THE NATION’S balance of payments (BoP) shortfall increased in November as the administration undertook additional repayments on overseas debts, the Bangko Sentral ng Pilipinas (BSP) announced on Thursday.

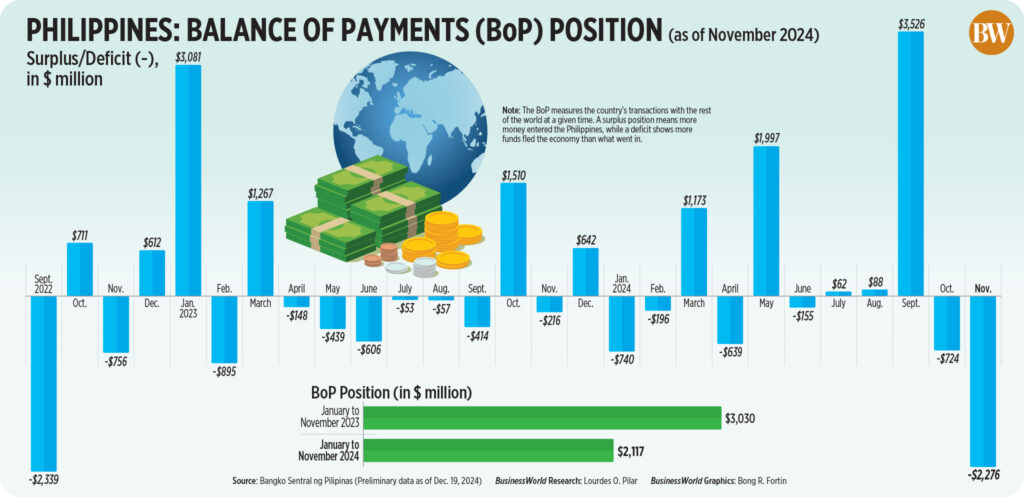

Figures from the central bank indicated that the BoP situation expanded to a $2.276-billion deficit in November, compared to the $216-million gap observed a year prior. It also more than tripled from the $724-million deficit recorded in October.

November represented the largest shortfall in 26 months, or since the $2.339-billion deficit noted in September 2022.

The BoP assesses the nation’s transactions with the global community at a specific time. A deficit indicates that more money exited the economy than entered, while a surplus signifies that more funds flowed into the Philippines.

“The BoP deficit in November 2024 reflected the National Government’s (NG) net withdrawals of foreign currency from its deposits with the BSP to fulfill its foreign currency debt responsibilities and cover various expenditures, alongside the BSP’s net foreign exchange activities,” it stated.

Previous data from the BSP showed that the Philippines’ external debt service obligations diminished by 3.8% to $8.68 billion during the January-to-August timeframe.

Outstanding external debt reached a historic $130.182 billion at the conclusion of June, causing the external debt-to-gross domestic product (GDP) ratio to climb to 28.9% at the end of the second quarter.

In the initial 11 months, the BoP recorded a surplus of $2.117 billion, which was 30% lower compared to the $3.03-billion surplus during the same period the previous year.

“Preliminary data suggest that the decrease in the cumulative BoP surplus was attributable to lesser net receipts from trade in services and net foreign borrowings by the NG,” the central bank indicated.

The nation’s trade deficit expanded by 36.8% year-on-year to $5.8 billion in October, marking its largest trade gap in 26 months or since August 2022, as per data from the local statistics agency.

For the first ten months, the trade deficit increased by 3.6% to $45.22 billion from the $43.64-billion gap noted a year prior.

“Nevertheless, this decrease was partly cushioned by ongoing net inflows from personal remittances as well as net foreign portfolio and direct investments,” the BSP added.

During the first ten months, cash remittances surged by 3% to $28.3 billion from $27.49 billion a year earlier.

In the same timeframe, BSP-registered foreign investments attracted a net inflow of $2.49 billion, a rebound from the $715.43-million outflow in 2023.

Conversely, foreign direct investment (FDI) net inflows increased by 3.8% to $6.66 billion in the first nine months, compared to $6.42 billion the previous year.

By the end of November, the BoP indicated a final gross international reserve (GIR) level of $108.5 billion, representing a 2.3% decline from $111.1 billion at the end of October.

The dollar reserves were sufficient to cover 4.3 times the nation’s short-term external debt based on residual maturity.

This amount is also equivalent to 7.7 months’ worth of goods imports and payments for services and primary income.

A robust level of foreign exchange reserves protects an economy from market fluctuations and serves as a guarantee of the nation’s ability to meet its debts in the event of an economic crisis.

This year, the BSP projects the nation’s BoP situation to conclude with a $2.3-billion surplus, equating to 0.5% of GDP.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort stated that the depreciation of the peso influenced the net payment of foreign debt maturities.

The peso fell to the historic low of P59-per-dollar level on two occasions in November.

“In the upcoming months, the country’s GIR and BoP could continue to benefit from the persistent growth in structural inflows from OFW (overseas Filipino worker) remittances, BPO revenues, exports, and a relatively rapid rebound in foreign tourism income,” Mr. Ricafort remarked.

He noted that further fundraising efforts such as global bond issuances may also enhance the BoP position.

Finance Secretary Ralph G. Recto indicated they are planning to issue dollar- and euro-denominated bonds in the first half of 2025.

“Thus, the still relatively high GIR at $108.5 billion could further bolster the nation’s external position, which is a critical factor for the country’s ongoing favorable credit ratings,” Mr. Ricafort concluded. — Luisa Maria Jacinta C. Jocson