By Luisa Maria Jacinta C. Jocson, Reporter

NET INFLOWS of foreign direct investments (FDI) dropped to their lowest point in more than four years in September, as indicated by data from the Bangko Sentral ng Pilipinas (BSP).

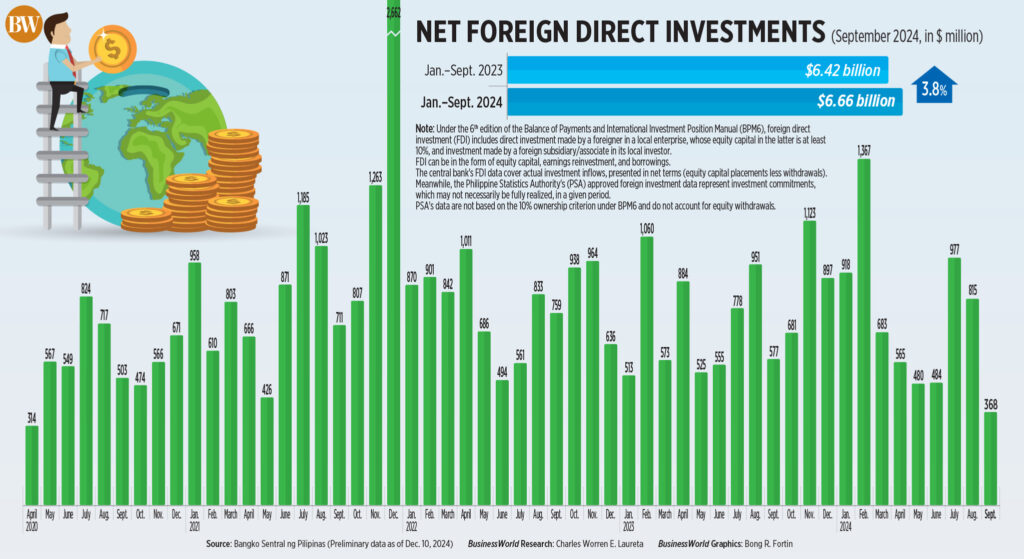

The central bank disclosed on Tuesday that FDI net inflows decreased by 36.2% to $368 million in September compared to $577 million during the same month last year.

This marked the lowest monthly FDI inflow in 53 months, since the $314 million recorded in April 2020, when strict lockdown measures were implemented to prevent the spread of the coronavirus disease 2019 (COVID-19).

On a month-to-month basis, net inflows also plummeted by 54.8% from $815 million.

“The decline in FDI net inflows in September 2024 was mainly attributed to the decrease in nonresidents’ net investments in debt securities,” the BSP stated.

Investments by nonresidents in debt instruments of domestic affiliates fell by 32.8% to $277 million in September from $413 million the previous year.

Net investments in equity capital, excluding reinvested earnings, plunged by 91.2% to $7 million in September compared to $83 million in the previous year.

Equity capital contributions dropped by 53.4% year on year to $82 million, while withdrawals reduced by 19.7% to $75 million.

In terms of origin, equity contributions largely came from Japan (60%), followed by the United States (25%), and Singapore (8%).

These investments were primarily allocated to manufacturing (58%), real estate (19%), information and communication (8%), and wholesale and retail trade (5%).

Meanwhile, investments in equity and investment fund shares totaled $91 million in September, representing a 44.6% decrease from $164 million a year prior.

Conversely, reinvestment of earnings rose by 3.6% to $84 million in September from $81 million the previous year.

NINE-MONTH FDI

For the first three quarters of the year, FDI net inflows experienced a 3.8% increase to $6.66 billion from $6.42 billion during the same timeframe last year.

Investments in equity and investment fund shares soared by 20.4% to $2.3 billion by the end of September, compared to $1.91 billion the previous year.

Net foreign investments in equity capital surged by 46.9% to $1.36 billion by the end of September from $923 million last year.

This coincided with equity contributions rising by 28.1% to $1.79 billion, while withdrawals decreased by 8.5% to $434 million.

During the nine-month duration, the majority of these contributions were sourced from the United Kingdom (43%), Japan (37%), the United States (9%), and Singapore (4%).

On the other hand, foreign investments in debt instruments fell by 3.3% to $4.35 billion during the January-September period, down from $4.5 billion.

Reinvestment of earnings declined by 4.2% to $949 million as of the end of September compared to $991 million a year prior.

“The relatively diminished FDI inflows might largely stem from a wait-and-see approach by certain foreign investors anticipating the passage of the CREATE MORE Act,” Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort mentioned in a Viber message.

In November, President Ferdinand R. Marcos, Jr. enacted the Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy (CREATE MORE) Act, which broadens fiscal incentives and reduces corporate income tax for particular foreign enterprises.

Mr. Ricafort further highlighted the “still relatively high” interest rates, which may have deterred foreign investments.

The BSP initiated its rate-cutting cycle in August of this year with a 25-basis-point (bp) reduction. It subsequently implemented another 25-bp cut in October, bringing the key rate to 6%.

“Persistently elevated global interest rates, led by the US Federal Reserve, have rendered investments in emerging markets like the Philippines less appealing,” stated John Paolo R. Rivera, a senior research fellow at the Philippine Institute for Development Studies.

“Under such circumstances, investors frequently favor safe-haven assets in advanced economies,” he added.

The US Federal Reserve commenced its easing cycle with a 50-bp reduction in mid-September.

Mr. Rivera also pointed out that “increased geopolitical tensions and economic uncertainties may have further eroded global investor confidence.”

“Similarly, sluggish economic growth might have raised apprehensions among foreign investors. Economic growth was somewhat below expectations in the third quarter of 2024, possibly affecting investment sentiment,” he added.

The Philippine economy expanded by a weaker-than-expected 5.2% in the July-to-September period, marking its slowest growth in five quarters since the 4.3% growth in the second quarter of 2023.

“In the months ahead, the CREATE MORE law could motivate international investors to establish their presence in the country with better incentives, allowing for enhanced competition with other Asian nations,” Mr. Ricafort stated.

Additional rate reductions by the BSP and the Fed could also stimulate loan demand and attract more FDIs going forward, he noted.

The Monetary Board is scheduled for its final policy review on December 19. BSP Governor Eli M. Remolona, Jr. has indicated the possibility of lowering or maintaining rates.

Additionally, Reuters noted that traders are anticipating an 86% likelihood of another 25-basis-point rate cut from the Fed during its December 17-18 meeting.

Conversely, Mr. Ricafort highlighted US President-elect Donald J. Trump’s protectionist trade strategies.

“Increased protectionist measures during a Trump presidency starting in 2025 could dissuade US companies from investing and creating additional jobs outside of the US, along with a potential trade conflict between the US and China or other nations, which may hinder global economic growth and international trade,” he added.

Mr. Trump has pledged to impose an additional 10% tariff on Chinese goods to compel Beijing to take further action against the trafficking of chemicals utilized in fentanyl production, according to Reuters.

Previously, Mr. Trump indicated he would implement tariffs exceeding 60% on Chinese goods.

The BSP projects FDI net inflows of $10 billion for this year.