Bitcoin is wrapping up one of its most extraordinary months in history, soaring past $30,000 in November and indicating a revitalized optimistic sentiment in the market. As we look forward to December and beyond, traders are keen to determine whether Bitcoin’s momentum can maintain itself through 2025. With macroeconomic circumstances, historical patterns, and on-chain statistics favoring Bitcoin, let’s delve into what’s unfolding and what it may signify for the future.

November’s Historic Performance

November 2024 wasn’t merely another month for Bitcoin; it was momentous. The price of Bitcoin escalated from about $67,000 to nearly $100,000, reflecting an approximate 50% increase from the lowest to highest point, making it the most successful month ever in terms of dollar elevation. This surge benefited long-term investors who persevered through months of stability following Bitcoin’s record peak of $74,000 earlier in the year.

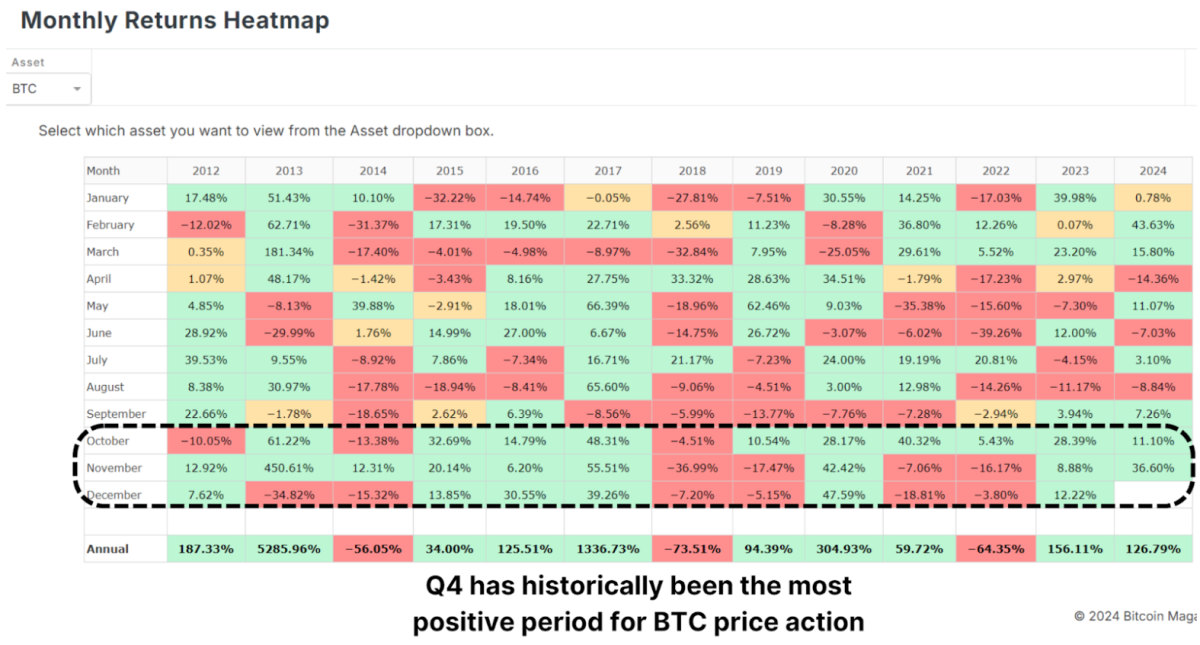

Traditionally, Q4 stands out as Bitcoin’s strongest quarter, and November has frequently been a highlight month. December, which has also done well in previous bullish cycles, offers a hopeful projection. However, as with any surge, some temporary cooling may be anticipated.

The Influence of the Dollar and Global Liquidity

Remarkably, Bitcoin’s ascent took place against the backdrop of a strengthening U.S. Dollar Strength Index (DXY), a context where Bitcoin usually underperforms. Over time, Bitcoin and the DXY have typically shown an inverse correlation: as the dollar strengthens, Bitcoin tends to weaken, and the reverse is also true.

In a similar vein, the Global M2 money supply, another significant metric, has exhibited slight contraction lately. Bitcoin has historically shown a positive correlation with global liquidity; thus, its current performance contradicts typical expectations. If liquidity conditions enhance in the upcoming months, this could create a strong tailwind for Bitcoin’s value.

Similarities to Previous Bull Cycles

Bitcoin’s current path closely resembles prior bullish markets, particularly the 2016–2017 cycle. That cycle commenced with gradual price hikes before breaking through essential resistance points and initiating an exponential growth phase.

In 2017, Bitcoin’s price broke free from a crucial technical threshold of about $1,000, culminating in a parabolic surge that peaked at $20,000, a 20x increase. Likewise, the 2020-2021 cycle witnessed Bitcoin ascended from $20,000 to almost $70,000 after moving above the significant YoY Performance mark.

If Bitcoin can convincingly break out above this historic level and surpass the crucial $100,000 resistance, we may observe a recurrence of these explosive price movements as BTC enters a dynamic phase of optimistic price action.

Institutional Engagement and Accumulation

A significant element supporting Bitcoin’s resilience is the ongoing accumulation by institutions. Bitcoin ETFs are contributing billions of dollars worth of BTC to their inventories, while companies like MicroStrategy have intensified their Bitcoin strategy, now holding around 400,000 BTC. Even with BTC marching toward new all-time highs, ‘smart money’ is rushing to amass as much as possible to avoid being left behind.

This institutional interest reflects a growing belief in Bitcoin as a long-term hedge against value loss, even amidst volatile market conditions. Such accumulation also restricts the circulating supply, creating upward pressure on prices as demand rises.

Conclusion

Although December has a history of being a robust month for Bitcoin, short-term fluctuations might moderate gains as the market processes November’s significant rally. Nevertheless, considering the vigorous accumulation we’re observing from institutional players, anything is achievable.

Looking ahead, however, the outlook remains exceedingly optimistic. The pivotal level to monitor is $100,000 as the next substantial checkpoint, which, if surpassed, could set the stage for an even larger rally in 2025. Bitcoin is entering one of its most thrilling phases yet, as various elements align favorably across macroeconomic, technical, and on-chain analyses.

For a more comprehensive exploration of this subject, check out a recent YouTube video here: The BIGGEST Bitcoin Month EVER – So What Happens Next?

🎁 Black Friday: Our Largest Sale Ever

The BEST discount of the year has arrived. Enjoy 40% Off all our annual packages.

- Access over 100 Bitcoin charts.

- Receive Indicator alerts – so you never miss an update.

- Private TradingView indicators of your favorite Bitcoin charts.

- Exclusive Members-only Reports and Insights.

- Many new charts and features on the way.

All for just $15/month with the Black Friday offer. This is our largest sale all year.

UPGRADE YOUR BITCOIN INVESTING NOW

Don’t let this pass you by! 👉 https://www.bitcoinmagazinepro.com/subscribe/