By Luisa Maria Jacinta C. Jocson, Correspondent

REMITTANCES SENT BACK by overseas Filipino laborers (OFW) increased by an annual 3.3% in November, amidst the peso’s decline against the US dollar, as reported by the Bangko Sentral ng Pilipinas (BSP).

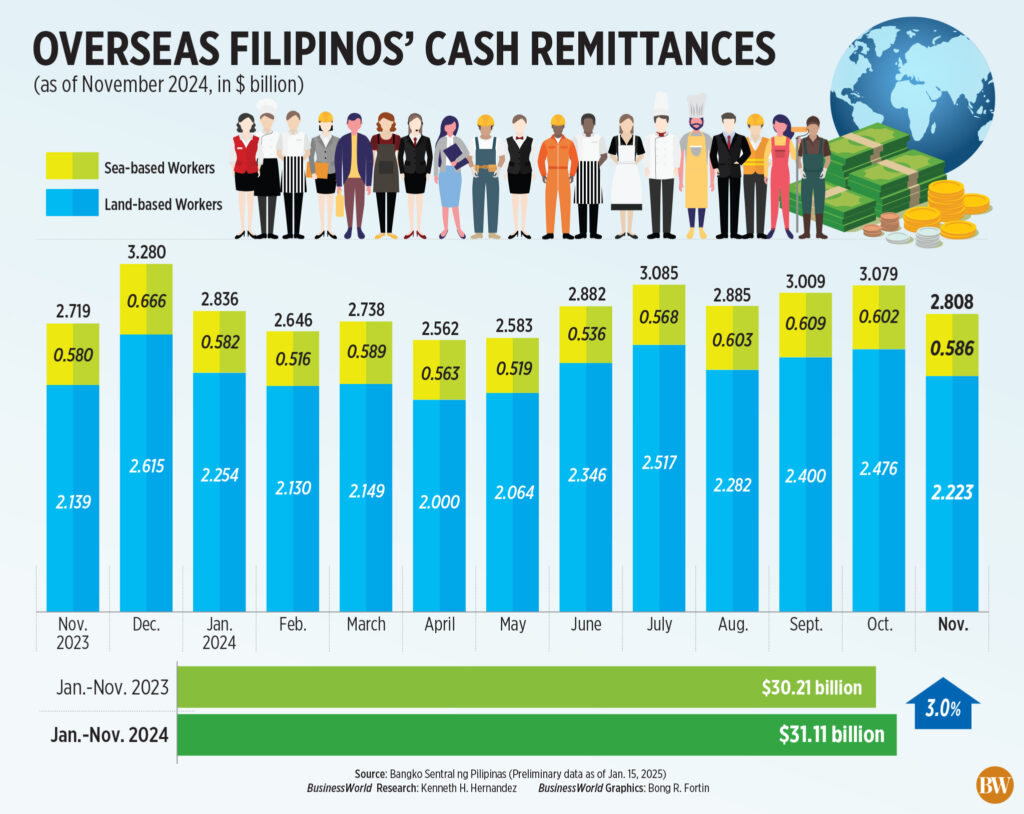

Information from the central bank indicated that cash remittances channeled through banking institutions rose by 3.3% to $2.81 billion in November compared to $2.72 billion during the same month the previous year.

Nevertheless, the remittance amount in November marked the lowest level in six months, or since the $2.58 billion recorded in May.

On a month-to-month basis, cash remittances dropped by 8.7% from $3.08 billion noted in October.

BSP data revealed that remittances from land-based laborers surged by 3.9% year-on-year to $2.22 billion in November, while funds dispatched by sea-based workers slightly increased by 1% to $585.505 million.

In addition, personal remittances, which encompass non-cash inflows, rose by 3.5% to $3.12 billion in November compared to $3.02 billion a year prior.

Remittances from employees with contracts lasting a year or longer jumped by 3.7% to $2.4 billion, whereas funds sent home by workers under contracts shorter than a year edged up by 1.7% to $650 million.

11-MONTH PERIOD

In the January-to-November timeframe, cash remittances grew by 3% to $31.11 billion from $30.21 billion the previous year.

“Cash remittances are anticipated to rise by 3% for the entire year of 2024,” the central bank noted.

The remittances by the end of November constituted 90.2% of the BSP’s total annual estimate of $34.5 billion.

“The increase in cash remittances from the United States, Saudi Arabia, Singapore, and the United Arab Emirates (UAE) was a significant factor in the rise from January to November 2024,” the central bank stated.

“Regarding country sources, the US represented the largest portion of total cash remittances from January to November 2024, followed by Singapore and Saudi Arabia.”

The United States comprised 40.9% of all remittances during the 11-month span, succeeded by Singapore (7.1%), Saudi Arabia (6.3%), Japan (5%) and the United Kingdom (4.7%).

Other significant contributors of remittances included the UAE (4.4%), Canada (3.5%), Qatar (2.9%), Taiwan (2.8%) and South Korea (2.5%).

Personal remittances similarly increased by 3% to $34.61 billion as of end-November from $33.59 billion the preceding year.

Experts indicated that the recent peso depreciation may have influenced cash remittances during the month.

“For November, the US dollar-peso exchange rate largely hovered between P58-59 levels compared to the P56-58 levels in the prior month, which slightly elevated the peso equivalent of OFW remittances,” said Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort.

Mr. Ricafort indicated this may “diminish the amount of OFW remittances dispatched in US dollars or other foreign currencies to cover equivalent amounts in pesos.”

The peso concluded at P58.62 against the dollar at the close of November, depreciating by 52 centavos from its P58.10 rate at the end of October.

The local currency also dropped to the unprecedented low of P59 per dollar on two occasions throughout the month.

“The peso experienced depreciation, resulting in needing more pesos for the equivalent foreign currency,” noted Leonardo A. Lanzona, an economics professor at the Ateneo de Manila University.

“Remittances are primarily utilized by recipients to satisfy their essential needs. The sender may have realized they do not need to send more funds to fulfill the requirements of their family members here,” he added.

Mr. Ricafort further stated that the rising cost of living in the host countries of OFWs could have led to a decrease in remittances sent back home.

Looking ahead to December, Mr. Ricafort predicted that remittances would have likely increased during the festive season.

“It is possible for OFW remittances to rise in December due to the expected seasonal influx typical of the Christmas and New Year holiday cycle, which is the peak spending period for households in any given year,” he remarked.

The central bank anticipates cash remittances to expand by 3% in 2024 and 2025.