By Luisa Maria Jacinta C. Jocson, Reporter

HEADLINE INFLATION may have increased in November as costs of essential food commodities surged due to the effects of multiple typhoons, analysts indicated.

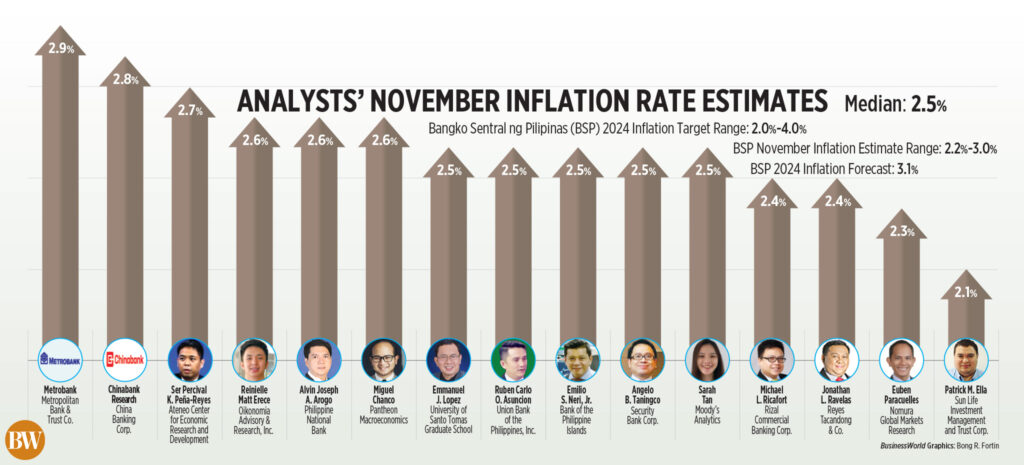

A BusinessWorld survey of 15 analysts conducted last week produced a median forecast of 2.5% for the November consumer price index (CPI), falling within the central bank’s 2.2% to 3% prediction for the month.

If actualized, the November figure would be slightly higher than the 2.3% rate observed in October but lower than 4.1% recorded in the same month last year.

The Philippine Statistics Authority is slated to unveil November inflation statistics on Dec. 5.

“For November, we anticipate inflation growth at 2.5%. This is a modest rise reflecting the influence of several typhoons from October to November, which impacted vegetable prices, leading to a slight increase in overall food inflation,” stated Ruben Carlo O. Asuncion, chief economist at Union Bank of the Philippines, Inc.

In November alone, numerous storms impacted the Philippines. Six typhoons entered its Area of Responsibility throughout the month, based on reports from the Philippine Atmospheric, Geophysical, and Astronomical Services Administration.

Recent data from the Department of Agriculture indicated that agricultural losses due to tropical storms Nika, Ofel, and Pepito amounted to P785.68 million.

“We predict an elevation of November’s inflation rate to 2.5% from October’s 2.3% figure, partly driven by supply constraints attributed to adverse weather conditions,” commented Bank of the Philippine Islands Lead Economist Emilio S. Neri, Jr.

“Weekly statistics on vegetable prices suggest that they were influenced by typhoons as month-to-month increases accelerated relative to October,” he added.

The Department of Agriculture (DA) indicated last month that prices of lowland vegetables are likely to stay high due to production disruptions from storm damage.

Typically, vegetable prices escalate by about 10-15% immediately following typhoons, according to the DA.

Sarah Tan, an economist from Moody’s Analytics, also remarked that food inflation will play a pivotal role in the anticipated rise in the November statistic, primarily due to the adverse weather.

“Among the crops, damage to rice was the most severe as the nation’s largest rice-producing regions, Cagayan Valley and Central Luzon, were significantly affected by rain and landslides,” Ms. Tan noted.

“As domestic rice production has decreased, rice imports are expected to have escalated to fill this gap. Despite lower rice tariffs, retail prices for rice are likely to have risen,” she added.

Chinabank Research also highlighted that rising price pressures originated from escalated costs of essential food items like fish, meat, and eggs.

ENERGY, PESO

“Compounding the issue, utility companies increased electricity prices in November from the previous month as they passed on some of the elevated generation costs to consumers,” Ms. Tan mentioned.

Manila Electric Co. also elevated the overall rate by P0.4274 per kilowatt-hour (kWh) to P11.8569 per kWh in November, up from P11.4295 per kWh in October.

Ms. Tan also referenced increased fuel prices throughout the month.

In November, adjustments in pump prices reflected a net increase of P1.70 a liter for gasoline, P3.20 a liter for diesel, and P1.60 a liter for kerosene.

“Local fuel prices rose in November, as recent developments threatened oil supply in the global market,” said Metropolitan Bank & Trust Co. (Metrobank).

