The Philippines is progressing towards the implementation of the Global Minimum Tax (GMT), a worldwide taxation standard aimed at reducing revenue losses and promoting equitable competition. In a pivotal discussion yesterday, the Senate Ways and Means Committee alongside the Organisation for Economic Co-operation and Development (OECD) deliberated on how the nation can synchronize with this international reform to bolster its fiscal resilience.

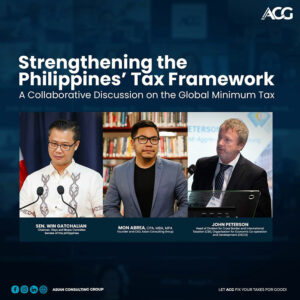

Mon Abrea, the founder and CEO of the Asian Consulting Group (ACG), facilitated the meeting, which was attended by Senator Win Gatchalian, Chair of the Senate Ways and Means Committee, alongside John Peterson, Head of the OECD’s Cross-Border and International Taxation Division. Their dialogue centered around the urgency of embracing the GMT, particularly as neighboring nations in Southeast Asia have commenced their compliance efforts.

Senator Gatchalian, acknowledging the intricacies of the GMT, reiterated his dedication to pushing the reform agenda in the Philippines. He underscored his proactive engagement with key government institutions, including the Department of Finance (DoF) and the Bureau of Internal Revenue (BIR), to facilitate the seamless passage of this crucial legislation. Additionally, he expressed his desire to partner with Mr. Abrea and the Asian Consulting Group (ACG), tapping into their expertise to further examine the Global Anti-Base Erosion (GloBE) rules for enacting a law that would adopt and implement GMT within the Philippines.

John Peterson conveyed perspectives from the OECD, stressing that the GMT transcends mere fiscal policy; it embodies a pledge to equity and international collaboration. The OECD reiterated its willingness to support the Philippines in navigating the challenges presented by this reform.

This collaborative initiative signifies a vital milestone in the Philippines’ pursuit of a more equitable and internationally compatible taxation system, ensuring that the nation retains its competitiveness on the global stage.

Spotlight is BusinessWorld’s sponsored section that allows advertisers to amplify their brand and connect with BusinessWorld’s audience by publishing their stories on the BusinessWorld Web site. For more information, send an email to online@bworldonline.com.

Join us on Viber at https://bit.ly/3hv6bLA to get more updates and subscribe to BusinessWorld’s titles and receive exclusive content through www.bworld-x.com.