By Lourdes O. Pilar, Researcher

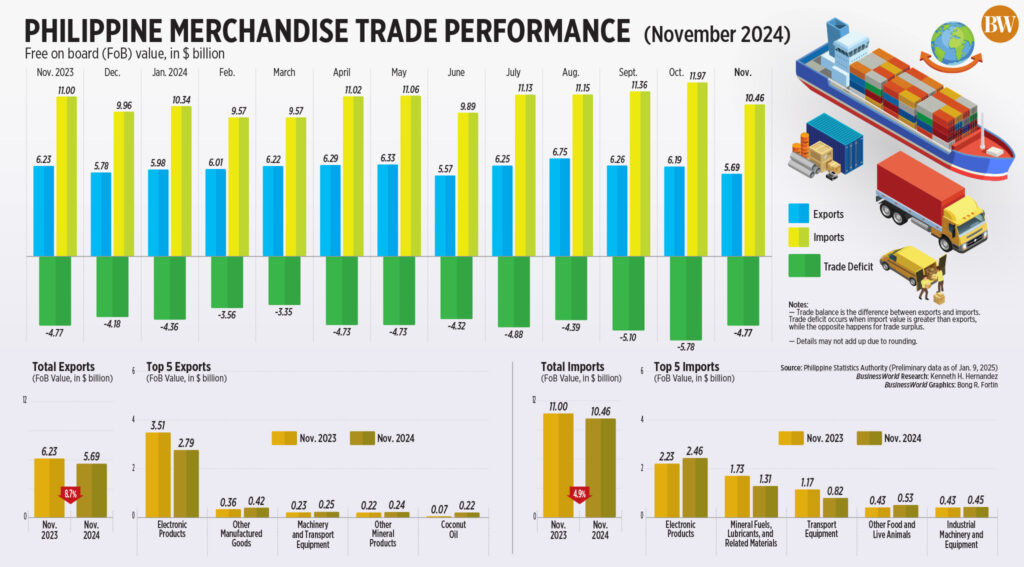

THE PHILIPPINES’ commercial deficit in November decreased to its lowest in three months, as both exports and imports diminished, according to data from the statistics office.

Initial data from the Philippine Statistics Authority (PSA) indicated that the country’s trade-in-goods balance — the disparity between exports and imports — reached a deficit of $4.767 billion in November, a decrease of 0.04% from the $4.769-billion gap in November 2023.

Month over month, the trade deficit reduced by 17.5% from the revised $5.78 billion in October.

November recorded the narrowest trade deficit in three months, or since the $4.39-billion gap in August.

Year to date, the trade deficit increased by 3.2% to $49.96 billion from the $48.41-billion gap one year prior.

In November, export values decreased for the third consecutive month, dropping by 8.7% year-on-year to $5.69 billion from $6.23 billion last year. Exports fell by 8.1% compared to the preceding month.

November’s exports were the lowest since $5.57 billion in June 2024.

For the initial eleven months, exports totaled $67.55 billion, a decline of 0.4% from $67.83 billion during the same timeframe in 2023.

Conversely, goods imports decreased by 4.9% — ending a four-month growth streak — to $10.46 billion in November. This marked a reversal from the 1.7% increase in November 2023 and represented the steepest drop in imports since a 7.3% decline in June.

The value of imports in November was the lowest recorded in five months or since $9.89 billion in June 2024.

Year to date, imports rose by 1.1% to $117.51 billion compared to $116.25 billion in 2023.

For 2024, the Development Budget Coordination Committee (DBCC) anticipates a 4% growth in exports and a 2% rise in imports.

ELECTRONICS DECLINE

“Exports were adversely affected by sluggish electronics sales. Imports declined due to a diminishing dollar value of energy purchases. Additionally, capital imports were lower as an aircraft order that bolstered previous months’ import figures subsided in November,” stated Metropolitan Bank & Trust Co. Chief Economist Nicholas Antonio T. Mapa in an email.

Manufactured goods, which comprised the majority of the country’s total export earnings, decreased by 12.9% to $4.43 billion in November from $5.09 billion in the same month the previous year.

Electronic products, which accounted for nearly two-thirds of manufactured goods and almost half of total exports, fell by 20.8% to $2.79 billion in November.

More than two-thirds of total exports consisted of semiconductors, which also dropped by 33.1% to $1.91 billion in November.

Mineral product exports fell by 5.6% to $563.17 million in November, while agro-based product exports surged by 51% to $456.53 million.

The United States remained the leading destination for Philippine products in November, with exports worth $969.09 million constituting 17% of total export sales.

Following the U.S. were Japan with $916.12 million (16.1% share), China with $786.35 million (13.8%), Hong Kong with $600.24 million (10.5%), and Singapore with $288.11 million (5.1%).

On the other hand, imports of raw materials and intermediate goods fell by 1.9% to $3.849 billion in November, while capital goods reduced by 3.9% to $2.911 billion.

Imports of consumer items rose by 3.7% to $2.353 billion in November, whereas imports of mineral fuels, lubricants, and related materials declined by 24% to $1.3 billion.

In terms of commodity groups, electronic products registered the highest import value at $2.46 billion in November, an increase of 10.5% from $2.227 billion a year earlier.

China was the principal source of imports in November with $2.82 billion worth of goods, representing 27% of the total import expenditure.

It was succeeded by Indonesia with $877.77 million (8.4% share), Japan with $827.75 million (7.9%), South Korea with $774.55 million (7.4%), and the United States with $621.3 million (5.9%).

Sergio R. Ortiz-Luis, Jr., president of the Philippine Exporters Confederation, Inc., mentioned in a phone conversation that numerous “challenges,” particularly geopolitical tensions, impacted trade performance in November.

“Exports and imports of electronics, making up 60% of total exports, experienced the most significant declines due to geopolitical factors. Agricultural products also dropped amidst slow investment inflows into the country,” stated Mr. Ortiz-Luis in a mix of Tagalog and English.

Mr. Ortiz-Luis also noted that the decline in investments, particularly from China, has weighed heavily on trade.

“While some investments are arriving, the Philippines still lags behind compared to other neighboring nations, compounded by high fuel costs, bureaucratic hurdles, and various governmental issues in the country,” he remarked.

Mr. Ortiz-Luis expressed that trade performance has shown improvements but emphasized that “investment is insufficient.”

“We have become the last option for investors who favor our neighboring countries,” he asserted.