Security Bank Vice-President and Research Division Head Angelo B. Taningco also remarked on the effects of the recent peso depreciation.

The peso dropped to the P59-per-dollar mark twice during the month, reaching a record low on Nov. 21 and 26.

“The notable depreciation of the peso in November might have added to inflationary pressures this month,” Mr. Neri noted.

For the remaining months of the year, inflation is expected to stay within the 2-4% target range, analysts suggest, but raised concerns about potential threats to this outlook.

“Despite the upward pressures from the sequence of typhoons and geopolitical tensions, inflation is projected to remain within the BSP’s target range of 2-4% for the remainder of the year,” Metrobank stated.

Chinabank Research predicted that inflation would stay within the BSP’s target range, unless unforeseen shocks occur. However, it acknowledged that adverse weather conditions may jeopardize food prices.

The central bank anticipates an average inflation of 3.1% for this year. In the first ten months, headline inflation has averaged 3.3%.

“Inflation is likely to remain manageable over the next six months, supported by the slower growth in rice prices and stable commodity prices amidst an economic slowdown in significant economies like China,” Mr. Neri expressed.

“Nonetheless, we also identify risks that may elevate inflation, such as weather disruptions and potential further depreciation of the peso,” he added.

EASING TO CONTINUE

With inflation expected to stay within target, the central bank is also likely to persist in its rate-cutting strategy, analysts indicated.

“I still believe the BSP will adhere to their schedule of reductions as inflation appears set to remain within their aims,” noted Oikonomia Advisory & Research, Inc. economist Reinielle Matt Erece.

Pantheon Chief Emerging Asia Economist Miguel Chanco asserted that weaker-than-anticipated gross domestic product (GDP) growth in the third quarter will strengthen the case for additional rate cuts.

“I doubt the upcoming inflation data will be critical for the BSP’s meeting (in December), which is likely to be significantly influenced by the weaker-than-expected third-quarter GDP report, prompting the Monetary Board to ease by a further 25 basis points (bps) next month,” he stated.

The economy expanded by an annual 5.2% in the July-to-September timeframe, declining from the revised 6.4% growth in the second quarter and 6% a year prior.

This also marked the weakest growth in five quarters, since the 4.3% increase in the second quarter of 2023.

“While the GDP growth for the third quarter has been disappointing, achieving our 2024 target of at least 6% may be challenging. This could lead the BSP to resume its rate cuts to stimulate economic growth,” added Mr. Erece.

Mr. Taningco mentioned that he anticipates the BSP to reduce rates by an additional 25 bps in December as “inflation remains manageable.”

“With 2024 average inflation hovering near mid-target, the probability of another 25-bp cut during the Monetary Board’s December meeting is high, as price pressures remain more manageable than assessed in the previous October meeting,” Mr. Asuncion noted.

BSP Governor Eli M. Remolona, Jr. previously mentioned that the Monetary Board might either cut or maintain rates at its Dec. 19 meeting, the final policy review for the year.

For 2025, Sun Life Investment Management and Trust Corp. economist Patrick M. Ella foresees up to 100 bps in rate cuts.

“We anticipate 100 bps next year (according to our model), but we remain receptive to the possibility of a slight chance of a rate pause in the first quarter, provided the Fed also pauses on rate cuts. Otherwise, we expect the BSP to continue their rate-cutting cycle through 2025,” he remarked.

Mr. Remolona had also previously stated that the Monetary Board might implement rate reductions around 100 bps, though he noted this would not necessarily take place in every meeting.

“The combination of consistent inflation aligned with goals and sub-target growth offers sufficient space for the BSP to implement another 25-bp cut in their final December meeting along with an additional 75 bps in cuts in 2025 to promote growth,” Metrobank suggested.

Conversely, analysts indicated potential risks that could disrupt the BSP’s easing cycle.

Mr. Neri noted that the decisions of the Monetary Board might depend on the peso’s movement in the upcoming weeks.

“The currency has faced pressure recently, reflecting market adjustments to Federal Reserve rate cut anticipations driven by the expected inflationary effects of Donald Trump’s economic policies as well as Fed Chair [Jerome] Powell’s statements minimizing the urgency for rate cuts,” he stated.

The central bank may opt to keep rates steady if the Fed halts its rate cuts or if the peso surpasses the P60-per-dollar mark, Mr. Neri added.

“Ongoing upward pressures on inflation could compel the BSP to reassess the pace of its easing strategy,” Metrobank indicated.

Furthermore, Mr. Asuncion pointed out the likelihood of a “hawkish pause” as the BSP previously indicated that the balance of risks concerning the inflation outlook for this year until 2026 has tilted upward.