Bitcoin has maintained its declining price trend as on-chain analytics indicate a significant drop in inflows into the cryptocurrency market recently.

Cryptocurrency Capital Inflows Have Experienced A Noticeable Decrease Recently

As detailed by analyst Ali Martinez in a recent post on X, capital inflows into the cryptocurrency domain have decelerated in the previous month. Capital enters (or exits) the digital asset market mainly via three asset categories: Bitcoin (BTC), Ethereum (ETH), and stablecoins. It is only after the inflows reach these coins that they circulate into the altcoins.

Therefore, the flows associated with these assets could be viewed as the netflows for the entire cryptocurrency sector. Regarding the calculation of these flows, the Realized Cap metric can be utilized for Bitcoin and Ethereum.

The Realized Cap is an on-chain market capitalization model that calculates the total worth of any specific asset by presuming that the actual value of any circulating token equals the price at which it was most recently traded on the network.

The last trade of any coin typically represents the final moment it changed ownership, so the price at that point would indicate its present cost basis. Since the Realized Cap aggregates this value for all tokens in circulation, it fundamentally gauges the total amount of capital that investors have invested in the asset.

Netflows of capital for Bitcoin and Ethereum can be correlated with adjustments occurring in this metric. For stablecoins, there isn’t a necessity for this model since their price is consistently anchored around the $1 threshold; hence, modifications in their overall market cap are adequate for determining capital flows.

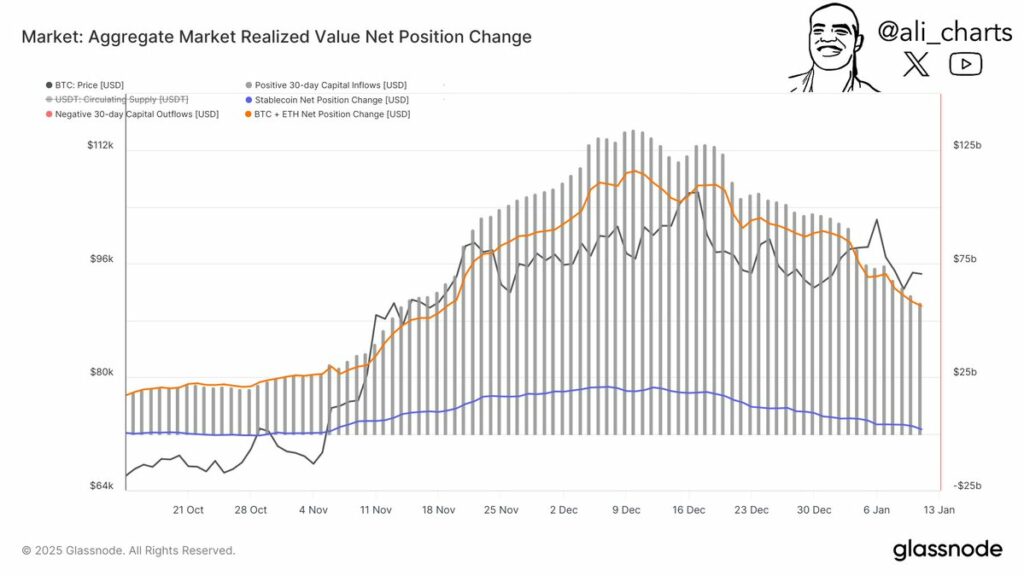

Now, here is the chart presented by the analyst illustrating the trend in the 30-day flows pertaining to the three asset classes over the previous months:

As evidenced in the chart above, the total netflows associated with the cryptocurrency sector have been positive in recent months, indicating that a net volume of capital has been flowing into the various assets.

The 30-day inflows seemed to have reached a peak last month; however, they have been on a downward path since then. During this timeframe, the value of the metric has dropped from $134 billion to $58 billion, marking a decline of over 56%.

“This indicates a substantial decrease in investment activity,” points out Martinez. The slowdown in capital inflows might be the reason Bitcoin and other assets have recently adopted a bearish trend.

BTC Price

Bitcoin momentarily dipped below the $91,000 level earlier today, but it seems the coin has since recovered above it with its price now trading near $91,800.