “Individuals attempt to associate it with bitcoin’s quadrennial ‘halving,’ but those halvings are miscalibrated with the cycle, having taken place in 2016, 2020, and 2024.”

Historically, Bitcoin’s four-year cycle has been influenced by a combination of investor sentiment, technological advancements, and market forces. Generally, a bull market arises following a significant trigger—whether it be enhancements in infrastructure or the adoption of Bitcoin by institutions—which draws in fresh capital and sparks speculation. With the passage of time, leverage builds, excesses surface, and a critical incident—such as regulatory clampdowns or financial misconduct—leads to a severe correction.

This sequence has consistently recurred: from the early instability of Mt. Gox in 2014 to the ICO frenzy and collapse of 2017-2018, and most recently, the deleveraging crisis of 2022 with the downfall of FTX and Three Arrows Capital. Yet, every downturn has been succeeded by an even more powerful rebound, culminating in Bitcoin’s latest bull market driven by the widespread adoption of Bitcoin ETFs in 2024.

Related: Nasdaq Proposes In-Kind Redemptions for BlackRock’s Bitcoin ETF

A Transformative Executive Order

The pivotal question Hougan analyzes is whether Trump’s recent Executive Order, which emphasizes the advancement of the digital asset ecosystem in the U.S., will unsettle the entrenched cycle. This directive, which delineates a clear regulatory framework and even envisions a national digital asset reserve, stands as the most optimistic position on Bitcoin from any current or former U.S. president.

The consequences are immense:

- Regulatory Transparency: By eliminating legal ambiguities, the EO facilitates the influx of institutional capital into Bitcoin on an unparalleled scale.

- Wall Street Inclusion: With the SEC and financial authorities now favoring crypto, major banks may enter the sector, providing Bitcoin custody, lending, and structured products to their clientele.

- Government Incorporation: The notion of a national digital asset reserve indicates a future where the U.S. Treasury might hold Bitcoin as a reserve asset, solidifying its reputation as digital gold.

These changes won’t materialize overnight, but their aggregate impact could fundamentally modify Bitcoin’s market dynamics. Unlike former cycles which were propelled by speculative retail enthusiasm, this transformation is rooted in institutional acceptance and regulatory endorsement—a significantly more stable foundation.

Related: Why Hundreds of Companies Will Buy Bitcoin in 2025

The Conclusion of Crypto Winters?

If history were to repeat, Bitcoin would maintain its upward trajectory through 2025 before facing a substantial retracement in 2026. Nonetheless, Hougan suggests this scenario might not occur this time. While he concedes the possibility of speculative excess and leverage-induced bubbles, he maintains that the vast extent of institutional participation will avert the prolonged bearish markets observed in the past.

This is a significant differentiation. In earlier cycles, Bitcoin lacked a robust foundation of value-oriented investors. Nowadays, with ETFs simplifying the process for pensions, hedge funds, and sovereign wealth funds to invest in Bitcoin, the asset is no longer solely reliant on retail sentiment. The outcome? Corrections may still happen, but they are likely to be less severe and of shorter duration.

What Lies Ahead?

Bitcoin has already surpassed the $100,000 milestone, and predictions from industry leaders, including BlackRock CEO Larry Fink, indicate it may reach $700,000 in the upcoming years. If Trump’s policies expedite institutional adoption, the standard four-year framework could be supplanted by a more conventional asset-class growth trend—similar to the response of gold following the cessation of the gold standard in the 1970s.

Related: BlackRock CEO Larry Fink Forecasts $700K Bitcoin Price Amid Inflation Worries

While risks persist—including unforeseen regulatory reversals and excessive leverage—the trajectory is unmistakable: Bitcoin is becoming a mainstream financial asset. If the four-year cycle was fueled by Bitcoin’s nascent stage and speculative characteristics, its maturation may render such cycles irrelevant.

Final Thoughts

For more than a decade, investors have regarded the four-year cycle as a guide for Bitcoin’s market fluctuations. However, Trump’s Executive Order could represent the pivotal moment that disrupts this trend, replacing it with a more prolonged and institutionally-supported growth phase. As Wall Street, corporations, and even governments increasingly adopt Bitcoin, the question is no longer if the crypto winter will arrive in 2026—but rather whether it will arrive at all.

Disclaimer: This article is intended solely for informational purposes and does not represent financial counsel. Readers are advised to conduct in-depth independent research prior to making investment choices.