The Director of Global Macro at Fidelity Investments, Jurrien Timmer, consistently offers valuable frameworks for deciphering Bitcoin’s valuation and expansion. In a latest report, Timmer presented his perspective on Bitcoin’s adoption and value paths, depicted through comprehensive charts that represent both historical data and theoretical scenarios.

Timmer’s models strive to clarify Bitcoin’s intricate growth patterns, connecting network adoption with valuation. “Although the supply is established, the demand remains uncertain,” he remarked, stressing the essential role of adoption curves and macroeconomic factors, such as actual rates and monetary policies.

Adoption Curves: Steady Yet Gradual Expansion

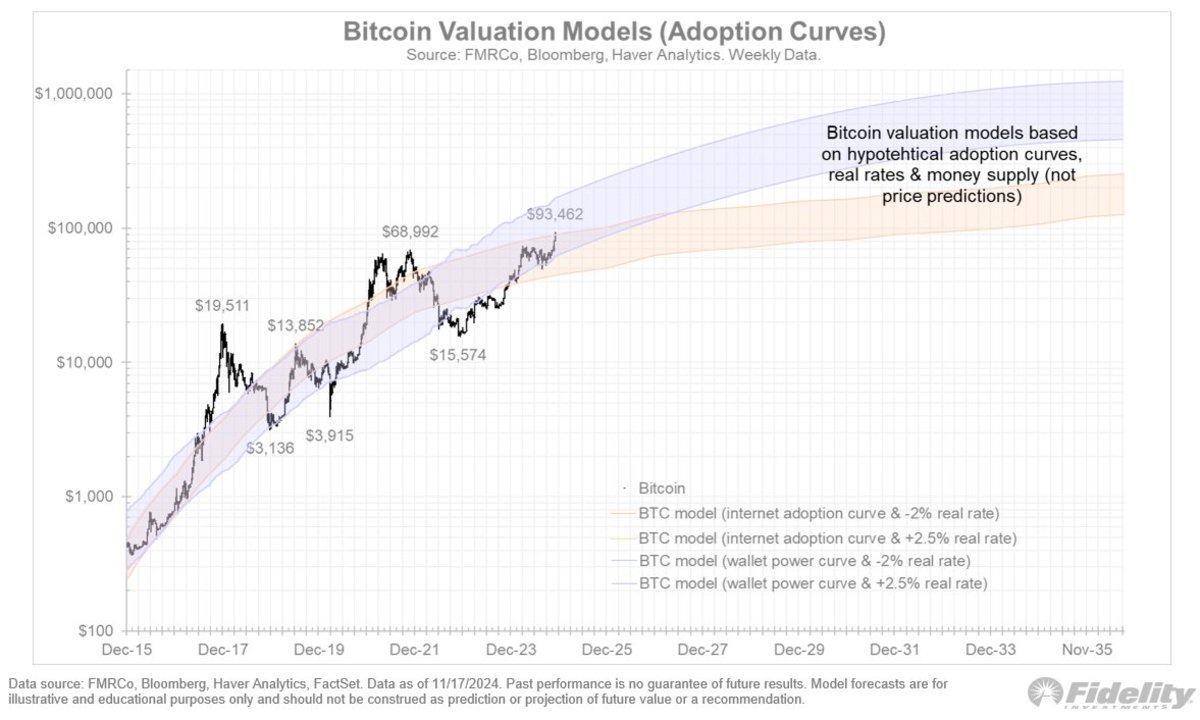

In spite of a deceleration in Bitcoin’s network expansion, measured by the number of wallets that hold a non-zero balance, Timmer observed that the trend still corresponds with the significant power curve depicted in his revised adoption chart. While the internet adoption curve has a more gradual incline, Bitcoin’s adoption trajectory continues to be more pronounced, indicating its swift yet evolving growth.

Crucially, Timmer pointed out a significant limitation in tracking wallet growth: the underestimated wallet/address total due to Bitcoin ETFs, which aggregate holdings into only a few wallets. “It’s highly probable that the wallet/address count is underestimated,” he mentioned, noting that ETFs obscure the wider distribution of Bitcoin adoption.

Monetary Policy and Adoption Dynamics

Expanding upon his earlier models, Timmer introduced an additional layer to his valuation framework by integrating money supply growth along with real interest rates. The revised charts juxtapose two theoretical paths for Bitcoin’s valuation: one influenced by adoption curves and real rates, and another that factors in monetary inflation.

The Significance of This Information

Timmer’s updated models reinforce Bitcoin’s status as an evolving financial asset. By merging historical S-curves, Metcalfe’s Law, and macroeconomic elements, he presents a holistic view of Bitcoin’s distinctive mix of network utility and monetary characteristics. His contributions accentuate the significance of adoption in enhancing Bitcoin’s value while illustrating how real-world monetary situations might mold its future.

For both Bitcoin advocates and skeptics, Timmer’s insights offer a significant framework for grasping the asset’s dual identity as a network and a form of currency. The integration of monetary inflation in his models further highlights Bitcoin’s potential as a safeguard against fiat currency depreciation.

Looking Forward

As Bitcoin progresses, Timmer’s models offer an essential perspective for monitoring its advancement. Whether considering the leveling off of the adoption curve or the interaction between monetary policy and valuation, his analysis emphasizes the asset’s increasing complexity—and its lasting significance in the financial landscape.

For investors, analysts, and enthusiasts, these insights serve as a reminder of Bitcoin’s transformative capacity, even as its growth trajectory matures.