By Luisa Maria Jacinta C. Jocson, Correspondent

CASH REMITTANCES originating from overseas Filipino laborers (OFW) increased by 2.7% in October, marking the slowest expansion in four months, as indicated by data from the Bangko Sentral ng Pilipinas (BSP).

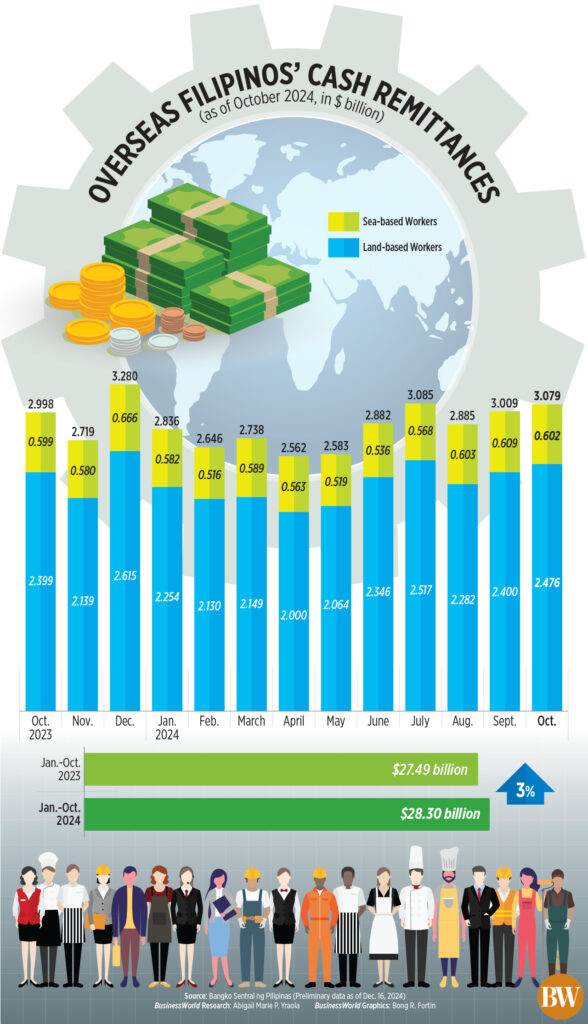

Information from the central bank revealed that cash remittances rose to $3.08 billion in October compared to $3 billion during the same month last year.

This growth rate in remittances represented the weakest performance since the 2.5% recorded in June of this year. October also signified the first instance in four months where growth fell beneath 3%.

“The growth was observed in remittances from both land-based and sea-based laborers,” the BSP noted.

Remittances from land-based workers surged by 3.2% year-on-year to $2.48 billion, while funds sent by sea-based workers grew slightly by 0.6% to $602.35 million.

Personal remittances, which encompass in-kind contributions, also climbed by 2.7% to $3.42 billion in October from $3.33 billion a year earlier.

Remittances from workers employed for contracts of one year or longer rose by 3% to $2.68 billion, while the funds sent back by workers on contracts of less than a year increased by 1.3% to $670 million.

During the January-October timeframe, cash remittances grew by 3% to $28.3 billion from $27.49 billion the previous year.

As of the end of October, cash remittances from land-based workers grew by 3.4% to $22.62 billion, while those from sea-based workers modestly increased by 1.4% to $5.69 billion.

“The rise in cash remittances from the United States, Saudi Arabia, Singapore, and the United Arab Emirates significantly contributed to the overall increase in remittances from January to October 2024,” the BSP stated.

The United States accounted for 41.2%, making it the largest contributor to overall cash remittances during the ten-month period.

Following this were Singapore (7.1%), Saudi Arabia (6.2%), Japan (4.9%), and the United Kingdom (4.8%).

Other leading sources of remittances included the United Arab Emirates (4.3%), Canada (3.5%), Qatar (2.8%), Taiwan (2.8%), and South Korea (2.5%).

Conversely, personal remittances increased by 3% to $31.49 billion as of the end of October compared to $30.57 billion during the same period last year.

John Paolo R. Rivera, a senior research fellow at the Philippine Institute for Development Studies, remarked that the latest remittance statistics reflect global uncertainties.

“Foremost are global economic uncertainties. Economic difficulties in host countries, like inflationary pressures or slowed growth, might have diminished disposability for OFWs, thereby restricting the amounts they can remit,” he stated.

Geopolitical tensions among major remittance sources such as the Middle East, Europe, and the United States also influenced remittance flows, he added.

Mr. Rivera noted that October typically experiences slower growth in remittances “as OFWs tend to prepare for larger transfers closer to the festive season (e.g., November and December).”

Simultaneously, Rizal Commercial Banking Corp.’s Chief Economist Michael L. Ricafort commented that the weaker peso during the month “would necessitate lesser remittances from OFWs to cover the same amount of expenses in pesos, which ultimately would lead to slower year-on-year growth in OFW remittances.”

The peso depreciated to P58.1 against the dollar at the end of October, compared to P56.03 per dollar at the end of September.

For the remainder of the year, remittance inflows are expected to continue rising, particularly during the holiday season.

“In the upcoming months, growth may pick up again in November and December due to the festive period. Continuous demand for OFWs in affluent countries and the potential easing of global inflation may also promote a rebound,” Mr. Rivera expressed.

Conversely, Mr. Ricafort pointed out risk factors such as the incoming Trump administration’s stringent immigration policies that could hinder remittances next year.

“Possible protectionist measures from US President-elect Donald J. Trump, who will take office on Jan. 20, 2025, could tighten immigration regulations in the US to foster and secure more jobs for US citizens, potentially slowing down OFW remittances from the US,” he remarked.

The central bank anticipates cash remittances to grow by 3% this year and in 2025.